What the Autumn Budget means for you

We explore what the Autumn Budget could mean for you and some of the ways to shield your investments from the rise in capital gains tax.

Chancellor Rachel Reeves announced tax hikes that could impact investors in her Autumn Budget on Wednesday, but there are still many ways to mitigate the impact on your savings and investments. For most investors it will be business as usual.

The chancellor’s measures included increases in the rates of capital gains tax (CGT) for shares and some changes to inheritance tax (IHT), alongside a rise in employer national insurance (NI).

The good news is that the chancellor didn’t make any changes to pensions tax relief or individual savings accounts (ISAs), meaning these remain a simple and tax-efficient way of saving for your future. The chancellor also refrained from reducing the cap on pensions tax-free cash.

It’s always best to consider your individual circumstances and avoid making knee-jerk reactions based on tax changes. However, this could be a good time to ensure you’re investing as tax-efficiently as possible.

Below, we’ve summarised the key changes and what they might mean for you. You can also watch our video for our top takeaways from the Budget.

How is capital gains tax changing?

The chancellor announced that the lower rate of CGT will increase from 10% to 18%, while the higher rate will increase from 20% to 24%1. These increases are effective immediately2 and will bring rates in line with the CGT payable on property that isn’t your main home.

CGT is a tax on the profit you make when selling certain assets that have increased in value. This includes investments like individual shares, certain types of bonds3 and funds. Everyone has a CGT allowance, which is the amount of profits you can make before you start paying CGT. This is currently set at £3,000 per tax year.

To put the changes into context, if a basic-rate taxpayer realised a gain of £20,000 in the 2025-26 tax year, they would pay £3,060 in CGT – that’s £1,360 more than if rates hadn’t risen. A higher-rate taxpayer would pay £4,080, which is an increase of £680.

Investing through an ISA or pension is a simple way to limit your potential CGT bill. Both ISAs and pensions shield your investments from CGT. They differ from a general account, where you pay tax on any profits, dividends or interest that exceed your tax-free allowances.

Under current rules, you can invest up to £20,000 in ISAs in the 2024-25 tax year, which ends on 5 April 2025. The annual ISA limit will remain at £20,000 until 2030. This limit applies across all your ISAs, including cash ISAs and stocks and shares ISAs. The Junior ISA limit will also remain the same – at £9,000 a year until 2030.

You can also invest up to the lower of £60,000 or 100% of your gross relevant earnings in pensions4.

You can read more below on other ways to reduce your CGT bill.

What’s happening to pensions?

Pensions tax-free cash

There were rumours that the chancellor would limit the amount of tax-free cash you can take from your pension in retirement to £100,000. This did not happen, which means you can continue to take up to 25% of your pension as tax-free cash, capped at £268,275 over your lifetime.

If you’ve made a request to take your tax-free cash because of rumoured changes in the Budget, you might want to think about whether it’s still the right decision for you. You can change your mind as long as you’re within the 30-day cancellation period and meet other relevant criteria. (If you have a Vanguard Personal Pension, you can only cancel the first time you take tax-free cash or an individual lump sum from your pension. You have 30 days from the date of your pension payment confirmation letter to cancel your withdrawal request.)

Pensions tax relief

It was also rumoured that the chancellor would introduce a flat rate of pensions tax relief. Again, this did not come to fruition, which means basic-rate, higher-rate and additional-rate taxpayers will continue to receive tax relief of 20%, 40% and 45%, respectively, on personal pension contributions5.

Tax relief could make a big difference to the size of your pension pot at retirement. Read our earlier article to find out how tax relief boosts long-term savings.

Making pensions subject to inheritance tax

Those with larger pension pots could be affected by new rules on how pensions are taxed on death.

Currently, pension assets are typically excluded from an individual’s estate for inheritance tax (IHT) purposes, meaning they can be passed on free of IHT upon death.

From April 2027, however, any money left in your pension will be included in your estate, which means it will be subject to 40% tax if your estate exceeds the IHT nil-rate band (more on this below). This may be something to consider if you’re deciding how to fund your retirement or leave a legacy for the next generation.

What’s happening to inheritance tax?

