4 ways to invest a lump sum of money

Knowing where to invest a lump sum isn’t always easy. From boosting your emergency savings to investing in ISAs and pensions, we explore four options.

If you’ve received a lump sum of money – perhaps a bonus or financial gift – you might be wondering what to do with it.

It’s tempting to splurge, but putting that money to work for your future could pay off far more in the long run. The big question is: where should you invest it?

To help you decide, we’ve summarised four options to consider.

1. Build your emergency savings

First and foremost, it’s important to have a solid safety net. An emergency fund covers unexpected costs, like your boiler or car breaking down, or a period of unemployment.

For one-off expenses, one rule of thumb is to keep the greater of £2,000 or half a month’s expenses in a bank account. When it comes to an income shock, we generally suggest holding 3-6 months’ worth of expenses in an accessible account. If you don’t have this already, consider using your lump sum to start or top up this fund.

2. Invest in a diversified portfolio

Once your emergency fund is sorted, investing gives your money the chance for greater growth over time, helping you reach your goals faster.

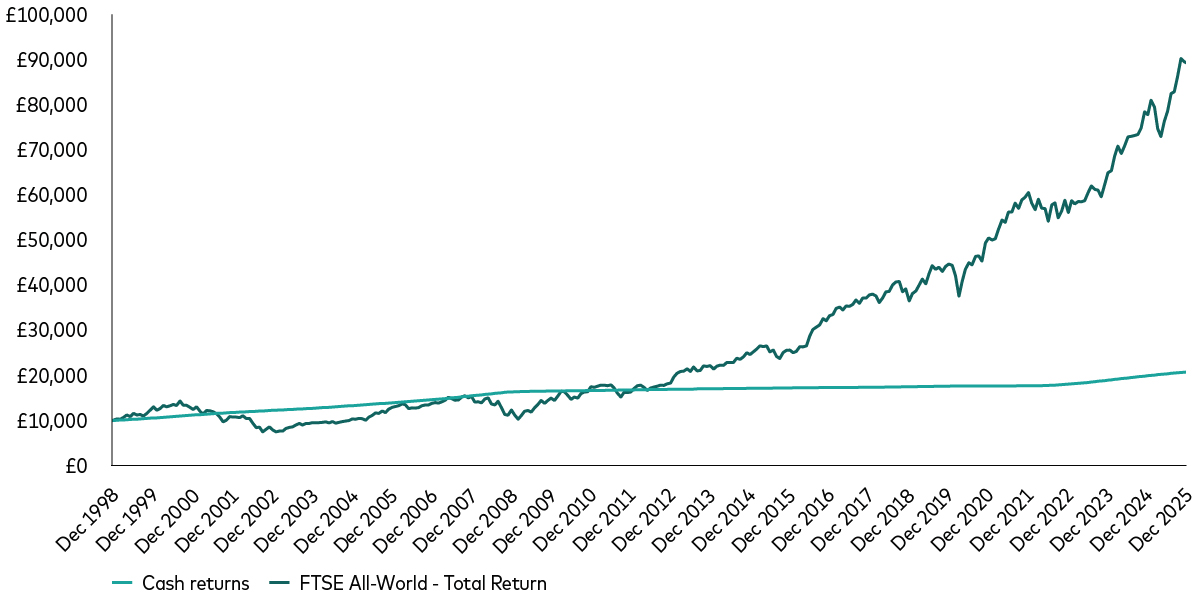

History shows that shares have delivered better returns than cash over long periods. For example, the chart below shows that a £10,000 investment in cash at the end of 1998 would have grown to £20,798 by the end of 2025. In contrast, a £10,000 investment in shares would have grown to £89,225.

Past performance is not a reliable indicator of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Notes: Cash returns represented by the UK Sterling Overnight Index Average benchmark (SONIA) and global shares by the FTSE All-World Index with dividends reinvested. SONIA reflects the average rate of interest banks pay to borrow overnight.

Source: Factset, Vanguard calculations based on period 31 December 1998 to 31 December 2025.

Investments go down as well as up, but you can reduce risk by spreading your money across different types of investments, sectors and regions of the world. If you’re not sure where to start, we offer a managed service where we select investments for you, based on your attitude to risk. If you’re happy to choose investments yourself, our ready-made portfolios, such as our LifeStrategy funds, are already diversified across global shares and bonds. Alternatively, you can choose from our wide range of low-cost individual funds.

3. Make it tax-efficient with an ISA

To really make the most of your lump sum, you need to make sure you’re not paying more tax than necessary. A simple way to do this is to invest through an individual savings account (ISA).

An ISA is a tax-efficient wrapper that lets your money grow free from income tax on dividends1 or interest, as well as capital gains tax (CGT) on any profits you make. You can currently invest up to £20,000 in ISAs each tax year.

4. Boost your pension

If you won’t need the money until you retire, investing it in a pension could give your retirement savings a much-needed boost.

Your retirement might be decades away, but it’s never too early to start investing. You could spend two or even three decades in retirement, so the more you can contribute to your pension now, the better. Investing early on will let you harness the full power of compounding – when you earn returns on the money you invest as well as on the returns themselves.

