How much cash should I hold as an investor?

Markets have been volatile recently, but holding too much cash in your investment portfolio could prove costly. We explore how much cash investors really need.

When markets are turbulent, it might be tempting to hold more cash in your investment portfolio.

Unlike shares and bonds1 there’s no risk of incurring a loss on cash savings. So, why take the extra risk?

While this may seem like a rational argument, our research2 shows that holding too much cash in your investment portfolio could affect your ability to reach your long-term financial goals.

Read on to find out why holding excess cash can be costly and how to work out how much you really need.

Emergency cash holdings

First and foremost, it’s essential to have an emergency fund to cover unexpected expenses. Whether it’s a broken boiler or a period of unemployment, having accessible cash can prevent you from going into debt or selling investments at a loss.

For one-off expenses, one rule of thumb is to keep the greater of £2,000 or half a month’s expenses in a bank account. When it comes to an income shock, we suggest keeping 3-6 months’ worth of expenses in an accessible savings account.

The cost of holding too much cash

Beyond your emergency fund, holding excess cash in your investment portfolio could cost you in the long run.

The concept of ‘risk premium’ is central to this understanding. Risk premium refers to the additional return investors receive for taking on extra risk. When you invest in shares and bonds, there is a risk of losing some or all of your investment, but this risk is compensated by higher potential returns.

At Vanguard, we expect cash to deliver annualised returns3 of 3.8% over the next 30 years, compared with 6.6% for shares and 4.8% for bonds, based on average market conditions4. When we factor inflation5 into our projections, those figures decline to 1.8% for cash, 2.8% for bonds and 4.6% for shares.

Shares and bonds will experience volatility – or swings in prices – along the way. But that doesn’t mean you should move to cash when markets are particularly volatile. Doing so could have a long-term, detrimental impact on your finances.

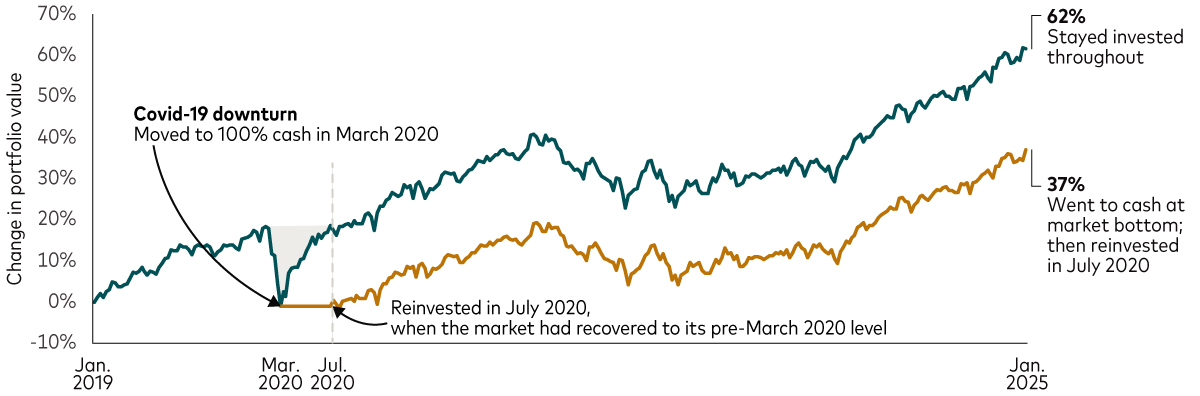

The chart below illustrates how moving to cash for just a few months can lead to significant underperformance. It shows the investment returns for a portfolio containing 60% shares and 40% bonds between January 2019 and January 2025, comparing two investor behaviours during the Covid-19 market downturn:

- Staying invested throughout (green line);

- Moving to cash in the week of 20 March 2020 (the market bottom) and reinvesting in the week of 7 July 2020 (gold line).

The investor who remained invested throughout the downturn achieved a 62% return, whereas the investor who moved to cash only saw a 37% return. To put these returns into perspective, if both investors started with a £50,000 portfolio in January 2019, the investor who stayed invested would have seen their portfolio grow to £80,873 by January 2025. In contrast, the investor who sold out and moved to cash would have only £68,625, a difference of £12,248.

Reacting to market volatility can jeopardise returns

Going to cash for just a few months can lead to underperformance

Past performance is not a reliable indicator of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Notes: The investment is in a portfolio made up of 60% shares and 40% bonds. Shares are represented by the FTSE Global All Cap Index. Bonds are represented by the Bloomberg Global Aggregate Bond Index (GBP Hedged). Currency hedging reduces the increase or decrease in the value of an investment due to changes in the exchange rate. It usually involves a separate transaction that is undertaken in the foreign exchange market before being converted into the investor's local currency. Cash is represented by the Sterling Overnight Index Average (SONIA) rate. Returns do not take into account inflation.

Sources: Vanguard calculations, using data from Morningstar, 1 January 2018 to 1 January 2025.

How much cash do you really need?

So, what does this all mean for you? At Vanguard, we believe there are three things to consider when deciding whether to include cash in your investment portfolio: your risk tolerance, your time horizon and how close you are to achieving your goal amount.

Risk tolerance

Risk tolerance is a measure of how comfortable you are with investment risk. Cash is the least volatile asset, so it tends to be suitable for investors with a lower risk tolerance. Conversely, those with a higher risk tolerance are more willing to accept market fluctuations in exchange for potentially higher returns.

