Why ignoring market dips can double your wealth

Discover how staying invested through market downturns can boost your wealth. Learn about the power of compounding and the risks of market timing.

Since our founding 50 years ago, we’ve always believed that focusing on the long term and ignoring the market’s inevitable dips can improve your chances of investment success.

We call this being disciplined and it’s one of our four investment principles. This principle is particularly relevant given the heightened stock market turbulence we’ve seen in recent weeks. It’s at times like this that it really counts.

The importance of being disciplined isn’t just a belief or idea – it’s backed by solid data. Recently, we conducted a study to quantify the benefits of staying invested through all the major market downturns since 1975, compared with exiting the market each time and buying back in six months later. We found that someone who stayed invested would have nearly double the wealth today.

Read on to learn more about our findings and what they mean for you.

Staying invested versus market timing – we crunch the numbers

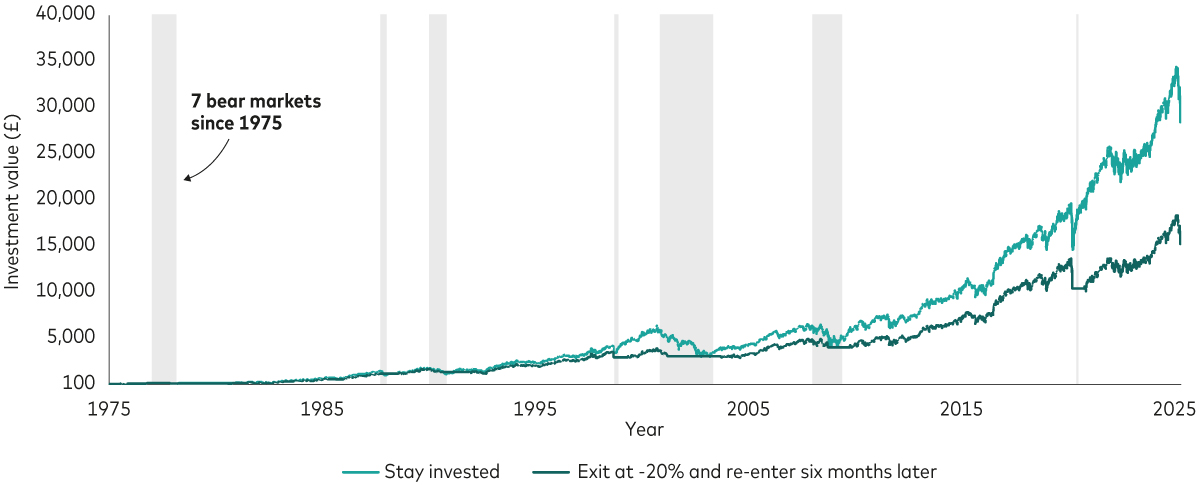

We analysed how much an investor could have today if they invested £100 in global shares1 at the start of 1975.

While 50 years sounds like a very long time to invest, it’s not dissimilar to the length of time many of us will be investing in pensions. This long investing timeframe also lets us see the impact of several different ‘bear’ markets, defined as a fall of more than 20% from the market’s most recent high. There have been seven bear markets in global shares since 1975, including the bursting of the dot-com bubble (when technology stocks fell after a rapid rise in valuations in the late 1990s), the global financial crisis in 2007-09 and the Covid-19 pandemic in 2020.

We found that if the investor stayed invested through all these bear markets, their £100 would have grown to £29,307 today. However, if they exited the market every time it dropped by 20% or more and then bought back into the market six months later each time, they would have only £15,663.

In other words, by ignoring market downturns and staying disciplined, they would have nearly twice the amount.

Past performance is not a guarantee of future results, but it’s a compelling example of the power of staying invested.

Staying invested versus market timing

Past performance is not a reliable indicator of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Notes: The chart shows the MSCI World Total Return Index from 1 January 1975 to 31 December 1987 and the MSCI AC World Total Return Index thereafter. The grey shaded areas represent bear markets, defined as price decreases of more than 20% from the most recent high.

Source: Vanguard calculations in GBP, based on data from Refinitiv, as at 20 April 2025.

Why staying invested beats market timing

The stock market is inherently volatile and it's natural to feel anxious when you see your investments drop in value. However, history has shown that the market tends to recover and continue growing over the long term. By staying invested, you give your portfolio the best chance to benefit from these recoveries. It also enables you to harness the full power of compounding. This is when you earn returns on the money you invest as well as on the returns themselves. When you stay invested, this compounding effect can potentially turn a small initial investment into a substantial sum over time.

Conversely, attempting to time the market is a risky strategy. It requires not only predicting when the market will drop but also knowing when it will recover. This is incredibly difficult, even for professional investors. This is because the market’s best days often follow its worst days. Missing these recovery periods can be costly.

If you panic and sell out when the market drops, you’re likely to only buy back in when you feel more confident. By that time, the market may already have risen, which means you’ll have locked in losses and missed out on subsequent gains. This can also leave you facing more uncertainty when the markets dip again.

How to stay disciplined

Staying disciplined is not just about the numbers; it’s also about managing your emotions. Market downturns can be stressful, and it’s natural to feel the urge to sell and protect your capital. However, reacting emotionally to short-term market movements can be detrimental to your long-term financial goals. It’s much better to have a well-thought-out investment plan and stick to it.

At Vanguard, we offer a range of services to help you stay disciplined. If you’re confident building and managing your portfolio yourself, you can choose from our wide range of low-cost individual funds. Or you can keep things simple by picking one of our LifeStrategy funds or Target Retirement funds, which combine different types of investments in one ready-made portfolio. You pick the fund and we do the rest, keeping your portfolio to the target risk level.

For clients in our managed services, we select investments for you based on your attitude to risk, so you don’t need to worry about picking funds. We also manage your portfolio for you, making changes only when necessary to maintain the right level of risk. This can help you avoid making impulsive decisions, such as panic-selling when markets are choppy.

1 Global shares are represented by the MSCI World Index until 31 December 1987 and the MSCI All Country World Index thereafter.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

The Vanguard LifeStrategy® Funds and Vanguard Target Retirement Funds may invest in Exchange Traded Fund (ETF) shares. ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

For further information on risks please see the “Risk Factors” section of the prospectus on our website.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

For further information on the fund's investment policies and risks, please refer to the prospectus of the UCITS and to the KIID before making any final investment decisions. The KIID for this fund is available, alongside the prospectus via Vanguard’s website.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information is general in nature and does not constitute legal, tax, or investment advice.

Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

The Authorised Corporate Director for Vanguard LifeStrategy Funds ICVC is Vanguard Investments UK, Limited. Vanguard Asset Management, Limited is a distributor of Vanguard LifeStrategy Funds ICVC.

For investors in UK domiciled funds, see our summary of investor rights which is available in English.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4471074