What is ‘bed and ISA’ and ‘bed and pension’?

‘Bed and ISA’ or ‘bed and pension’ means moving investments from a general account to an ISA or pension. We discuss how it works and whether it’s worth doing.

‘Bed and ISA’ and ‘bed and pension’ are among the more unusual phrases you’ll come across as an investor.

Despite the strange terminology, they can be a simple and effective way of shielding more of your investments from tax. In turn, this could help to boost your overall returns.

Here, we explain how the process works, whether it’s worth it and the potential drawbacks to be aware of.

What is bed and ISA?

Bed and ISA is when you move investments from your general account to an individual savings account (ISA).

The reason for doing so is that ISAs let your investments grow free from tax. This includes the income tax you might pay on the dividends1 or interest you receive, as well as the capital gains tax (CGT) that could be applied on any profits (‘gains’) you make when selling investments.

With a general account, you’ll pay tax on any dividends, interest or profits that exceed your tax-free allowances. By moving your investments to an ISA, you can reduce or even eliminate these potential tax liabilities.

How does bed and ISA work?

It isn’t possible to transfer investments directly from a general account to an ISA, which is where bed and ISA comes in. Bed and ISA is a two-step process which involves selling holdings in your general account and then buying back the same holdings within your ISA. You effectively end up with the same portfolio as before, but your investments are housed in a more tax-efficient account.

Find out how to carry out a bed and ISA transaction with Vanguard.

Bed and ISA benefits

If you haven’t already used up your £20,000 ISA allowance2 – or aren’t intending to do so with ‘new’ money – bed and ISA could be well worth considering.

When you initially sell holdings in your general account, you’ll be liable to tax on profits that exceed your CGT allowance (which is £3,000 for the 2025-26 tax year). However, once your investments are inside an ISA wrapper, you won’t have to pay tax on any future profits, interest or dividends. This could make a big difference to your long-term returns.

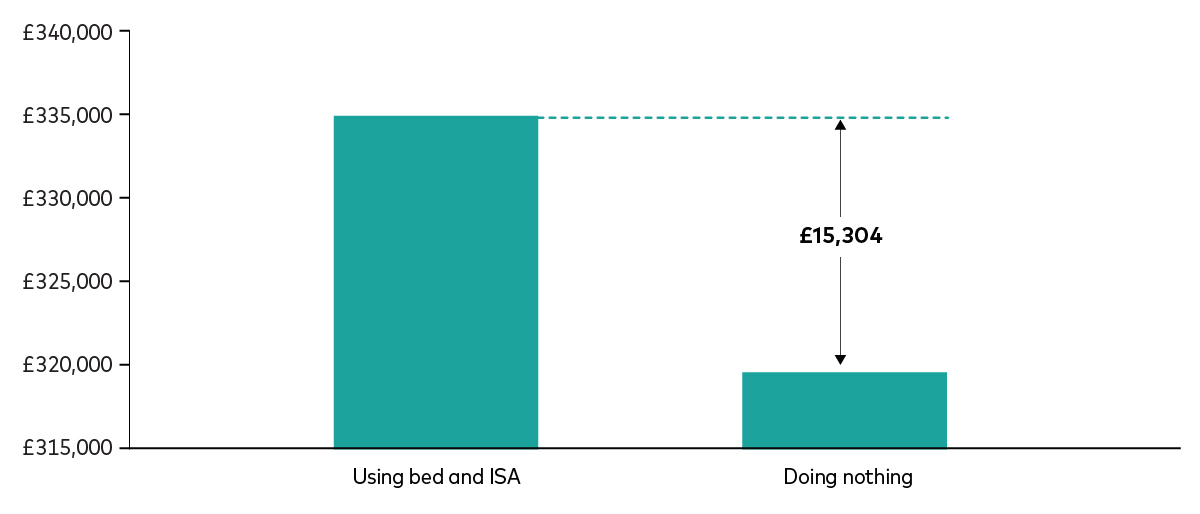

To help illustrate this, we calculated the potential increase in returns that a higher-rate taxpayer could realise by using bed and ISA every year, based on a CGT rate of 24%3. In our hypothetical example, the investor starts off with both a general account and an ISA, valued at £100,000 each. They invest in a portfolio which returns 5% a year after fees and then sell the investments after 10 years, paying CGT due on the remaining general account balance.