Time horizon

Your time horizon is the length of time until you need to access your investments. At Vanguard, we generally categorise a short time horizon as up to two years, intermediate between two and 10 years, and a long time horizon as anything over 10 years.

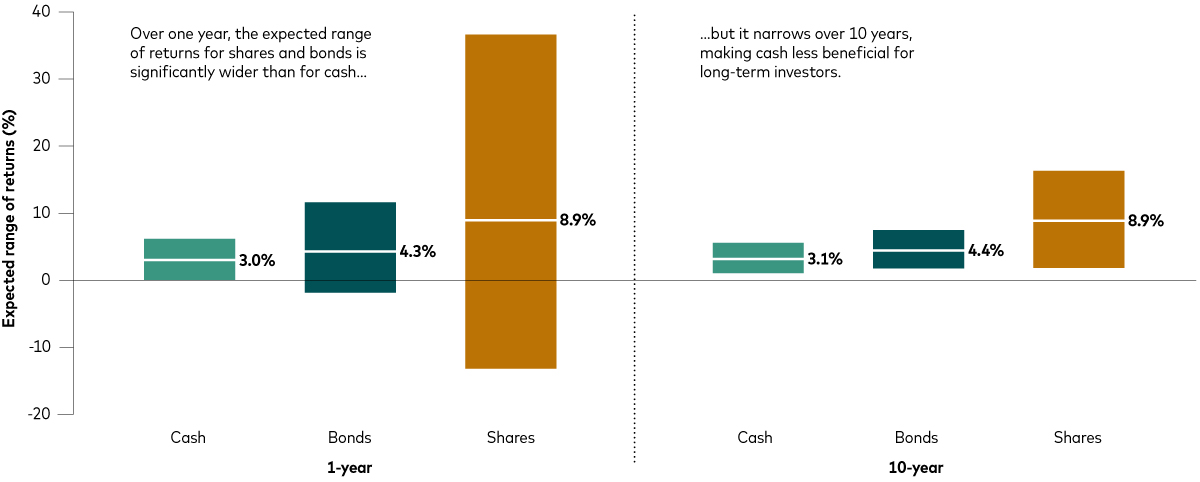

The chart below shows our expectations for cash, bonds and shares over one-year and 10-year time horizons. The coloured bars show the expected range of returns, while the bold figures indicate the expected median (or ‘middle’) returns on an annualised basis. The data shows that the longer you invest, the narrower the expected range of annual returns, particularly when it comes to shares and bonds.

So, while shares and bonds are more volatile, long-term investors have more chance of riding out the market’s ups and downs and benefitting from higher potential returns. Cash is useful for those with a short time horizon because there’s no risk of a stock market decline depleting your wealth just before you need to access it.

Expected range of returns for cash, bonds and shares

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Notes: Returns are from the Vanguard Capital Markets Model (VCMM) as at 31 December 2024 and are based on very long-term expectations where today’s market valuations have minimal influence. Returns are annualised and represent the range we expect to see the vast majority of the time. Shares and bonds are both defined as 95% non-UK/5% UK.

Source: Vanguard calculations, using data from the VCMM.

IMPORTANT: The projections or other information generated by the VCMM regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modelled asset class. Simulations are as at 31 December 2024. Results from the model may vary with each use and over time. For more information, please see the section below.

Funding level

Your funding level is how close you are to achieving your financial goal. The better funded your goal, the less return you’ll need and therefore the less risk you need to take. This is where cash plays a role in preserving your portfolio. If your goal isn’t well-funded, holding too much cash could mean you end up with a shortfall, especially over longer periods.

How it works in practice

In practice, you’ll need to bring all the above factors together when deciding whether to include cash in your investment portfolio.

If you’re saving for a house in 18 months’ time, are close to meeting your target and have a low risk tolerance, a lower-risk portfolio with some cash might be appropriate. On the other hand, someone who is saving for retirement in a decade or so, is far away from meeting their target and has a high risk tolerance might choose not to include cash in their portfolio at present.

Bear in mind that things change over time. As you get closer to your goal, your time horizon will shorten, you might be closer to meeting your target and your capacity to handle risk will likely reduce. This may prompt you to shift some of your portfolio into cash to preserve your returns.

1 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term.

2 Vanguard, “A framework for allocating to cash: risk, horizon and funding level”, April 2024.

3 Annualised returns show what an investor would earn over a period of time if the annual return was compounded (i.e. the investor earns a return on their return as well as the original capital).

4 Return expectations are 30-year figures from the Vanguard Capital Markets Model (VCMM) as at December 2024.

5 Inflation is the rate of increase in prices for goods and services.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time. The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include US and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, US money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

The primary value of the VCMM is in its application to analysing potential client portfolios. VCMM asset-class forecasts—comprising distributions of expected returns, volatilities, and correlations—are key to the evaluation of potential downside risks, various risk–return trade-offs, and the diversification benefits of various asset classes. Although central tendencies are generated in any return distribution, Vanguard stresses that focusing on the full range of potential outcomes for the assets considered, such as the data presented in this paper, is the most effective way to use VCMM output.

The VCMM seeks to represent the uncertainty in the forecast by generating a wide range of potential outcomes. It is important to recognise that the VCMM does not impose “normality” on the return distributions, but rather is influenced by the so-called fat tails and skewness in the empirical distribution of modeled asset-class returns. Within the range of outcomes, individual experiences can be quite different, underscoring the varied nature of potential future paths. Indeed, this is a key reason why we approach asset-return outlooks in a distributional framework.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information is general in nature and does not constitute legal, tax, or investment advice.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4510973