Is now a good time to invest in the stock market?

Find out if now is the right time to invest in the stock market and why a long-term focus is crucial, especially when markets are turbulent.

Clients often ask us whether now is a good time to invest, and this question becomes even more frequent when stock markets are volatile.

New investors might be hesitant to start, while experienced investors might be considering pausing their regular contributions or, conversely, investing more to take advantage of lower share prices.

Investor legend Warren Buffett, who recently announced his retirement, once said, “Be fearful when others are greedy and be greedy when others are fearful.” This means that when everyone else is excited and buying shares, it might be a good time to be cautious because prices might be inflated. But when people are scared and selling, it could be a great opportunity to buy. This advice encourages you to think independently and not get caught up in the emotions of the crowd.

Consider the risks of holding cash

Keeping your money in cash might seem like the safest option when markets are volatile because you don’t have to worry about losing it in a downturn. However, cash isn’t entirely risk free. While cash can provide some security, it is eroded by inflation, meaning your money could buy you a lot less in the future than it can today.

For example, goods and services costing £100 in December 2024 would only have cost £56 in 20041. In other words, prices have nearly doubled over the past 20 years.

By investing, you can give your money the chance to keep pace with inflation and grow in value over time.

Focus on the time you spend in the market

It might seem counterintuitive to invest when markets are in turmoil, but it could benefit you in the long run. Buying shares when the market is down allows you to take advantage of lower prices, which can lead to bigger gains when the market recovers. When the price of shares falls, the potential for higher returns in the future increases.

This doesn’t mean you should wait until markets have fallen before investing. The stock market is unpredictable and it’s very difficult to know when it has reached the bottom. It could stay down for longer than you expect, leading to further losses before you see gains, or bounce back before you’ve had chance to invest.

Waiting for the perfect moment to invest can be costly. There’s a risk that if you wait for the market to reach the bottom, you might instead miss out on the market’s best days, which can significantly impact your returns.

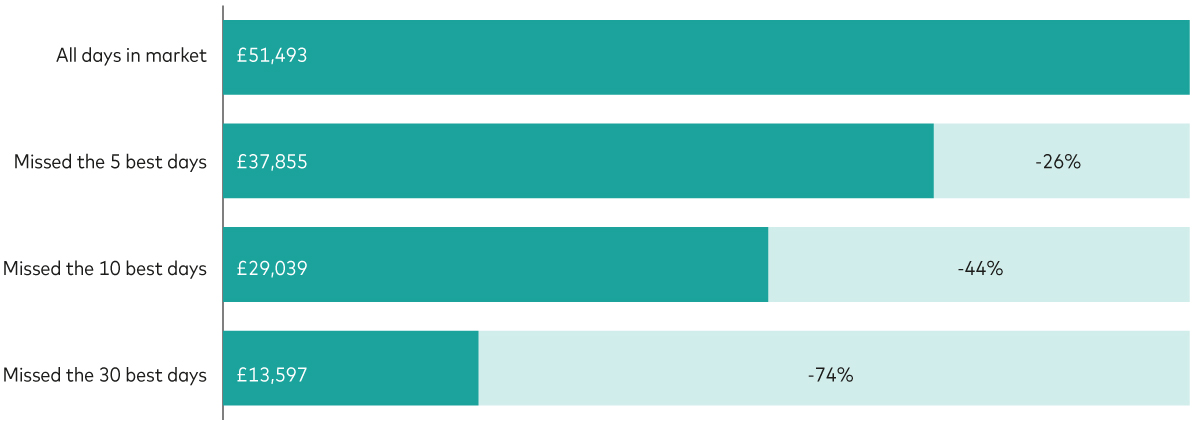

The chart below shows that if someone invested £10,000 in the stock market in January 2000 and was invested for all the days since then, their investment would have grown to £51,493 today. But if they missed five of the market’s best days, their investment would be worth only £37,855. If they missed the market’s 30 best days, their investment would be worth just £13,597.

The cost of missing the market’s best days

Growth of £10,000 in the MSCI AC World Index

Past performance is not a reliable indicator of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Notes: The chart shows the growth of £10,000 invested in the MSCI AC World Index at 1 January 2000 until 20 April 2025, and the impact of excluding the best 5, the best 10 and the best 30 daily returns from the calculation.

Source: Vanguard calculations in GBP, based on data from Refinitiv, as at 20 April 2025.

Given the unpredictability of the stock market, it’s usually better to focus on the time you spend in the market rather than trying to time it. Consider sticking to your plans and, if you decide to buy shares when prices have fallen, staying committed through any further market fluctuations.

Keep a long-term perspective

Instead of worrying about what the market is doing today, next week or next month, it’s much better to consider the longer-term picture. Whether the market goes up or down in the short term, it doesn’t matter much when you’re investing for the long haul. What’s crucial is that you start investing and then stay invested. The stock market has a history of recovering from downturns, and over time, it tends to grow.

The key is to stay calm, focus on your long-term goals and avoid making impulsive decisions based on short-term market movements. By taking a steady and thoughtful approach, you can keep progressing towards your financial goals.

1 Source: Bank of England inflation calculator.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information is general in nature and does not constitute legal, tax, or investment advice.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4558599