The chancellor announced some further changes to IHT. These include:

Extending the freeze on the IHT nil-rate band

The chancellor announced that the freeze on the IHT nil-rate band – the amount you can pass on to your beneficiaries free from IHT when you die – will be extended for another two years. The nil-rate band was frozen by the previous Conservative government in 2022 but was due to start rising again from 2028.

Today’s announcement means the IHT nil-rate band will remain at £325,000 until April 2030. Married couples and civil partners can transfer any unused element of their IHT nil-rate band to their living partner when they die, which means a couple effectively has a joint nil-rate band of £650,000.

There is also an additional ‘residence nil-rate band’, which is £175,000. This is also being frozen for a further two years to 2030. The residence nil-rate band applies to those leaving property to direct descendants. Again, this can be transferred to the surviving spouse or civil partner, meaning a couple can have a joint residence nil-rate band of £350,000 (this reduces for estates worth more than £2 million)6.

Overall, a couple could potentially pass on up to £1 million before IHT becomes due.

Restricting business property relief

Currently, investors can pass on certain business assets to their beneficiaries free from IHT when they die. This is known as ‘business relief’ and it includes shares listed on the Alternative Investment Market (AIM), which is a stock market for smaller and typically riskier companies7. From April 2026, AIM shares will be subject to IHT of 20%. Other business relief-qualifying assets will be IHT-free up to £1 million, but assets over £1 million will be subject to IHT of 20%.

Were there any other tax changes?

Employer national insurance increased

The chancellor announced that the rate of employer national insurance (NI) will increase from 13.8% to 15% from April 2025. Employers will start paying NI when an employee’s salary hits £5,000 – down from £9,100 currently.

While the move won’t affect investors directly, employers may reduce pay rises or benefits such as pensions.

If you have a workplace pension, it’s worth checking whether your employer will change how much they pay into your pension following the changes.

If they are, you might want to consider how to make up the difference – for example, by paying more into your workplace pension or by contributing to a personal pension. When you pay into a pension, you get tax relief on contributions, which can help to boost the size of your pension pot over time.

Income tax thresholds to start rising from 2028

There was some speculation that the thresholds at which certain rates of income tax kick in will be frozen for another two years to 2030, but this did not happen. Instead, the chancellor said income tax thresholds8 will start rising again from 2028 in line with inflation. The thresholds were frozen by the previous Conservative government in 2022.

While the announcement is welcome news, the freeze isn’t over yet, so we are likely to see more people being pulled into paying taxes at a higher rate.

Taking advantage of tax-efficient pensions and ISAs, where appropriate, is one way of managing frozen tax thresholds. The current tax year ends in just over five months on 5 April 2025, which is the deadline to invest this year’s ISA and pension allowances to shelter your investments from tax on income and profits.

What else can I do to reduce my CGT bill?

As well as investing through ISAs and pensions, another way investors can potentially reduce their CGT liability is through ‘bed and ISA’ or ‘bed and pension’. This is when you move investments from your general account to a more tax-efficient ISA or pension.

You do this by selling holdings in your general account and then buying back the same holdings within your ISA or pension. You end up with the same portfolio as before, but your investments are housed in a more tax-efficient account.

When you initially sell holdings in your general account, you’ll be liable to tax on profits that exceed your CGT allowance. However, once your investments are inside your ISA or pension, you won’t have to pay tax on any future profits (subject to the IHT changes on pensions mentioned above).

Today’s announcement could make bed and ISA and bed and pension even more valuable.

We calculated the potential increase in returns that a higher-rate taxpayer could realise by using bed and ISA every year, based on the new CGT rate of 24%. In our hypothetical example, the investor starts off with both a general account and an ISA, valued at £100,000 each. They invest in a portfolio which returns 5% a year after costs and then sell the investments after 10 years, paying CGT due on the remaining general account balance.

