How to help fund university costs

University tuition fees are set to rise in September and living costs have soared. We explore how planning ahead can help ease the burden for your child.

With many students starting or returning to university in September, many parents will be considering whether a degree is an affordable aspiration for their children. There are increasing questions around how you fund a degree.

Tuition fees will rise from £9,250 to £9,535 a year for courses starting in September 20251, which is a huge amount of debt for a student to take on.

Additionally, living costs increased by more than 8% between the 2022-23 and 2023-24 academic years, according to a 2024 student housing survey2. In some cases, the increases were significantly higher, up by as much as 27%. The report also found that university maintenance loans (loans provided by the government’s Student Finance England for general living costs) are failing to keep pace with rising rents.

While graduates will not necessarily repay their student loan in full and only have to make payments once their income is above a certain level, the idea of accumulating debt so early on in life is understandably unappealing3.

So, how much might you need to save for university? We’ll take a look at the costs below and explore some key considerations if your children are thinking about pursuing higher education.

How much does a university education cost?

Tuition fees quickly mount up for undergraduates, with a typical three-year degree set to cost £28,605. Factor in interest, and many people are already more than £30,000 in debt by the time they have taken their final exam4.

If you apply for a maintenance loan to cover your living costs as well, the debt will be even higher. A student living away from home at a non-London university can borrow up to £10,544 a year5, equating to £31,632 over the course of a three-year degree. For a London university, the figures are £13,762 and £41,286, respectively. These figures are also determined by your household income, with less available for those with a higher household income6.

Altogether, if a student borrows the maximum amount for both tuition fees and maintenance loans, they could graduate owing around £60,000 for a university outside London, and more than £70,000 if they study in London.

However, not every student will repay the full loan amount. For the 2025-26 academic year, most graduates will only begin making repayments once their annual income goes above £25,0007. Any remaining loan balance will be cancelled after 40 years. UK government estimates suggest that 34% of full-time undergraduate students who start university in 2024-25 won’t repay their loan in full8.

How can you save for university?

Despite the possibility of not having to repay a student loan in full, many parents have an instinctive reaction against their children taking on so much debt so early in life.

Many therefore look to set aside money ahead of time, potentially with the help of other family members such as grandparents. A Junior individual savings account (JISA) is ideal in this respect, offering a tax-efficient way to invest up to £9,000 a year9.

While anyone can put money in, only the parents or legal guardians of a child can open one.

The downside to a Junior ISA is that the assets legally belong to the child. That means they can choose to spend the JISA assets on whatever they like once they turn 18. This puts some parents off. It should also be noted that JISAs cannot be accessed before the child’s 18th birthday.

An alternative option is for parents to invest through their own ISAs, although grandparents and other family members can’t directly contribute to the parents’ ISAs.

How much could you build up in a Junior ISA?

Few people will be able to set aside £9,000 each year, particularly if they have more than one child.

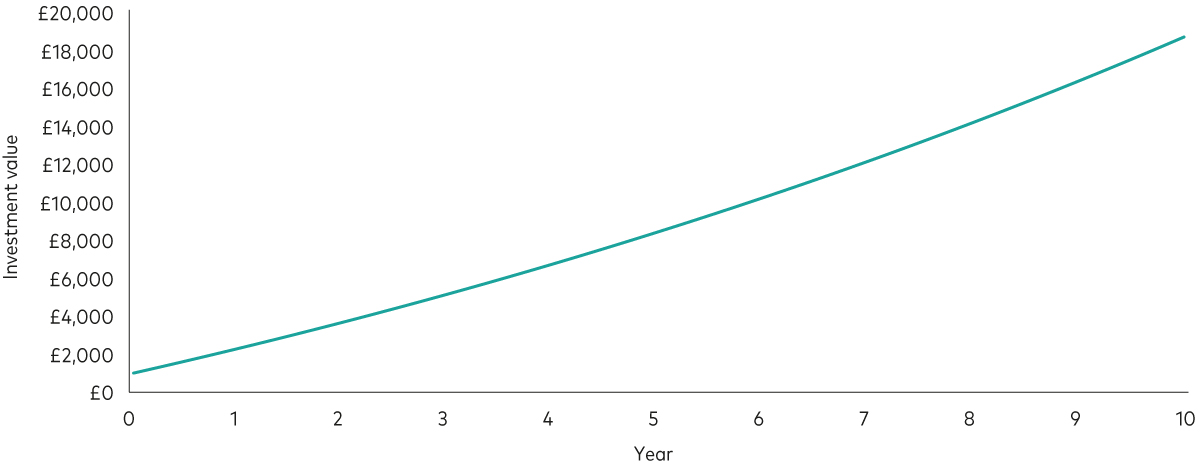

Our chart below shows a potentially more realistic example. The investor starts with an initial £1,000 investment and begins investing £100 a month, increasing that amount by 2% a year to take into account inflation. We’ve assumed investment growth of 5% a year after fees. After 10 years, their pot is worth just over £18,500.

