Your pension allowance and tax relief explained

Tax relief is essentially income tax that is paid back to you by the government and can boost your pension savings. We explain how it works.

When you pay into a pension, you can get tax relief from the government, which can significantly boost your retirement savings. This tax relief is one of the best things about saving into a pension.

However, there’s a limit to how much you can pay into a pension and still get tax relief. This limit is called your annual allowance and while the rules can seem a bit complex, this guide aims to break them down for you.

How does tax relief work in practice?

Tax relief on your pension contributions can be applied in two ways: ‘relief at source’ and ‘net pay’.

Relief at source

Relief at source is used by some workplace pension schemes as well as self-invested personal pensions (SIPPs) like the one offered by Vanguard.

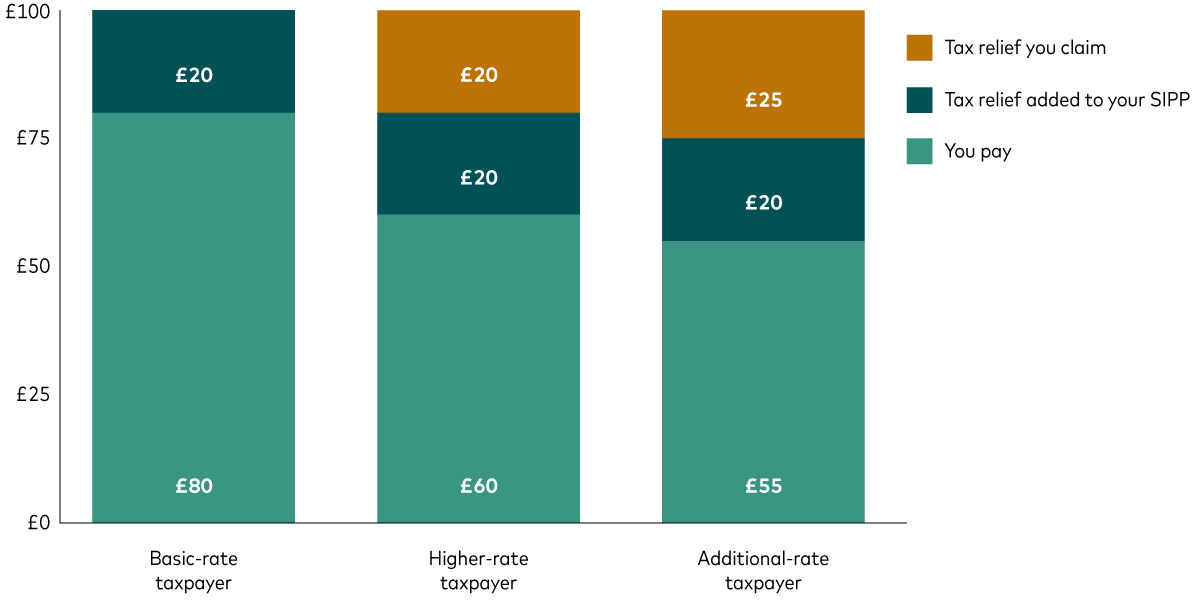

Your pension contribution is made from income that has already been taxed. Your pension provider then claims the tax back from the government at the basic rate of 20% and adds it to your pension pot. So, for every £80 you pay in, you get £20 in tax relief on top.

If you are a higher-rate (40%) or additional-rate (45%) taxpayer1, you can claim extra tax relief through your self-assessment tax return or via HMRC’s online service. You can receive this via a tax rebate, a reduction in your tax bill or a change to your tax code. It effectively means that a £100 contribution can cost as little as £60 or £55, respectively.

The illustration below shows how this works.

Total cost of a £100 pension contribution

Source: Vanguard calculations.

Net pay

Net pay is used by some workplace pension schemes. Your pension contributions are deducted from your salary before tax is applied. This means you automatically receive tax relief at your highest rate of income tax. If you’re a higher-rate or additional-rate taxpayer, you get the full 40% or 45% tax relief on earnings than push you into a higher tax band, without needing to claim it separately.

