How to be a successful investor in your 20s

Taking control of your finances and investing early is a great way to secure your financial future. Here are six ways to be a successful investor in your 20s.

Starting your investing journey in your 20s is a powerful way to secure your financial future. Whether you’re just entering the workforce or already have a steady income, the early years are a golden opportunity to build wealth and achieve your goals.

Even small contributions, combined with good financial habits, can make a significant difference over time.

Here are six tips to be a successful investor in your 20s.

Lay solid foundations

If you haven’t already done so, think about creating a budget. It’s important to know how much money you have coming in and what your regular outgoings are so you can manage your finances effectively. Make sure you have enough money to cover essentials like rent, your student loan, bills and transport costs.

It’s also important to have enough cash savings to cover emergencies. For one-off expenses, like an unexpected bill, one rule of thumb is to keep the greater of £2,000 or half a month’s expenses in a bank account. For larger unexpected costs, such as a period of unemployment, we generally suggest holding three to six months’ worth of expenses in an accessible account. You can adjust this based on your specific needs; for example, if you’re living with your parents and not paying rent, you might not need this much.

Once you’ve accounted for these things, you’ll know how much money you have left and can think about how to use it wisely.

Start early

If you ask any investor what they wish they'd done differently, most will say they wish they'd started sooner. More time in the market means more time for your money to grow.

Let’s imagine two investors who are aiming to build an investment pot to use when they are 65 years old. One investor starts putting aside £200 every month from the age of 20. The other invests the same amount but starts at age 30.

Assuming an annual investment return of 5% before fees, the investor who starts at age 30 would have a pot valued at £221,692 by age 65. It sounds impressive, but the investor who starts at age 20 would have £391,986 – that’s £170,000 more! And that’s without increasing their contributions over time (more on that later).

Take advantage of your workplace pension

Your choices in your 20s can significantly impact your financial future. Make sure you’re still opted into your workplace pension scheme1, even if it feels like you could use that extra money now. Unlike other ways of saving, contributing to a workplace pension means you aren’t the only one putting in money. If you earn more than £10,000 a year, your employer is required to contribute, which is essentially free money. Some employers will pay more into your pension if you increase your contributions too, giving you an extra boost.

You also get a contribution from the government as tax relief, which means that paying into a pension costs less than you might think. To add £100 to a pension, a basic-rate taxpayer only needs to pay in £80 – the remaining £20 comes from the government. As well as getting tax relief, money inside a pension grows tax-free – you’ll usually only pay tax when you come to withdraw the money in retirement. Retirement might feel like a lifetime away but when the time comes, you will need an income. The younger you are when you start paying into a pension, the better. Even if it’s only a small amount, the money you put away early in life can build up over time.

Consider a stocks and shares ISA

For goals other than retirement, a stocks and shares individual savings account (ISA) is one of the best ways to build your wealth. When you invest through an ISA your money grows tax-free. That means you won’t pay income tax on the dividends2 or interest you receive, and you won’t pay capital gains tax (CGT) on any profits you make when selling investments.

You can invest as much or as little as you want (up to your annual ISA allowance of £20,0003) and can access your investments when you’re ready.

Increase your contributions over time

When you’re just starting out, you might only be able to invest a little to begin with. But that’s ok – a little can go a long way thanks to compounding. This is when you earn returns on the money you invest as well as on the returns themselves.

For example, if you invest £1,000 in a fund with an annual return of 5%, after the first year, you will have £1,050 (excluding the impact of fees). In the second year, you earn returns on both your initial investment and the additional £50 gained in the first year, ending up with £1,102.50. It’s a simple concept, but it can have a big impact on your wealth over time.

