How compounding can supercharge your ISA returns

Find out what compounding is, how it works and why it can help to boost your investment returns over time.

Albert Einstein reportedly called compounding the eighth wonder of the world. While it might not rival the Great Pyramid of Giza, compounding can work wonders for your money over time.

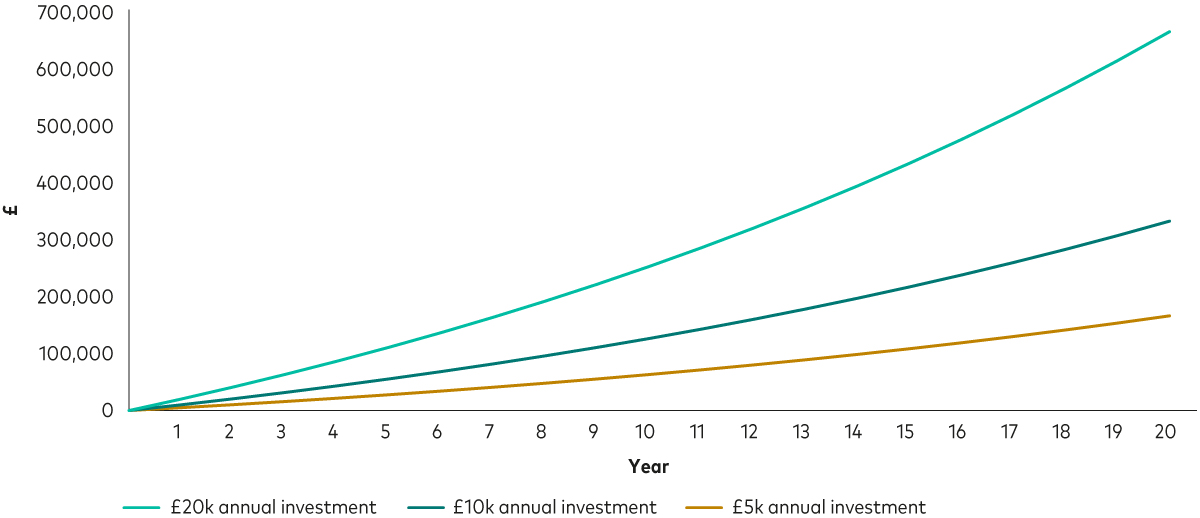

In this article, we’ll show how investing your full individual savings account (ISA) allowance every year for 20 years could potentially grow your savings to over £660,000, with £260,000 of that coming from compounded returns.

Of course, not everyone is able to invest £20,000 a year. But the beauty of compounding is that even relatively small amounts can grow into sizeable sums over time.

What is compounding?

Compounding is when you earn returns on the money you invest as well as on the returns themselves. It’s a simple concept, but it can have a powerful effect on your wealth. Over time, the impact of compounding on a stocks and shares ISA can be significant.

The table below shows a simple example of compounding in action. It assumes an initial investment of £1,000, which grows by 5% a year after fees.

Compounding in action

Year |

Total amount |

Increase |

||

0 |

£1,000 |

n/a |

||

1 |

£1,050 |

£50 |

||

2 |

£1,102.50 |

£52.50 |

||

3 |

£1,157.63 |

£55.13 |

||

4 |

£1,215.51 |

£57.88 |

||

5 |

£1,276.28 |

£60.78 |

Source: Vanguard calculations

Notice how the growth gets bigger each year? That’s because the 5% return applies to a progressively larger total. It’s almost like a snowball rolling downhill – as it gathers more snow, it gets bigger faster.

In reality, your investments won’t rise every single year because markets go down as well as up. However, the longer you invest the higher the chance your money can grow overall and benefit from the power of compounding.

How could compounding boost your ISA?

Compounding becomes even more powerful if you keep adding to your initial investment.

Let’s imagine you invest £20,000 (the current ISA allowance) every year for 20 years and your money grows by 5% a year after fees. At the end of the 20 years, your portfolio would be worth £661,319. Of that, just over £260,000 would come from compounded returns.

Even if you invest half the amount – £10,000 a year – you could still end up with a portfolio worth £330,660, with around £130,000 coming from compounded returns.

In the chart below, you can see how the returns begin to accelerate over time. The line gets steeper and steeper as the effects of compounding take hold.

If you continued investing £20,000 every year, your portfolio would reach £1 million after 26 years.

The power of compounding your ISA allowance

Notes: This hypothetical scenario is for illustrative purposes only and doesn’t represent a particular investment or its expected returns. It assumes annual returns of 5% after fees. Balances reflect the value at the end of each period. The value of your investments and the income received from them can fall as well as rise.

Source: Vanguard calculations, January 2025.

Remember, these are all hypothetical examples, and market performance will be a key factor in how fast your money grows. However, staying invested gives you a better chance to recover from market dips and benefit from the snowball effect of compound growth.

Beware the impact of fees

Another factor that will affect how fast your money grows is fees. Just like investment returns, fees compound over time, which means they can add up and eat into your overall gains.

In the example above, paying an additional 1% in fees on your ISA and underlying investments would reduce the value of the £20,000 annual investment to £595,562 after 20 years – a difference of £65,000.

While you can’t control market performance, you can control the fees you pay. By choosing low-cost investments, you can keep more of your returns.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

The eligibility to invest in either ISA or Junior ISA depends on individual circumstances and all tax rules may change in future.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2026 Vanguard Asset Management Limited. All rights reserved.

5138526