Investing over 10 years

Notes: This hypothetical scenario is for illustrative purposes only and doesn’t represent a particular investment or its expected returns. It assumes annual returns of 5% after fees.

Source: Vanguard

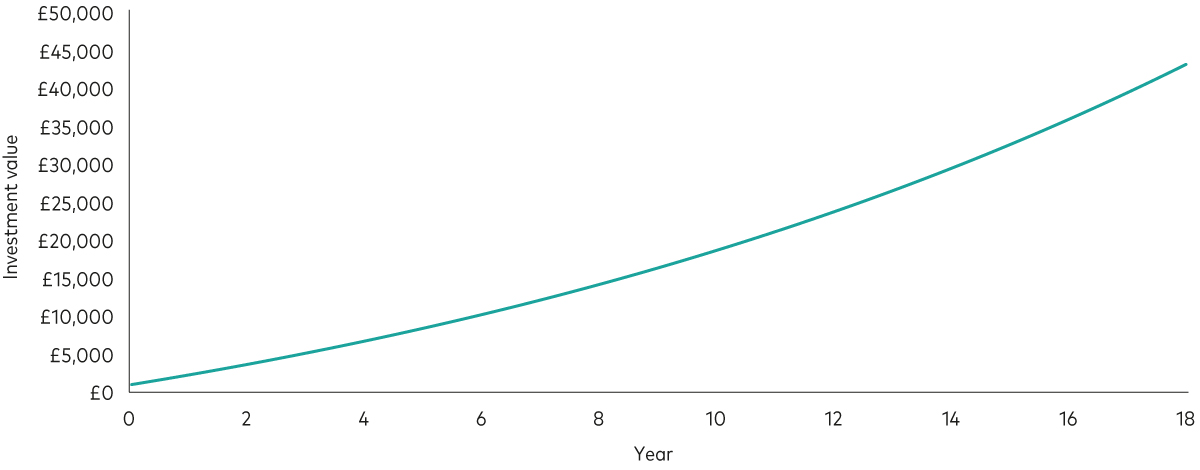

If you’re really organised, you could start saving from birth. Using the same assumptions as above, but with an investment time period of 18 years, a pot for university savings could amount to just shy of £43,000.

Investing over 18 years

Notes: This hypothetical scenario is for illustrative purposes only and doesn’t represent a particular investment or its expected returns. It assumes annual returns of 5% after fees.

Source: Vanguard

Either scenario would make a big difference to someone’s university experience, helping to fund tuition costs or, in the case of the larger savings pots, funding tuition and helping with living expenses over three years.

If there are any savings remaining after graduation, they could be earmarked for future goals such as a house deposit.

So, should I save for university costs?

Ultimately, there are a lot of different factors to consider when saving for university.

But having a pool of savings will help to give someone flexibility, whether that’s enabling them to concentrate on their studies and not take a part-time job, or perhaps allowing them to pursue a postgraduate degree, further professional studies, or a completely different goal.

2 Cushman & Wakefield UK Student Accommodation Report 2024.

3 For an overview of what undergraduates are entitled to, see gov.uk. The student loan system provides an overview of the terms and conditions when taking out a student loan.

4 Figures based on tuition fees of £9,535 a year for a three-year course, together with interest at 4.3% per year.

5 Student Maintenance Loans 2025, Save the Student. 15 April 2025.

6 Undergraduates who come from a household with an income above £70,116 are only entitled to a maximum of £4,915 if living outside of London, or £6,853 if living in London, for 2025-26.

7 For a plan 5 student loan. See HMRC website for all repayment plans and figures.

8 See gov.uk for further details. Information sourced July 2025.

9 Information correct as of 2025-26 tax year.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

The eligibility to invest in either ISA or Junior ISA depends on individual circumstances and all tax rules may change in future.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4687699