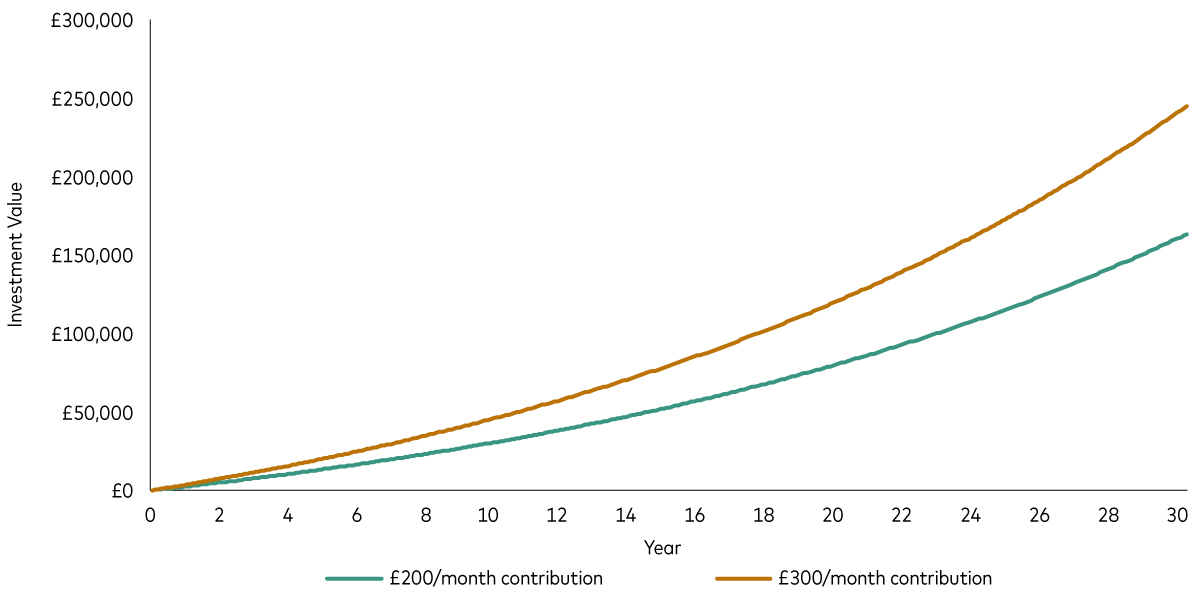

As you start to earn more money, increasing your monthly contribution can help you achieve your goals faster and take full advantage of the power of compounding. The chart below shows that investing £200 a month into an ISA with an annual return of 5% before fees would give you £163,075 after 30 years. However, a £300 monthly investment would see that figure become £244,612 after 30 years, showing that increasing your monthly contribution by a small amount can have a big impact over the long term.

An extra £100 a month could make you £80,000 richer after 30 years

Notes: This hypothetical scenario is for illustrative purposes only and doesn’t represent a particular investment or its expected returns. It assumes annual returns of 5% before fees. Balances reflect the value at the end of each period.

Source: Vanguard calculations.

Choose the right investments for you

To make sure your money is working hard for you and that you’re not taking on too much risk, it’s crucial to have the right investments. To get started, ask yourself what your goals are and when you want to achieve them by. Perhaps you want to buy a house in a few years’ time or just want to build up your wealth over the next decade or so. Having a goal will help you decide which investments are right for you.

Shares typically offer higher returns over the long run but come with more risk. Bonds4 tend to be more stable but offer lower potential returns. The longer you invest, the more time to have to ride out ups and downs of the stock market, which means you might want to invest more in shares and less in bonds. The mix of shares and bonds in your portfolio should also reflect how you feel about risk.

Investments can go down as well as up, but you can reduce risk by spreading your money across different industries and regions of the world. When one area of the market is underperforming, other areas will hopefully perform more strongly, resulting in a smoother investing journey.

At Vanguard, we offer a range of services to help you invest in the way that’s right for you. You can build your own portfolio from our wide range of individual funds. Or you can keep things simple with an all-in-one solution, such as our LifeStrategy funds, which combine different types of investments in one ready-made portfolio.

If you don’t want to choose and manage funds yourself, our managed service can do this for you. We’ll select a portfolio of investments for you based on how you feel about risk and manage your portfolio moving forwards. Our managed service is designed to take the guesswork out of investing, ideal for those getting started or who need an extra helping hand.

No matter how you do it, investing in your 20s is the perfect time to lay the groundwork for a bright financial future.

1 All employers must automatically enroll you into a pension scheme and make contributions to your pension if you’re 22 or older. For more information, see Gov.uk.

2 Dividends are the payments some companies make to their shareholders out of their profits.

3 £20,000 is the most you can currently invest in ISAs in a tax year, which runs from 6 April to 5 April the following year. This limit covers all types of ISAs, so if you invest £10,000 in cash ISAs you can only invest up to £10,000 in stocks and shares ISAs in the same tax year. The allowance resets on 6 April and you can’t carry over any unused allowance into the following tax year.

4 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

The Vanguard LifeStrategy® Funds and Vanguard Target Retirement Funds may invest in Exchange Traded Fund (ETF) shares. ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

For further information on risks please see the “Risk Factors” section of the prospectus on our website.

Eligibility to invest in a Vanguard Personal Pension depends on your individual circumstances. Please be aware that pension and tax rules may change in the future and the value of investments can go down as well as up, so you might get back less than you invested. You cannot usually access your pension savings or make any withdrawals until the age of 55, rising to the age of 57 in 2028.

Any tax reliefs referred to are those available under current legislation, which may change, and their availability and value will depend on your individual circumstances. If you have questions relating to your specific tax situation, please contact your tax adviser.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The Authorised Corporate Director for Vanguard LifeStrategy Funds ICVC is Vanguard Investments UK, Limited. Vanguard Asset Management, Limited is a distributor of Vanguard LifeStrategy Funds ICVC.

For investors in UK domiciled funds, see our summary of investor rights and is available in English.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4551765