9 ways to make the most of your pension

Want to improve your retirement prospects? We explore nine ways to boost your pension savings, no matter where you are in your retirement planning journey.

Saving enough money for retirement can seem daunting, but there are some simple ways you can boost your chances of a comfortable and fulfilling life after work.

Whether you’re in the early stages of your career or in the run-up to retirement, carrying out a ‘pension MOT’ could make a significant difference to your future.

Here, we explore nine ways to make the most of your pension.

1. Start saving early

The earlier you start saving for retirement, the better. Starting early gives your money more time to grow and harness the power of compounding. This is when you earn returns on the money you invest as well as on the returns themselves. It’s a relatively simple concept, but it can have a significant impact on your money over time.

Saving into a pension, such as a self-invested personal pension (SIPP), is especially powerful because you get tax relief on your pension contributions. For every £80 you save into a pension, the government adds £20, boosting your contribution to £100. If you’re a higher or additional-rate taxpayer, you can claim back an additional £20 or £25, respectively, via your self-assessment tax return.

Over time, tax relief could make a big difference to the size of your pot at retirement.

2. Save more if you can

It might seem obvious, but the more you save, the bigger your pension will be. Even small increases in your monthly pension contributions can have a substantial impact over time.

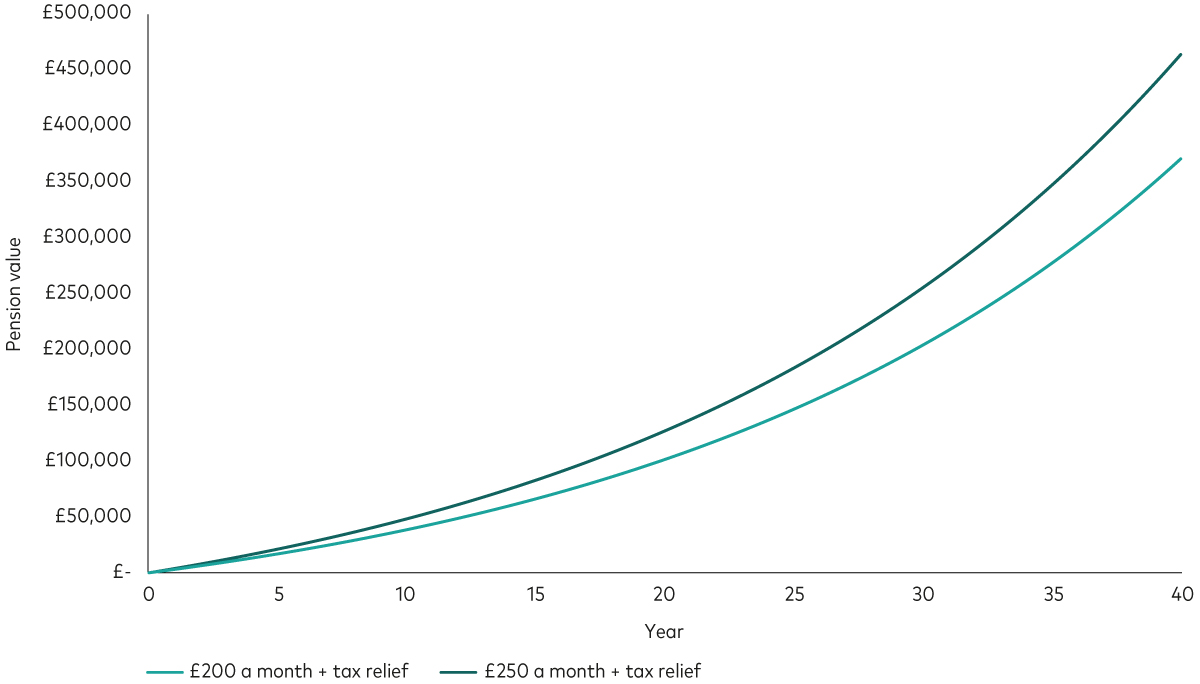

The chart below shows how much a basic-rate taxpayer could have built up in their pension after 40 years, based on two different monthly savings amounts. For simplicity’s sake, we assume their contributions stay constant over time.

If they saved £200 a month into their pension (which is £250 a month including tax relief) they could end up with a pot worth just over £370,000 after 40 years, assuming an investment return of 5% after fees. But if they saved £250 a month (£313 a month including tax relief) their pot would be worth over £460,000.

In other words, a £50 monthly increase boosts their pot by £90,000!

Small increases in pension contributions can have a significant impact

Notes: This hypothetical scenario is for illustrative purposes only and doesn’t represent a particular investment or its expected returns. It assumes annual returns of 5% after fees.

Source: Vanguard calculations.

You could also consider adding lump sums, such as bonuses or financial gifts, into your pension. This could help you make up any gaps in your pension contributions – perhaps you took a career break, for example. Tax relief and investment growth on a lump sum could really help to supercharge how much money you have at retirement.

Most people can get tax relief on pension contributions of up to 100% of gross relevant earnings, capped at £60,0001. In some circumstances, you might be able to make pension contributions over your annual allowance and still benefit from tax relief. This is because you can ‘carry forward’ unused allowances from the previous three tax years. Read more about carry forward rules.

3. Maximise employer contributions

If you’re employed, you’ll also benefit from employer pension contributions, so it’s worth finding out exactly how much your employer can contribute. Some employers will pay in more if you increase your own contributions too, usually up to a certain percentage. If you’re not sure where to find this information, speak to your HR department.

