What is portfolio rebalancing and why is it important?

Find out what rebalancing is, how it works and why it can help you avoid making costly mistakes.

Portfolio rebalancing is when you adjust the proportions of different assets (such as shares and bonds) in your investment portfolio to maintain the mix that’s right for you.

This means periodically selling some assets and buying others to get back to the mix of shares and bonds that aligns with your goals and attitude to risk.

In this article, we explain why rebalancing is important and how it works in practice.

Why is the mix of shares and bonds important?

Research has shown that the mix of assets in your portfolio will have the greatest impact on your long-term investing success¹. Investors typically set a target asset allocation, such as 60% shares and 40% bonds. The right mix for you depends on your goals, how long you plan to invest for and how you feel about risk.

For example, if your goals are far in the future, you might want to invest more in shares. Shares typically provide higher returns over long periods, but they can also be more volatile, meaning their value can fluctuate a lot.

If your goals are closer, you might want to invest more in high-quality bonds. Bonds are generally less risky and can help protect your portfolio from big market drops.

The longer you’re investing, the more time you have to recover from stock market dips. That’s why people nearing retirement might start shifting more of their investments into bonds.

It’s also important to consider how you feel about risk. Some people are more cautious and prefer to take fewer risks with their money, while others are more comfortable with higher risk for the potential of higher returns.

Why is rebalancing needed?

Different types of investments tend to perform differently to one another. Over time, this can change the mix of shares and bonds in your portfolio.

Imagine you start with a portfolio made up of 60% shares and 40% bonds. If shares grow by 10% in one year and bonds fall by 10%, the split might change to 65% shares and 35% bonds. This means your portfolio has become riskier than you originally intended.

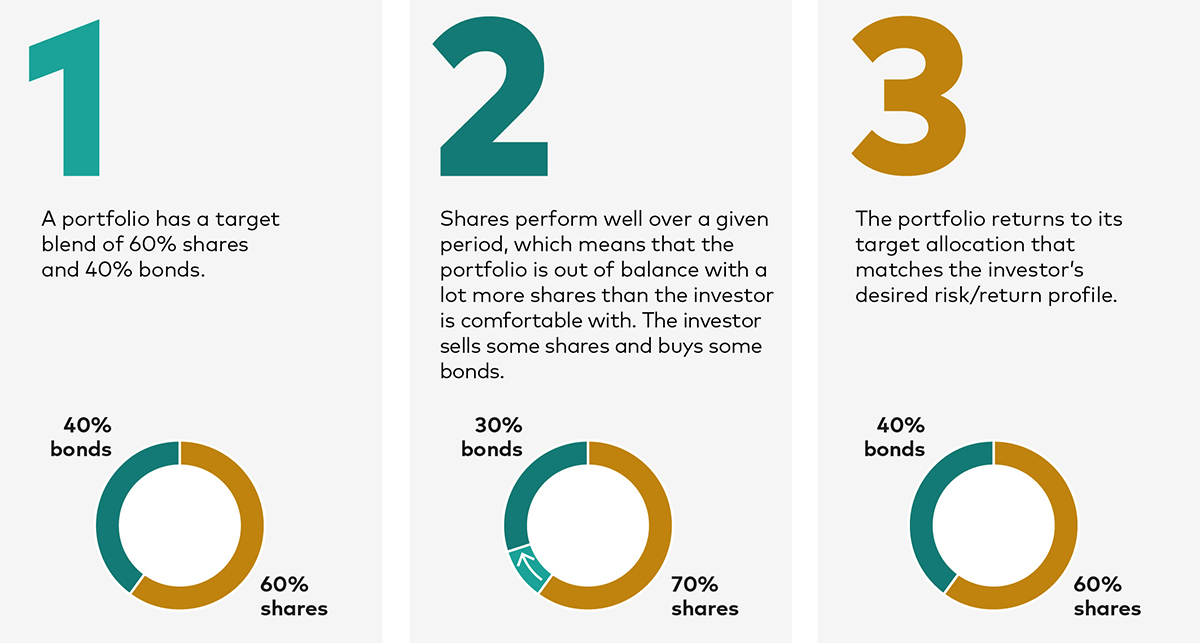

The change might seem small but, if left unchecked, you’ll drift further and further away from your original allocation over time. The diagram below illustrates the rebalancing process.

The rebalancing process

Source: Vanguard.

How portfolio rebalancing works

To get your portfolio back to its original asset allocation, you would sell some of your better-performing investments (in this case shares) and use the proceeds to buy more of your underperforming investments (in this case bonds). Alternatively, you can add new money to the investments that haven’t done as well.

It might seem counterintuitive to invest more money in assets that are falling in value, but the goal of rebalancing is to ensure you don’t stray too far from the right risk level. This helps to protect you when stock markets go down in the future. It also keeps you disciplined, so you avoid making costly mistakes.

The above example shows the rebalancing process when a portfolio has become too risky. But what if your portfolio becomes less risky, shifting from, say, 60% shares and 40% bonds to 50% shares and 50% bonds? Why rebalance in this scenario? First, it ensures you maintain enough risk to allow your portfolio to grow over the long term. Second, by buying more shares, your portfolio will be better positioned to benefit from stock market recoveries.

This is why our all-in-one multi-asset funds – our LifeStrategy funds and our Target Retirement Funds – do the rebalancing for you.

It’s also why our managed service selects funds based on how you feel about risk and rebalances your portfolio to keep you to the right risk level. If the mix of shares and bonds in your portfolio drifts by more than 5 percentage points, we’ll rebalance the portfolio back to the target mix.

1 Gary P. Brinson, L. Randolph Hood, and Gilbert L. Beebower, 1995. "Determinants of portfolio performance." Financial Analysts Journal 51(1):133–8. (Feature Articles, 1985–1994.)

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

The Vanguard LifeStrategy® Funds and Vanguard Target Retirement Funds may invest in Exchange Traded Fund (ETF) shares. ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

For further information on risks please see the “Risk Factors” section of the prospectus on our website.

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

For further information on the fund's investment policies and risks, please refer to the prospectus of the UCITS and to the KIID before making any final investment decisions. The KIID for this fund is available, alongside the prospectus via Vanguard’s website.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

The Authorised Corporate Director for Vanguard LifeStrategy Funds ICVC is Vanguard Investments UK, Limited. Vanguard Asset Management, Limited is a distributor of Vanguard LifeStrategy Funds ICVC.

For investors in UK domiciled funds, see our summary of investor rights which is available in English.

Vanguard will manage your investments in the Managed SIPP and Managed ISA on your behalf. You will not be able to place trades on your own account.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4661266