Why it pays to stay prepared for the next market downturn

You can’t predict what markets will do but a little preparation today can make it easier to stay on track if conditions change.

This year has started on a high, with both global shares and bonds1 up, even as headlines continue to circle around trade tariffs, geopolitical tensions and high valuations2 in the artificial intelligence (AI) space.

But strong performance can be deceptively soothing. When markets are up, it’s easy to assume the trend will continue and that any risks have faded. Complacency can easily set in.

But markets don’t move in straight lines and periods of calm often precede bouts of volatility. The most reliable defence isn’t prediction, but preparation: having a plan that can withstand market ups and downs rather than trying to second‑guess them.

Don’t let emotions drive decisions

Last year offered a powerful reminder of how costly emotional decisions can be. After a strong start to the year, a short-lived but sharp sell-off in April hit global markets. But the recovery came just as quickly and markets went on to go from strength to strength.

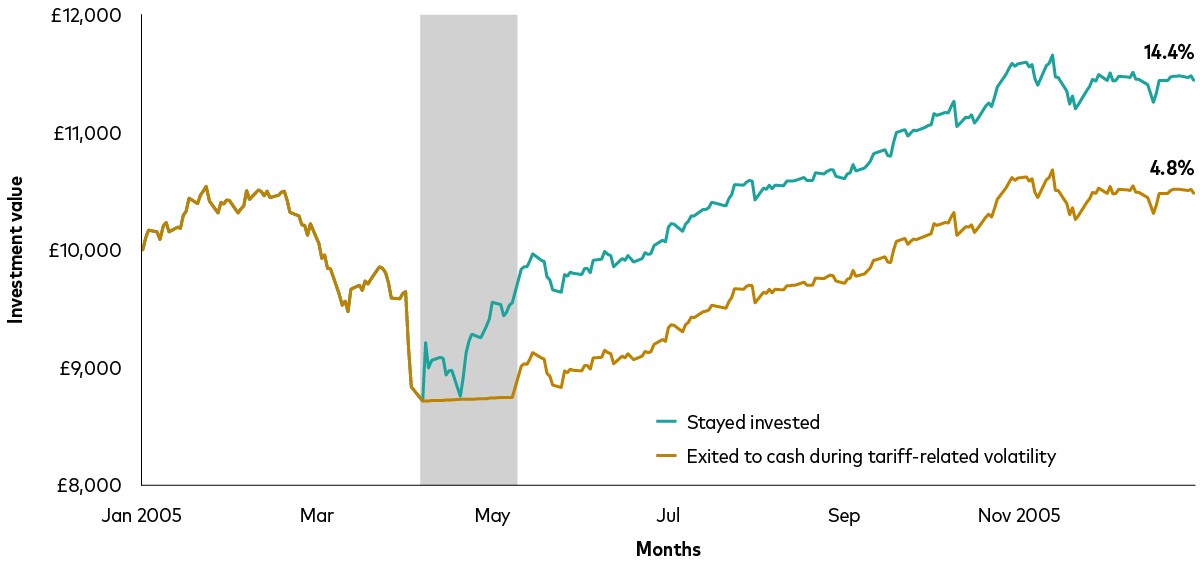

Our research shows that if an investor sold their investments and moved to cash on 8 April and then re-entered the market on 12 May – after the recovery was underway – they would be far worse off than if they’d stayed invested throughout. As the chart below shows, their return for the year would have been just 4.8%, compared with 14.4% if they’d stayed invested.

Past performance is not a reliable indicator of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. For illustrative purposes only.

Notes: The green line depicts a £10,000 investment in the MSCI AC World Index from 31 December 2024 to 31 December 2025. The gold line depicts the same investment, but the investor sells their investment at the end of the day on 8 April and then re-enters the market on 12 May. Cash is represented by the Sterling Overnight Index Average (SONIA) rate, which reflects the average rate of interest banks pay to borrow overnight. Returns do not take into account fees or inflation.

Source: Vanguard calculations, using data from Refinitiv, as at 31 December 2025.

Our emotions can also be influenced by recency bias – the tendency to assume that what just happened will keep happening. When markets fall, it can feel as though the decline will intensify; when they rise, it can feel like gains will persist indefinitely. But acting on those feelings often leads to the worst possible timing.

If there’s anything that 2025 taught us about investing, it’s that keeping your cool is one of the most valuable skills you can have.

Headlines can magnify fear, especially during sudden drops, but maintaining a long‑term perspective is usually far more productive than reacting to short-term noise.

You can’t predict markets – but you can prepare for them

Strong markets can create a different kind of anxiety depending on what type of investor you are and your attitude to risk. Some may try to chase performance, while others may fear an imminent correction. Both reactions can lead to poor decisions.

The reality is that downturns are a normal and expected part of long-term investing. Historically, they have been relatively short-lived and many of the market’s best days occur close to its worst ones. That’s why trying to time exits and re‑entries rarely pays off.

Preparation means accepting that markets will fall – sometimes sharply and without warning. It’s not about foreseeing the next downturn, but ensuring your financial plan is built to weather one.

So how can you prepare for something that may or may not come? We believe following our four investing principles can help:

Know what you’re investing for

Clear goals give you something steadier than market movements to anchor your decisions. When volatility strikes, objectives – not emotions – should guide your next move.

Keep costs under control

You can’t control market returns, but you can control costs. Lower costs leave more of your investment working for you through the good times and the bad.

Be disciplined

Sticking to your plan and resisting the temptation to tinker has historically been one of the most reliable ways to grow wealth. Discipline helps to prevent the performance chasing that often harms long‑term results, as well as knee-jerk selling during tougher times.

Stay balanced

We believe investing in the right mix of shares and bonds for you could have a bigger impact on your returns than anything else you do. You can read more about the importance of keeping a balanced portfolio in our earlier article.

Expect volatility – don’t fear it

Volatility is not a flaw of investing; it’s a feature and it will always have its part to play. But when you expect downs as well as ups, you’re less likely to panic when they arrive.

Downturns may feel dramatic in the moment but when you view them in the context of decades – rather than days or weeks – they typically appear small.

Uncertainty is a permanent part of markets, but fear doesn’t have to be. Being mentally prepared, and understanding how markets behave over time, gives investors the confidence to stick to their plan – whatever the headlines say.

1 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term.

2 A measure of how well company share prices are justified by important measures such as their earnings.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2026 Vanguard Asset Management Limited. All rights reserved.

5197947