Baby boomer? 3 ways to improve your retirement readiness

Most UK baby boomers are expected to fall short of the savings they need to fund their retirement. We explore three ways to improve your ‘retirement readiness’.

If you have only a few years to go until you retire, you might be feeling a mixture of excitement and trepidation. Excitement about spending more time doing what you love, and trepidation about making sure your savings last as long as you need them to.

Having sufficient savings to fund your retirement is a valid and common concern. Our comprehensive research1 shows that only 40% to 50% of UK baby boomers2 are ready for retirement, with middle-income baby boomers (those earning between £32,600 and £46,599) particularly unprepared. However, we also found that there are several steps these individuals can take to improve their chances of a secure and fulfilling retirement.

Read on to discover three ways to give your retirement savings a last-minute boost.

What does retirement readiness mean?

We focused on two measures of retirement readiness:

Maintaining your current lifestyle in retirement

This is based on the Pensions Commission’s3 ‘target replacement rates’ (TRRs), which estimate the percentage of pre-retirement income an individual needs to maintain their current lifestyle in retirement. This ranges from 86% for low-income individuals to 72% for middle-income individuals and 50% for high-income individuals4.

Achieving a ‘moderate’ standard of living in retirement

This is based on the Pensions and Lifetime Savings Association’s (PLSA’s) retirement living standards. According to the PLSA, a single retiree would need to spend just under £36,000 a year before tax to achieve a moderate standard of living, rising to nearly £47,600 for couples.

How retirement ready are you?

To assess retirement readiness, we combined data from the Office for National Statistics5 with our own return forecasts for different asset classes, such as shares and bonds6. Our research found that most full-time employees aged between 61 and 65 are not retirement ready.

Only 51% of UK baby boomers are on track to maintain their current lifestyle once they retire and only 39% are on track to achieve a moderate standard of living in retirement.

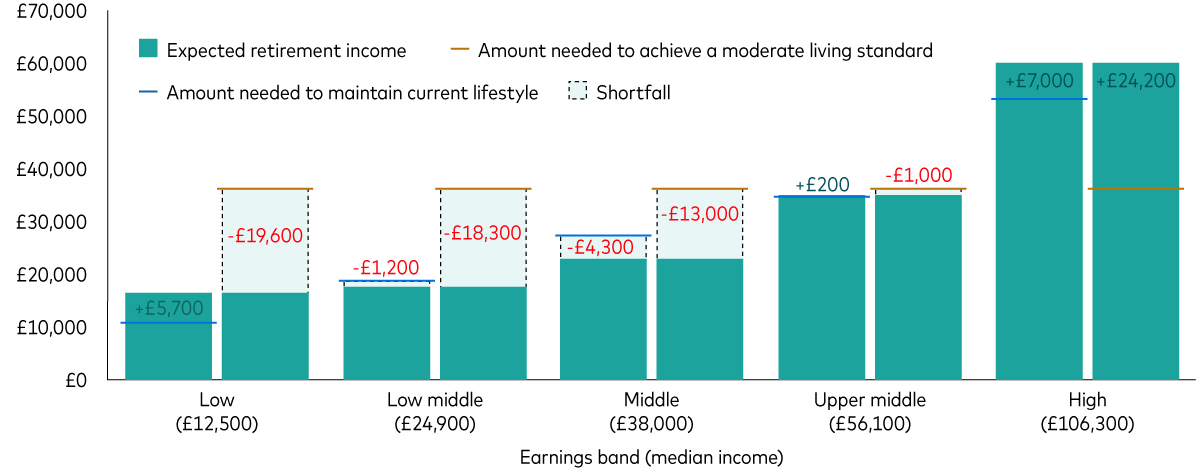

To help you understand how retirement ready you are, the chart below shows how much baby boomers need versus how much they’re on track to have. For example, it shows that someone earning £38,000 is expected to have a retirement income of £23,000 a year. This is around £4,000 less than they’d need to maintain their current lifestyle and £13,000 less than they’d need to achieve a moderate living standard.

Baby boomers’ retirement readiness by income

Notes: The current income amounts were chosen because they are the median (or ‘middle’) for each group analysed (low income, low-middle, middle, upper-middle and high income). The amount needed to maintain current lifestyle is based on the Pensions Commission’s target replacement rates. The amount needed to achieve a moderate living standard is based on data from the PLSA and is for a single retiree (as opposed to a retiree in a couple).

Sources: Vanguard calculations, based on data from the ONS Wealth and Assets Survey, the Pensions Commission and the PLSA.

How to improve your retirement readiness

Although many baby boomers aren’t on track for a financially secure retirement, we found that there are several ways to improve your retirement readiness, even when you’re close to retirement. We analysed how the following three methods can brighten the retirement outlook, based on the TRR spending measure.

1. Delay retirement by two years

Not everyone will be able to work for longer, but for those who can, working just two more years until age 68 instead of the current state pension age of 66 can enhance financial security.

By working for longer, you have more time to continue paying into your pension and, if you’re employed, benefit from employer pension contributions. The extra two years will also allow your pension to grow further. Additionally, you’ll have a shorter period to fund your living expenses in retirement, and you’ll be able to claim a higher state pension7.

