Why diversification beats chasing the top stocks

Discover three reasons why holding a diversified portfolio, as opposed to concentrating on the top stocks, is key to long-term investment success.

In the world of investing, the temptation to chase the top-performing stocks is strong, especially when they dominate news headlines and deliver eye-catching returns.

However, our analysis shows that while the leading companies offer the potential for high returns, the risk of concentrating your investments in those stocks can be just as significant.

Here, we explore three reasons why holding a diversified portfolio, rather than chasing the top stocks, is essential for long-term investment success.

1. Market leaders are always changing

Recently, the top 10 stocks globally have been led by the so-called Magnificent 7: Apple, Microsoft, Amazon, Alphabet (Google), Meta (Facebook), Tesla and Nvidia. These companies have earned this nickname because of their market dominance, strong financial performance and significant influence on consumer behaviour and economic trends.

However, today’s leaders weren’t always at the forefront. The S&P Total Market Index, which tracks the performance of around 3,900 US companies of all sizes, reveals just how much the landscape can shift over time. In 2010, for example, only two of the Magnificent 7 were among the index’s 10 largest holdings.

This underscores the importance of holding a portfolio that can weather market changes and capitalise on evolving opportunities.

The top stocks are an evolving collection of leading companies

S&P Total Market Index – largest holdings and respective weightings 2010 and 2025

| December 2010 | July 2025 |

| Exxon Mobil (2.6%) | Nvidia (7.1%) |

| Apple (2.1%) | Microsoft (6.5%) |

| Microsoft (1.5%) | Apple (5.1%) |

| General Electric (1.4%) | Amazon (3.6%) |

| Chevron (1.3%) | Alphabet (3.3%) |

| IBM (1.3%) | Meta (2.8%) |

| Procter & Gamble (1.3%) | Broadcom (2.3%) |

| AT&T (1.2%) | Berkshire Hathaway (1.4%) |

| Johnson & Johnson (1.2%) | Tesla (1.4%) |

| JPMorgan Chase (1.2%) | JPMorgan Chase (1.4%) |

Notes: The table shows the 10 largest holdings of the S&P Total Market Index as at 31 December 2010 and 31 July 2025 with their respective index weightings in brackets. The Magnificent 7 are italicised.

Source: Vanguard analysis of Bloomberg data in GBP as at 1 August 2025.

2. A diversified index fund helps you capture tomorrow’s winners

As the table above shows, predicting which companies will become leaders in the future is nearly impossible. Take Nvidia as an example: when the technology company debuted on the stock market in January 1999, its market capitalisation (the value of all its shares) was about $600 million. Few could have foreseen that Nvidia would go on to fuel the artificial intelligence (AI) revolution and grow into the world’s largest company with a market capitalisation of $4.3 trillion1.

This is one of the reasons to invest in a diversified index fund. Such funds invest in hundreds, if not thousands, of companies across a wide range of industries, naturally including those that might one day become the next big success stories. You don’t need to guess which individual stocks will perform best because the fund does the work for you, holding emerging companies as they grow and keeping them as they ascend to market leadership.

Vanguard’s founder, Jack Bogle, summed it up best: “Don’t look for the needle in the haystack. Just buy the haystack.”

3. A diversified index fund softens downturns

Building on this, it’s important to recognise that while investing in a narrow theme or a handful of prominent stocks sometimes delivers impressive short-term gains, it also means you’re more exposed if those companies run into trouble. In contrast, a diversified index fund spreads your investments across many different companies, which helps to cushion the impact if one sector or company experiences significant falls. An index fund doesn’t eliminate risk entirely – it can go down as well as up in value – but it helps you weather downturns more smoothly.

