The biggest investing lesson of 2025? Keep your cool

Market swings tested investors’ nerves in the spring, but discipline, diversification and a long-term focus delivered results. These are the lessons to carry into 2026.

As we near the end of 2025, it’s worth reflecting on what this year taught us about investing – and how those lessons can guide us into 2026.

The year started on a high, with global stock markets powering ahead. Then came a sharp but short sell-off, a reminder of how easy it is to let emotions take over – and how costly that can be. Much of the conversation was dominated by the US, as if investing were only about one market. Yet other regions took the lead, underscoring why perspective and diversification matter.

The biggest takeaway? Don’t let emotions drive your investment decisions.

The spring sell-off: a case study in staying disciplined

In the spring, markets faced a sharp sell-off following tariff announcements. Headlines were dramatic and, for many investors, the temptation to “do something” was strong. In some instances, you could sense the fear in investors’ voices when speaking to them on the phone – those moments were a stark reminder of how unsettling volatility can feel. Yet, in hindsight, the downturn was short-lived. Despite global stock markets dropping 17% from their February peak to April’s low, investors who remained invested would have been well rewarded. Global stock markets enjoyed a strong year, rising by 14% since January1.

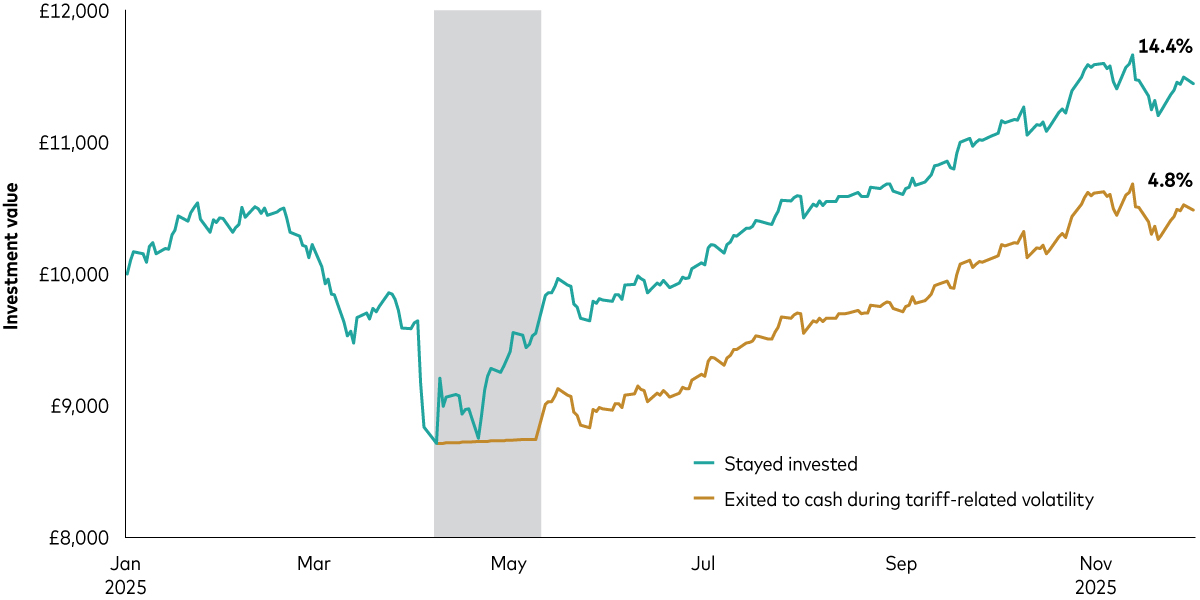

Our research shows that if an investor sold their investments and moved to cash on 8 April and then re-entered the market on 12 May – after the recovery was underway – they would be far worse off than if they’d stayed invested throughout. As the chart below shows, their return for the year would have been just 4.8%, compared with 14.4% if they’d stayed invested. On a £10,000 portfolio, that’s a difference of nearly £1,000, despite being out of the market for only a few weeks.

Reacting to market volatility can jeopardise returns

Going to cash for just a few months can lead to underperformance

Past performance is not a reliable indicator of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. For illustrative purposes only.

Notes: The green line depicts a £10,000 investment in the MSCI AC World Index from 31 December 2024 to 1 December 2025. The gold line depicts the same investment, but the investor sells their investment at the end of the day on 8 April and then re-enters the market on 12 May. Cash is represented by the Sterling Overnight Index Average (SONIA) rate, which reflects the average rate of interest banks pay to borrow overnight. Returns do not take into account fees or inflation.

Source: Vanguard calculations, using data from Refinitiv, as at 2 December 2025.

Timing markets is incredibly hard to do successfully. Selling during periods of market volatility often makes us feel better in the short term because we’ve limited our losses and can watch as markets continue to fall. However, we only tend to re-invest once we’re more certain about the outlook. By this stage, markets have usually bounced back and we’ve missed the boat.

Discipline matters more than predictions

Although 2025 proved to be a strong year overall, it’s important to remember that markets can change. While we can’t predict how 2026 will unfold, being prepared for the occasional bout of volatility can help you stay on track with your long-term goals.

As we discuss in our 2026 economic and market outlook, much of the market’s optimism has been fuelled by excitement around artificial intelligence (AI) and its potential to transform economies and company earnings. While US technology stocks have performed extremely well and investment in AI continues to surge, expectations are now very high – and volatility in this sector is likely to increase.

Despite all the focus on the US and AI, other markets have performed more strongly this year, as we discuss below. This is a timely reminder not to get swept up in market excitement or headlines, but to stick to your long-term plan.

Balance and diversification: the foundations of success

Another important lesson from 2025 is that balance matters. We believe that having the right mix of shares and bonds2 for you – your “asset allocation” – could have a bigger impact on your returns than anything else you do. Shares provide more growth potential, while bonds add stability – together, they create a foundation for long-term success. In particular, with interest rates higher than in recent years, bonds are offering attractive income and can help protect your portfolio if stock market optimism fades or if sectors such as AI experience setbacks.

Building on that, having a globally diversified portfolio matters too. While many investors focus on the S&P 500 Index (which tracks the 500 largest US companies), other markets have taken the lead this year. The S&P 500 has returned 11% year to date, compared with 23% for both UK and emerging markets shares and 17% for both Europe ex-UK and Japan shares3. Holding investments across different regions gives you exposure to opportunities worldwide and helps manage risk when one area underperforms.

Looking ahead to 2026

No one can predict what 2026 will bring. Markets could rise, fall or move sideways. What you can control is your behaviour. Stay disciplined, stick to your plan and keep your portfolio balanced and diversified. Volatility will happen again, so next time try to remember what worked in April and in countless past downturns: stay the course.

1 Global shares are represented by the MSCI All Country World Index. Vanguard calculations in GBP, using data from Factset, 1 January to 30 November 2025.

2 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term.

3 UK, emerging markets, Europe ex-UK and Japan shares are represented by their equivalent MSCI indices. Vanguard calculations in GBP, using data from Factset, 1 January to 30 November 2025.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

5042688