4. Check how much you’ve saved already

Periodically checking how much you’ve saved in your pension so far can help you work out whether you’re on track to meet your retirement goals. You can then make more informed decisions about how much more you need to save.

You can find out whether you’re on target for the retirement you want with Vanguard’s pension calculator.

5. Track down lost pensions

Over the course of your working life, it’s easy to lose track of different pension pots, especially if you've changed jobs frequently. According to the Pensions Policy Institute, unclaimed pension pots totalled £26.6 billion in 20222. So, it’s well worth taking the time to track down any lost pensions.

The government has a free pension tracing service which can help you find the contact details for workplace or personal pensions. Recovering your lost pensions could provide a significant boost to your retirement savings.

6. Consider combining your pensions with a low-cost provider

Once you’ve tracked down your pensions and have all the details to hand, you might want to consider bringing them together in one place. Known as ‘pension consolidation’, combining your pensions can save on paperwork and admin and give you a clearer picture of your savings.

When you’re choosing which provider to transfer your pensions to, make sure you check what their charges are. Fees can eat into your investment returns, so the higher the fee, the smaller your pot will be. The Vanguard Personal Pension is covered by our annual account fee of 0.15%, which is capped at a maximum £375 per year. See a full breakdown of our costs.

Find out how to transfer your pension to Vanguard and what to know before starting a transfer.

7. Check where your pension is invested

Whether you have a workplace pension, a personal pension or both, the money in those pots will be invested – usually in a mix of shares3 and bonds4. It’s really important to check that the balance of shares and bonds is in line with your attitude to risk and goals. In general, a young person who is saving for retirement can typically afford to take on more risk than someone who is retiring in a few years’ time.

As you approach retirement, it often makes sense to start reducing the level of risk in your portfolio. This is because there might not be enough time to recoup losses. The last thing you want is for your portfolio to drop in value just before you need to access it.

At Vanguard, you can build your own pension portfolio from our wide range of low-cost funds. Or you can keep things simple with one of our Target Retirement Funds. These are ready-made retirement portfolios that mature with you, so you don’t have to worry about adjusting your investments as you get closer to retirement.

If you want more of a helping hand, our managed service will select investments based on your attitude to risk.

8. Decide how you’ll access your pension

In the 10 or so years before retirement, start thinking about how you’ll take an income from your pensions. There are several options to choose from, so consider what suits your individual circumstances and preferences.

With flexible income drawdown, you can take up to 25% of your pension as tax-free cash (capped at £268,275) and leave the rest invested. You can then draw the income you need and change this amount whenever you want to.

This differs to an annuity, which provides a guaranteed income. Annuities provide more certainty, but once it is set up, you can’t change your mind and you can’t increase or decrease the amount of income to suit your needs. Another option is to take a series of individual lump sums, where 25% of each lump sum is tax-free and 75% is taxable.

It’s also possible to use a combination of options, which adds further flexibility. Find out more about withdrawing your pension money.

9. Think carefully before taking cash from your pension

While you can access your pension from age 55 (rising to age 57 from April 2028), it may not always be the most sensible option, particularly if you don’t actually need the money at that point.

While we’re all entitled to a tax-free cash lump sum from our pensions, income drawn from a pension is taxable at your personal rate of income tax. That means if you take out too much too quickly, on top of any other income you are earning, you could unwittingly incur a high tax bill.

What’s more, by leaving the money in your pension, it will have the opportunity to keep growing in value. In the long run, that could mean you enjoy a more comfortable and secure retirement.

These nine tips won’t be suitable for everyone, so if you have any doubts about what’s right for you, we’d suggest speaking to a financial adviser.

1 For more on what counts as ‘relevant earnings’ that can earn tax relief when used to fund a pension, see the HMRC Pensions Tax Manual. Your annual allowance might be lower than £60,000 if you have a high income or you’ve already flexibly accessed your pension pot. To work out if you have a reduced (tapered) annual allowance, see HMRC’s website. If you’ve flexibly accessed your pension, you can work out what your alternative annual allowance is here.

3 Shares are units of ownership in a company.

4 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Eligibility to invest in a Vanguard Personal Pension depends on your individual circumstances. Please be aware that pension and tax rules may change in the future and the value of investments can go down as well as up, so you might get back less than you invested. You cannot usually access your pension savings or make any withdrawals until the age of 55.

Your pension transfer will be sent to us as cash. During this period you will be out of the market (not invested) so you could miss out on any increase in the value of your pension fund should the market rise.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Any tax reliefs referred to are those available under current legislation, which may change, and their availability and value will depend on your individual circumstances. If you have questions relating to your specific tax situation, please contact your tax adviser .

Vanguard Target Retirement Funds may invest in Exchange Traded Fund (ETF) shares. ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid-offer spread which should be considered fully before investing.

For further information on risks please see the “Risk Factors” section of the prospectus on our website.

Important information

Vanguard Asset Management Limited only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This article is designed for use by, and is directed only at persons resident in the UK .

For further information on the fund's investment policies and risks, please refer to the prospectus of the UCITS and to the KIID before making any final investment decisions. The KIID for this fund is available, alongside the prospectus via Vanguard’s website.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The Authorised Corporate Director for Vanguard LifeStrategy® Funds ICVC is Vanguard Investments UK, Limited. Vanguard Asset Management, Limited is a distributor of Vanguard LifeStrategy Funds ICVC.

For investors in UK domiciled funds, view our summary of investor rights – available in English.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Asset Management Limited. All rights reserved.