5 reasons to pay into your pension before tax year-end

From improving your retirement prospects to lowering your income tax bill, we explore five reasons to top up your pension before tax year-end on 5 April.

Time is running out to make sure your savings and investments are arranged as tax-efficiently as possible before the tax year ends on 5 April.

While topping up individual savings accounts (ISAs) will be the focus of many people’s tax year-end checklists, making the most of your pension annual allowance could make an even bigger difference to your overall financial health.

Pensions offer some fantastic tax advantages, which make them a great way of saving for retirement. And although you can’t withdraw money until at least age 55 (rising to age 57 from April 2028), saving into a pension can support your day-to-day finances by potentially lowering your income tax bill and, if you’re a parent, helping you retain more child benefit. So, even if your retirement is still decades away, making additional pension contributions is well worth considering.

Here are five reasons to boost your pension before the end of the tax year.

1. Get government top-ups on your pension contributions

The reason why pensions are such a valuable way of saving for retirement is you get tax relief on personal pension contributions. For every £80 you save into a pension, the government adds £20, boosting your contribution to £100. If you’re a higher or additional-rate taxpayer, you can claim back an additional £20 or £25, respectively, via your self-assessment tax return.

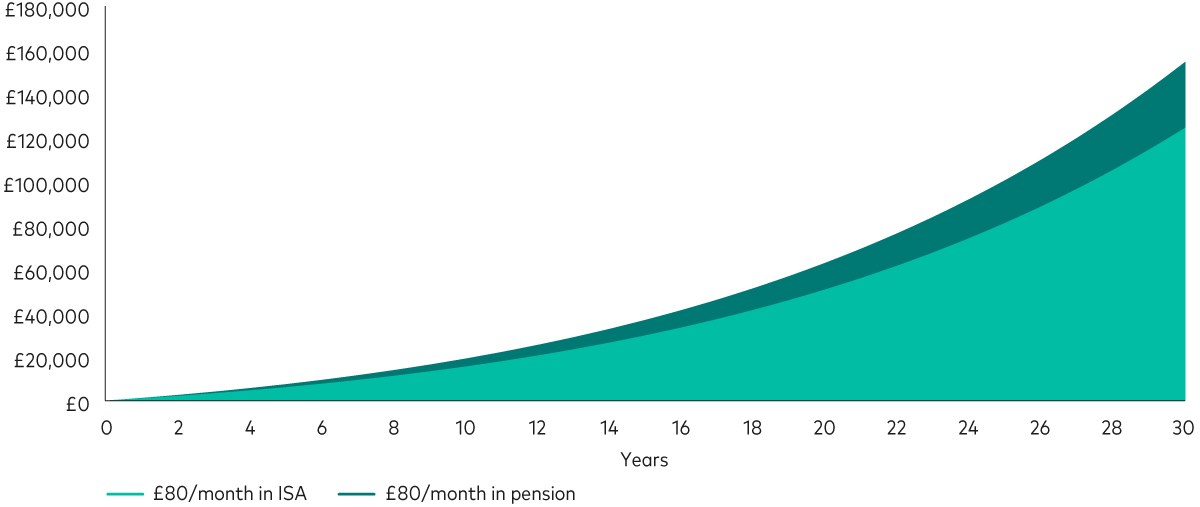

Over time, tax relief could make a big difference to the size of your pot at retirement. One way to illustrate this is to look at what would happen if a basic-rate taxpayer started investing £80 a month into a pension (with tax relief boosting it to £100) and £80 a month into an ISA. They increase their contributions by 5% a year and achieve an annual investment return of 5% after charges.

After 30 years, the pension would be worth £30,000 more than the ISA – all thanks to tax relief.

How tax relief boosts long-term savings

Notes: This hypothetical scenario is for illustrative purposes only and doesn’t represent a particular investment or its expected returns. It assumes annual returns of 5% after charges. Balances reflect the value at the end of each period.

Source: Vanguard.

Of course, tax relief isn’t the only thing to consider when you’re choosing between a pension and an ISA. As mentioned above, you can’t access the money in a pension until at least age 55, whereas you can draw money from ISAs whenever you like.

What’s more, there’s no tax to pay on ISA withdrawals. When you draw money from a pension, you can usually take up to 25% as a tax-free lump sum (capped at £268,275) and the rest is taxed as income.

2. Make the most of your annual allowance

The maximum amount you can save into pensions each year without paying a tax charge is currently £60,000. This is known as your ‘annual allowance’1.

If you didn’t fully use your pension annual allowance in the previous three tax years, and you haven’t flexibly accessed your pension, it might be possible to ‘carry forward’ the unused amount and contribute more than the current annual allowance.