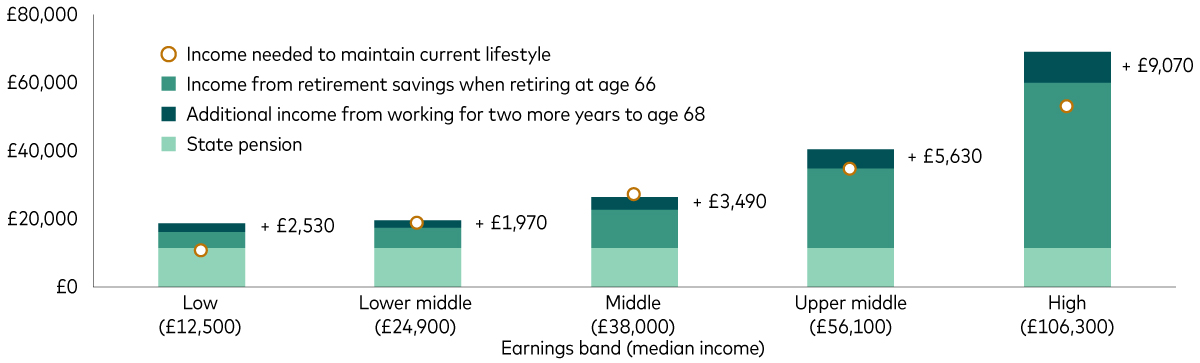

The chart below shows how much extra pre-tax retirement income baby boomers could expect to see each year if they delayed their retirement by two years. For example, the average middle-income earner would see a boost of £3,490 a year.

Impact of delaying retirement by two years by income group

Additional income generated by working to age 68 instead of age 66

Notes: The state pension is assumed to start at £11,502 a year (2024-25) and grow in line with inflation. Income from retirement savings includes both pension wealth and financial wealth. Earnings bands are as follows: low – less than £17,700; lower middle – £17,700 to £32,599; middle - £32,600 to £46,599; upper middle - £46,600 to £74,599; high – over £74,600. The number in brackets shows the median (or ‘middle’) income for each earnings band.

Sources: Vanguard calculations, based on data from the ONS Wealth and Assets Survey and the Pensions Commission’s target replacement rates.

2. Spend less in retirement

Evidence suggests that many people spend less than they anticipate during retirement. This may happen for a variety of reasons, such as fewer work-related expenses, including reduced commuting costs and a natural decrease in spending as you age.

We found that if the average middle-income baby boomer cut their planned retirement spending by 10%, they would reduce their retirement income shortfall by £750 a year.

However, it’s important to find a balance that works for you. While spending less can help, it’s crucial to ensure that you still meet your needs and enjoy your retirement. Everyone’s situation is unique, so consider what adjustments you can make without compromising your quality of life.

3. Access home equity

Another potential way to boost your retirement readiness is to access the equity in your home. This could be achieved by downsizing to a smaller home or relocating to a lower-cost area. While there are costs associated with moving house, selling a property and investing the proceeds can unlock additional funds, significantly reducing or even eliminating a shortfall in your savings.

Another option is equity release, which allows you to access the value in your property without selling it outright. This is typically done by borrowing against the value of your property and using this sum to supplement your income.

We found that if the average middle-income baby boomer released 20% of their net property wealth, they could boost their pre-tax retirement income by £3,480 a year. However, releasing home equity has pros and cons and isn’t right for everyone, so it’s important to seek financial advice before making any decisions.

Find the balance that’s right for you

Even though you’re close to retirement, there may still be practical steps you can take to improve your retirement readiness. Delaying retirement, adjusting your spending and releasing home equity are just a few strategies that can help you enjoy a more secure and fulfilling retirement. Remember, the key is to find a balance that works for you and ensures you enjoy the retirement you’ve been looking forward to.

1 The Vanguard Retirement Outlook: Assessing the retirement readiness of UK baby boomers. Vanguard, June 2025.

2 Full-time employees aged 61 to 65.

3 Target replacement rates were established by the Pensions Commission in 2004-05 and then uprated to 2024-25 values by the Resolution Foundation.

4 Low-income individuals, who typically spend a larger share of their pre-retirement income on necessities, need a larger share of their income to sustain their lifestyle in retirement compared to higher-income individuals.

5 Our sample included 717 individuals aged between 61 and 65 in full-time employment in the 2018-20 Office for National Statistics Wealth and Assets Survey, which is a representative bi-annual panel survey of UK individuals and households.

6 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term.

7 The state pension increases by the equivalent of 1% for every 9 weeks of deferral. This works out as just under 5.8% for every 52 weeks. For more information see https://www.gov.uk/deferring-state-pension.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Eligibility to invest in a Vanguard Personal Pension depends on your individual circumstances. Please be aware that pension and tax rules may change in the future and the value of investments can go down as well as up, so you might get back less than you invested. You cannot usually access your pension savings or make any withdrawals until the age of 55, rising to the age of 57 in 2028.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information is general in nature and does not constitute legal, tax, or investment advice.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4547690