The chart below shows the difference it would make if they depleted their general account over five years (by moving £20,000 a year into their ISA) compared with doing nothing. By diligently making the most of bed and ISA, the individual ends up with £15,304 more, despite holding exactly the same investments!

How bed and ISA can increase returns

Return on a £200,000 original investment over 10 years – using bed and ISA vs doing nothing

Notes: This hypothetical scenario is for illustrative purposes only and doesn’t represent a particular investment or its expected returns. The investor starts with £200,000 portfolio, split evenly between a general account and an ISA. The portfolio is made up of 75% shares and 25% bonds and returns 5% a year after fees. The calculations are based on a CGT rate of 24%. The investments are sold at the end of the final year.

Source: Vanguard calculations.

Bed and ISA drawbacks

Bed and ISA counts towards your ISA allowance, so you need to make sure the transactions – plus any contributions you’ve already made this tax year – don’t exceed the current £20,000 annual limit.

As mentioned before, selling investments in a general account could trigger CGT. Over time, this will hopefully be outweighed by the impact of future tax-free growth, but that isn’t guaranteed. Remember, the value of investments can fall as well as rise and you could get back less than you invest.

When you sell and re-buy investments, you’ll also be out of the market for a period of time. During that time, the price of the investments might change, so you could end up with fewer units or shares in your ISA than you originally held.

Selling funds in your general account and then transferring the proceeds to your ISA can take a few days to complete, so it’s best to plan ahead.

What is bed and pension?

It’s also possible to move existing investments to a pension through a similar process known as ‘bed and pension’. You sell holdings in your general account and then buy back the same holdings with your pension4.

Moving investments into a pension not only means future growth will be tax free, but you’ll also get tax relief on the pension contribution.

The main thing to bear in mind with bed and pension is that you can’t access money inside a pension until at least age 55, rising to age 57 from April 2028. You need to be sure you won’t need the money before then.

There are also limits on the amount you can contribute to pensions each year and still get tax relief. In general, this is the lower of £60,000 or your gross relevant earnings5 (including tax relief). For those with higher incomes, the £60,000 may be reduced6. Those without earned income can still contribute £3,600 per year (including tax relief).

Remember, bed and pension transactions will count towards your pension annual allowance. Check how much you and your employer have already contributed to your pension – and consider any further contributions you intend to make this tax year – before going ahead. If you’re not sure, speak to a financial adviser.

1 Dividends are the payments some companies make to their shareholders out of their profits.

2 Tax year 2025-26.

3 See the government’s website for more information on CGT rates.

4 Please note that with Vanguard, you’ll need to sell holdings in your general account, transfer the proceeds to your bank account, and then use the cash to make a pension contribution. This means the process will take a little longer than with bed and ISA. Make sure you have a verified bank account linked to your Vanguard account for us to make the payment.

5 For more on what counts as ‘relevant earnings’ that can earn tax relief when used to fund a pension, see the HMRC Pensions Tax Manual.

6 To work out if you have a reduced (tapered) annual allowance, see HMRC’s website.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Eligibility to invest in a Vanguard Personal Pension depends on your individual circumstances. Please be aware that pension and tax rules may change in the future and the value of investments can go down as well as up, so you might get back less than you invested. You cannot usually access your pension savings or make any withdrawals until the age of 55, rising to the age of 57 in 2028.

If you are not sure of the suitability or appropriateness of any investment, product or service you should consult an authorised financial adviser. Please note this may incur a charge.

The eligibility to invest in either ISA or Junior ISA depends on individual circumstances and all tax rules may change in future.

Any tax reliefs referred to are those available under current legislation, which may change, and their availability and value will depend on your individual circumstances. If you have questions relating to your specific tax situation, please contact your tax adviser.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4912702