In the 2024-25 tax year, it’s theoretically possible that someone could save up to £200,000 in pensions:

• 2021-22: £40,000

• 2022-23: £40,000

• 2023-24: £60,000

• 2024-25: £60,000

However, you must earn at least the amount you wish to contribute to benefit from tax relief. So, someone who wants to make total contributions of £200,000 in the 2024-25 tax year must earn at least £200,000.

Carry forward is only available to those who are active members of a registered pension scheme. So, if you’re not a member of a workplace pension scheme, you might want to consider opening a self-invested personal pension (SIPP) to take advantage of the carry forward rule. A SIPP is a pension scheme that offers a flexible way to save for retirement and gives you more control over how you want your money to be invested. Unlike a workplace pension, your employer can’t contribute to your SIPP.

3. Reduce your income tax bill

Although pensions are associated with improving your future financial security, they can also be a valuable tax planning tool if your salary and/or bonus pushes you into a higher tax band. This is because pension contributions effectively lower your taxable income.

Higher-rate income tax kicks in once your income exceeds £50,270. So, if your income is £60,270, you’d pay 40% tax on the £10,000 of income that falls within the higher-rate tax band. But if you made a £10,000 pension contribution (£8,000 plus £2,000 tax relief) to a SIPP, your ‘adjusted net income’2 would fall to £50,270, which is in the basic-rate band. The tax relief would be obtained through an extension of your basic-rate tax band, which can be done by filling in a tax return.

You’ve not only stopped your income being taxed at the higher rate, but you’ve made an important contribution towards your future retirement.

4. Keep more of your child benefit payments

Making pension contributions could also help parents retain more child benefit – again, by effectively lowering your taxable income.

Under current rules, you must pay back at least some child benefit when you or your partner’s income exceeds £60,000 in a given tax year3. Once income reaches £80,000, you pay the whole lot back. This is known as the ‘high income child benefit charge’.

If, however, you make a contribution to a SIPP which lowers your income to below £60,000, you’ll avoid the charge. If you lower it to between £60,000 and £80,000, the charge will be reduced.

Doing so could help you utilise your child benefit while putting aside money for your future. But it won’t necessarily be right for everyone. If you’re at all unsure, speak to a financial adviser.

5. The earlier you start, the better

The final reason why it makes sense to boost your pension before the end of the tax year is simple: why wait? After all, the earlier you start, the better your chances of enjoying a comfortable and fulfilling retirement.

Retirement might seem worlds away, but saving early and often can make a big difference to your long-term wealth. That’s because of the power of compounding – when you get returns on the money you invest as well as on the returns themselves. The longer you give it, the more dramatic the potential effects.

We looked at how much you’d need to save if you wanted £500,000 of pension savings by age 65 (to put this into context, a £500,000 pension could provide pre-tax income of around £28,000 a year for 25 years4). We assumed the investor had a workplace pension5 as well as a low-cost SIPP and that their salary increased by 3% a year. We also assumed an investment return of 5% after costs.

We found that a 25-year-old earning £30,000 a year would need to invest £87 a month in their SIPP to have £500,000 in pension savings by age 65. But for a 50-year-old earning £60,000 a year, they’d need to invest a huge £542 a month into their SIPP – even if they already had £100,000 of retirement savings!

In a nutshell, it’s never too soon to invest – but it can sometimes be too late, depending on your goals. It’s just one of the many reasons to consider topping up your pension before the end of the tax year.

1 Your annual allowance might be lower than £60,000 if you have a high income or you’ve already flexibly accessed your pension pot. To work out if you have a reduced (tapered) annual allowance, see HMRC’s website.

2 Adjusted net income is total taxable income before any personal allowances and after certain tax reliefs. To work out your adjusted net income, see HMRC’s website.

3 The £60,000 limit is tested against the highest earner in a couple.

4 Source: Vanguard calculations. Assumes income increases by 2% a year and an annual investment return of 5% after costs.

5 We assumed minimum auto-enrolment of 8% of salary between £6,420 and £50,270.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

The eligibility to invest in either ISA or Junior ISA depends on individual circumstances and all tax rules may change in future.

Eligibility to invest in a Vanguard Personal Pension depends on your individual circumstances. Please be aware that pension and tax rules may change in the future and the value of investments can go down as well as up, so you might get back less than you invested. You cannot usually access your pension savings or make any withdrawals until the age of 55, rising to the age of 57 in 2028.

If you are not sure of the suitability or appropriateness of any investment, product or service you should consult an authorised financial adviser. Please note this may incur a charge.

Any tax reliefs referred to are those available under current legislation, which may change, and their availability and value will depend on your individual circumstances. If you have questions relating to your specific tax situation, please contact your tax adviser.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information is general in nature and does not constitute legal, tax, or investment advice. Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4226634