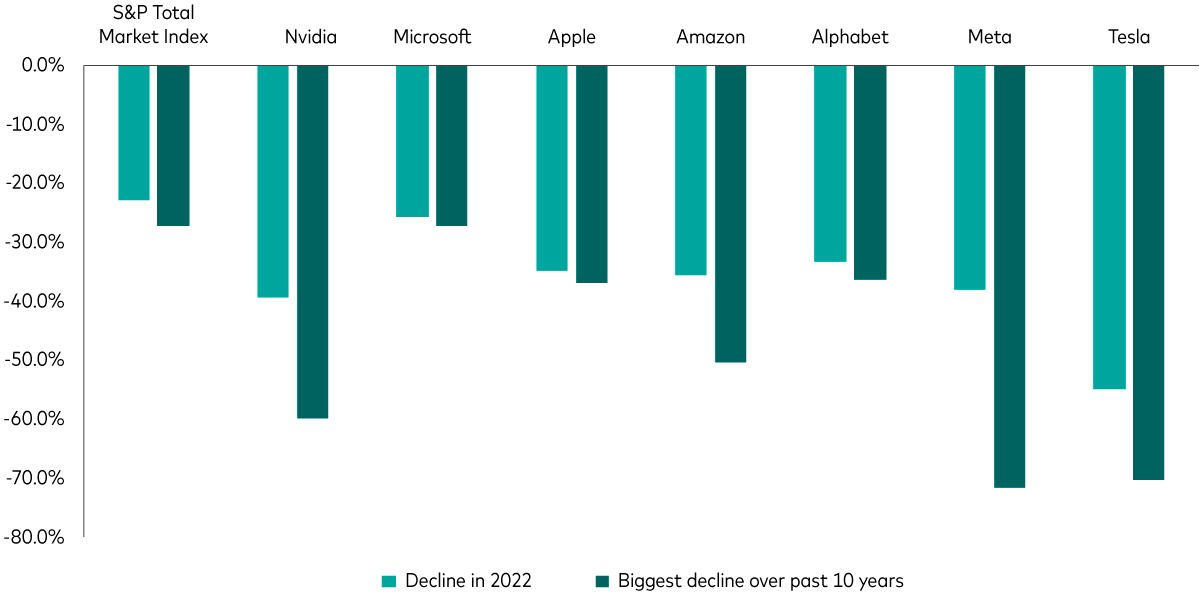

One way to illustrate this is to compare the Magnificent 7’s declines with those of the S&P Total Market Index which, as mentioned before, tracks around 3,900 companies in the US. The chart below shows the declines experienced during the tech sector slump in 2022 (the light green bars) and the largest drops over the past 10 years (the dark green bars). In the vast majority of cases, the individual companies saw much steeper declines than the overall index, underscoring how diversification can help smooth out the bumps along your investment journey.

S&P Total Market Index vs Magnificent 7: Recent and largest declines

Past performance is not a reliable indicator of future results.

Notes: The biggest decline over the past 10 years measures the largest drop in price from a peak to a trough over the previous 10-year period ending 31 July 2025.

Source: Vanguard analysis of Bloomberg data in GBP as at 1 August 2025.

Investing with Vanguard

At Vanguard, you can invest in funds yourself by choosing from our wide range of low-cost, diversified individual funds. Or you can keep things simple by picking one of our LifeStrategy funds or Target Retirement funds, which combine different types of investments in one ready-made portfolio.

For clients in our managed service, we select investments for you based on your attitude to risk, so you don’t need to worry about picking funds. We also manage your portfolio for you, making changes only when necessary to maintain the right level of risk.

1 Vanguard analysis of Bloomberg data as at 11 August 2025.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

The Vanguard LifeStrategy® Funds and Vanguard Target Retirement Funds may invest in Exchange Traded Fund (ETF) shares. ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

For further information on risks please see the “Risk Factors” section of the prospectus on our website.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

For further information on the fund's investment policies and risks, please refer to the prospectus of the UCITS and to the KIID before making any final investment decisions. The KIID for this fund is available, alongside the prospectus via Vanguard’s website.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information is general in nature and does not constitute legal, tax, or investment advice.

Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

The Authorised Corporate Director for Vanguard LifeStrategy Funds ICVC is Vanguard Investments UK, Limited. Vanguard Asset Management, Limited is a distributor of Vanguard LifeStrategy Funds ICVC.

For investors in UK domiciled funds, see our summary of investor rights which is available in English.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4741114