How much can you pay into a pension and get tax relief?

Annual allowance

Most people can pay up to 100% of their gross (pre-tax) relevant earnings2 into their pension each tax year, up to a maximum of £60,000. This is known as your annual allowance. It covers all your pensions (excluding the state pension) and includes employer and third-party contributions as well as your own personal contributions.

It means basic-rate taxpayers can contribute up to £48,000 and get a maximum £12,000 top-up from the government. Higher-rate taxpayers can also contribute £48,000 but can claim a further £12,000 through their tax return, so it would effectively cost them just £36,000.

If you exceed your annual allowance, you may have to pay a tax charge on the excess.

Tapered annual allowance

For very high earners, the annual allowance is gradually reduced (‘tapered’) until it drops to £10,000. The rules around tapering are complicated, so if you think you’re likely to be affected it’s worth seeking financial advice.

If your ‘adjusted income’ (your total income plus personal and employer pension contributions ) is above £260,000 in the current tax year, your annual allowance will be reduced by £1 for every additional £2 earned. However, this reduction will not apply if your ‘threshold income’ (your total income minus pension contributions) is £200,000 or less3.

For example, if you earn £250,000 and pay £30,000 into your pension, your threshold income is £220,000. If your employer also contributes £30,000, your adjusted income is £280,000. This is £20,000 above £260,000, so your annual allowance reduces by £10,000 to £50,000. In this example, you and your employer have contributed a total of £60,000, so you would usually need to pay income tax on the £10,000 that exceeds your tapered allowance.

Carry forward rules

It may be possible to contribute more than your annual allowance by carrying forward unused annual allowances from the previous three tax years.

To do this, you need have been an active member of a pension scheme during that time. You also need to use up your full allowance for the current tax year first and have earned at least what you wish to contribute. For example, if you want to make a total contribution of £100,000, you must earn at least £100,000 in that tax year.

Non-earners

If you don’t earn an income and don’t pay income tax, you can still get tax relief on pension contributions. The annual allowance for non-earners is £3,600. You can pay in up to £2,880 and get up to £720 in tax relief from the government. This can’t be carried forward to future tax years.

Money purchase annual allowance

Once you start taking money from your pension, your annual allowance may be reduced to £10,000. This is known as the money purchase annual allowance (MPAA)4.

The MPAA is triggered if you start taking income from your pension under flexible income drawdown or if you take an individual lump sum that is a mix of tax-free cash and taxable income (called UFPLS). This reduced allowance can’t be carried forward to future tax years.

The MPAA won’t be triggered if you leave your pension money untouched or only take your 25% tax-free cash.

Learn more about withdrawing your pension money.

Tax relief can be a powerful way to boost your pension savings. By understanding how much you can contribute, you can make the most of your retirement planning.

1 For the 2025-26 tax year, individuals earning between £50,271 and £125,140 fall within the higher-rate tax band, which is taxed at 40%. Any earnings above £125,140 are taxed at 45%.

2 For more on what counts as ‘relevant earnings’ that can earn tax relief when used to fund a pension, see the HMRC Pensions Tax Manual.

3 For more on working out your 'adjusted' and 'threshold' income, visit Gov.uk.

4 Under certain circumstances such as ill-health, and depending on a pension scheme’s rules, it may be possible to withdraw pension funds earlier. However, early withdrawals may also be classed as unauthorised and liable to a 55% tax charge. Visit Gov.uk for more information.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Eligibility to invest in a Vanguard Personal Pension depends on your individual circumstances. Please be aware that pension and tax rules may change in the future and the value of investments can go down as well as up, so you might get back less than you invested. You cannot usually access your pension savings or make any withdrawals until the age of 55, rising to the age of 57 in 2028.

If you are not sure of the suitability or appropriateness of any investment, product or service you should consult an authorised financial adviser. Please note this may incur a charge.

Any tax reliefs referred to are those available under current legislation, which may change, and their availability and value will depend on your individual circumstances. If you have questions relating to your specific tax situation, please contact your tax adviser.

Other important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.