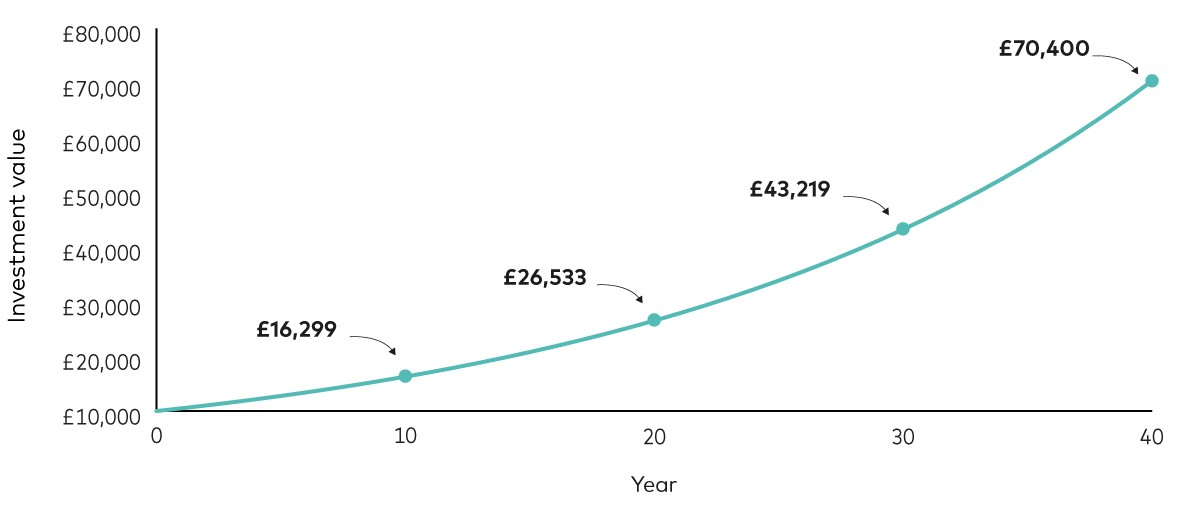

As the chart below shows, compounding can be particularly powerful over long periods. In our hypothetical example, a lump sum investment of £10,000 grows to more than £16,000 after 10 years, assuming annual returns of 5% after fees. Over 20 years, the investment increases to around £26,000 and after 40 years its value balloons to £70,000.

It pays to start early

Notes: This hypothetical scenario is for illustrative purposes only and doesn’t represent a particular investment or its expected returns. It assumes annual returns of 5% after fees.

Source: Vanguard.

When you make a personal pension contribution, you’ll also get an additional 20% in pension tax relief from the government. For every £80 you contribute to your pension, you’ll get a top-up of £20. If you’re a higher-rate or additional-rate taxpayer, you can claim back an additional £20 or £25, respectively, via your self-assessment tax return. This can help to supercharge how much money you have at retirement, and really make the most of that unexpected lump sum. The most you can pay into your pensions each year and receive tax relief on is £60,000 or 100% of your gross relevant earnings, whichever is lower2.

The bottom line

A lump sum can be more than just extra cash – it’s an opportunity to shape your financial future. Take time to think about what matters most to you, and let your money work toward those priorities. A thoughtful plan now could turn a one-off windfall into long-term confidence and security.

1 Dividends are the payments some companies make to their shareholders out of their profits.

2 For more on what counts as ‘relevant earnings’ that can earn tax relief when used to fund a pension, see the HMRC Pensions Tax Manual. Your annual allowance might be lower than £60,000 if you have a high income or you’ve already flexibly accessed your pension pot. To work out if you have a reduced (tapered) annual allowance, see HMRC’s website. If you’ve flexibly accessed your pension, you can work out what your alternative annual allowance is here.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

The eligibility to invest in either ISA or Junior ISA depends on individual circumstances and all tax rules may change in future.

Eligibility to invest in a Vanguard Personal Pension depends on your individual circumstances. Please be aware that pension and tax rules may change in the future and the value of investments can go down as well as up, so you might get back less than you invested. You cannot usually access your pension savings or make any withdrawals until the age of 55, rising to the age of 57 in 2028.

Any tax reliefs referred to are those available under current legislation, which may change, and their availability and value will depend on your individual circumstances. If you have questions relating to your specific tax situation, please contact your tax adviser.

If you are not sure of the suitability or appropriateness of any investment, product or service you should consult an authorised financial adviser. Please note this may incur a charge.

For further information on risks please see the “Risk Factors” section of the prospectus on our website.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

For further information on the fund's investment policies and risks, please refer to the prospectus of the NURS and to the KII before making any final investment decisions. The KII for this fund is available, alongside the prospectus via Vanguard’s website.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information is general in nature and does not constitute legal, tax, or investment advice.

Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

Vanguard will manage your investments in the Managed ISA and SIPP on your behalf. You will not be able to place trades on your own account.

The Authorised Corporate Director for Vanguard LifeStrategy Funds ICVC is Vanguard Investments UK, Limited. Vanguard Asset Management, Limited is a distributor of Vanguard LifeStrategy Funds ICVC.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2026 Vanguard Asset Management Limited. All rights reserved.

5075260