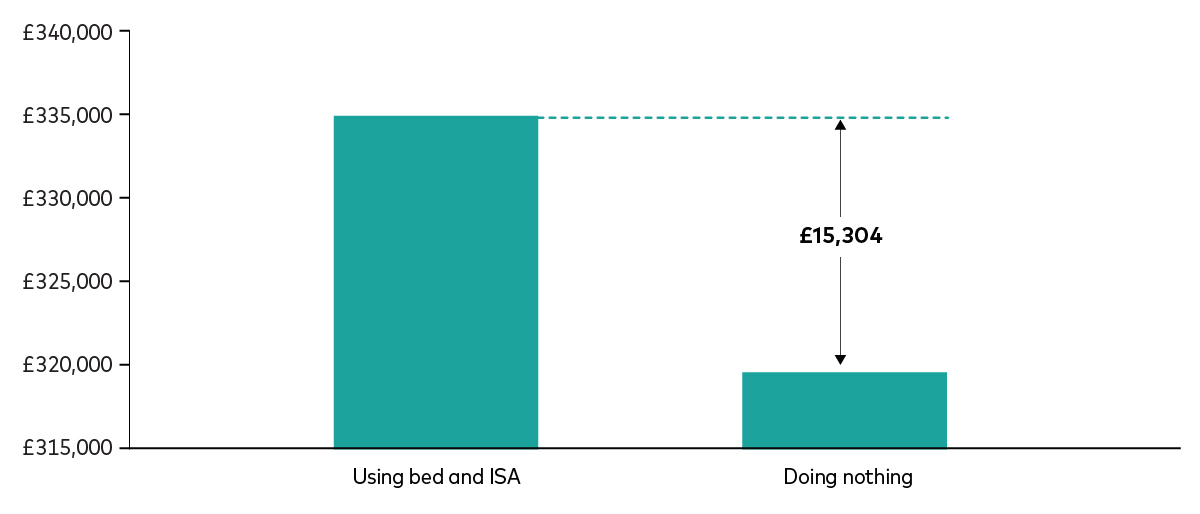

The chart below shows the difference it would make if they depleted their general account over five years (by moving £20,000 a year into their ISA) compared with doing nothing. By diligently making the most of bed and ISA, the individual ends up with £15,304 more, despite holding exactly the same investments.

How bed and ISA can increase returns

Return on a £200,000 original investment over 10 years – using bed and ISA vs doing nothing

Notes: This hypothetical scenario is for illustrative purposes only and doesn’t represent a particular investment or its expected returns. The investor starts with £200,000 portfolio, split evenly between a general account and an ISA. The portfolio is made up of 75% shares and 25% bonds and returns 5% a year after fees. The calculations are based on a CGT rate of 24%. The investments are sold at the end of the final year.

Source: Vanguard calculations.

Irrespective of the changes announced today, we believe that investors remain well-served by Vanguard’s four principles for investing success: have clear and appropriate investment goals; invest in a balanced portfolio of shares and bonds; minimise costs; and maintain perspective and long-term discipline.

Notes: All data in this article are sourced from Autumn Budget, HM Treasury, October 2024 and reflect information available at the time of publication.

1 For more information on CGT rates see HMRC's website.

2 Autumn Budget, HM Treasury, October 2024, section 2.48.

3 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term.

4 For more on what counts as ‘relevant earnings’ that can earn tax relief when used to fund a pension, see the HMRC Pensions Tax Manual. Your annual allowance might be lower than £60,000 if you have a high income or you’ve already flexibly accessed your pension pot. To work out if you have a reduced (tapered) annual allowance, see HMRC’s website. If you’ve flexibly accessed your pension, you can work out what your alternative annual allowance is here.

5 For more information on the residence nil-rate band see HMRC's website.

6 To qualify for business relief, the shares must have been held for more than two years at the time of death.

7 Tax relief of 20% is applied to your Vanguard Personal Pension. Higher- and additional-rate taxpayers then need to claim further tax relief through their self-assessment tax return.

8 For more information on income tax thresholds see HMRC's website.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Eligibility to invest in a Vanguard Personal Pension depends on your individual circumstances. Please be aware that pension and tax rules may change in the future and the value of investments can go down as well as up, so you might get back less than you invested. You cannot usually access your pension savings or make any withdrawals until the age of 55, rising to the age of 57 in 2028.

If you are not sure of the suitability or appropriateness of any investment, product or service you should consult an authorised financial adviser. Please note this may incur a charge.

The eligibility to invest in either ISA or Junior ISA depends on individual circumstances and all tax rules may change in future.

Any tax reliefs referred to are those available under current legislation, which may change, and their availability and value will depend on your individual circumstances. If you have questions relating to your specific tax situation, please contact your tax adviser.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Asset Management Limited. All rights reserved.