What to consider when choosing a multi-asset fund

Discover how multi-asset funds work and the key benefits of Vanguard’s LifeStrategy and Target Retirement funds.

Multi-asset funds are a popular choice for investors looking for diversification and simplicity. These funds are ready-made portfolios which hold a mix of different types of investments (‘assets’), typically shares (also known as equities) and bonds1.

By combining shares and bonds, multi-asset funds can help provide more stable returns over time compared to holding just one type of asset. When shares perform poorly, bonds often do well, and vice versa. This balance can help reduce overall risk.

At Vanguard, we offer three ranges of multi-asset funds: LifeStrategy, Target Retirement and ActiveLife. This article focuses on the two most popular ranges – LifeStrategy and Target Retirement – and highlights what to consider if you’re thinking about investing in them.

What exactly is a multi-asset fund?

A multi-asset fund is an all-in-one solution that combines different types of investments in one fund. This could include shares and bonds, although the exact blend of investments will depend on the fund. Some multi-asset funds invest directly in shares and bonds, while others invest in funds that, in turn, invest in shares and bonds (known as funds of funds).

Because shares and bonds tend to react differently to market events, holding both can lead to a smoother performance over time. Historically, bonds have been more stable but offered lower returns, while shares have delivered higher returns over the long term but come with more risk.

Like other types of funds, multi-asset funds can have different share classes: ‘income’ (also known as ‘distributing’) and ‘accumulation’. Income share classes pay income to investors, while accumulation share classes let that income build up (or accumulate) in the fund. Find out more about the difference between income and accumulation.

One of the key benefits of multi-asset funds is their convenience. Through a single investment, you can gain exposure to thousands of shares and bonds, saving you the time and effort of researching and managing individual investments.

Vanguard’s multi-asset funds all diversify across different countries, regions, sectors and assets, which means you can benefit from growth opportunities while reducing the impact of downturns in specific parts of the market. The funds are constructed, monitored and rebalanced by our experts to ensure they remain aligned to their risk level. This disciplined approach takes the emotion out of investing, so you can stay focused on your long-term goals.

What is a LifeStrategy fund?

LifeStrategy funds combine multiple individual index funds into one fund portfolio, giving you access to thousands of shares and bonds in a single investment. There are two fund families in the range: LifeStrategy and LifeStrategy Global. Both are globally diversified, but LifeStrategy has a stronger UK focus. Currently, the percentage of shares that invest in the UK is around 3% for LifeStrategy Global versus approximately 25% for LifeStrategy. The percentage of bonds that are GBP-denominated is around 4% for LifeStrategy Global versus around 35% for LifeStrategy2.

Each family offers five funds, each with a different split between shares and bonds. For example, the LifeStrategy 20% Equity Fund and LifeStrategy Global 20% Equity Fund invest 20% in shares and 80% in bonds. These are the lowest-risk option and are aimed at investors with shorter-term goals (they may need their money in 3–5 years) who prefer less risk and accept lower potential returns.

In contrast, the LifeStrategy 100% Equity Fund and LifeStrategy Global 100% Equity Fund invest entirely in shares. These are the highest-risk option and are aimed at investors who have longer-term goals (they may need their money in 10 years, or longer) who are willing to take on more risk for the potential of higher returns. Historically, shares have delivered higher returns than bonds over the long term but have been more volatile.

How to choose a LifeStrategy fund

If you’re choosing a LifeStrategy fund, some of the things to think about include:

- What are you investing for? Is it for retirement, a deposit on a house or something else? Your investment choices should align with how long you’re investing for and the nature of your goals.

- How comfortable are you with the possibility of losing money in the short term? Think about how much investment risk you are willing and able to take and still sleep at night.

If you have a lower appetite for risk or a shorter investment timeframe, a LifeStrategy fund with a higher proportion of bonds to shares is likely to be more appropriate. If you’re comfortable with more risk or are willing to leave your money invested for 5–10 years or longer, a fund with a higher percentage of shares is likely to be more suitable. The longer you invest for, the more time you have to recover from market dips.

LifeStrategy versus LifeStrategy Global

Choosing between LifeStrategy and LifeStrategy Global comes down to your personal goals and preferences. Here are some factors to consider:

- LifeStrategy funds: may be suitable if you like the familiarity of UK companies and markets, prefer to invest in the local economy, think there’s less risk in the UK market and want greater sterling exposure.

- LifeStrategy Global funds: may be suitable if you prefer to invest in a way that reflects global markets, don’t want to risk being more invested in the UK market and don’t want to be more exposed to sterling.

For more information, visit our LifeStrategy hub.

What is a Target Retirement fund?

Like our LifeStrategy funds, our Target Retirement funds are all-in-one solutions that provide access to thousands of different shares and bonds in one package. However, they are specifically designed to help people invest for retirement. You choose a fund based on when you plan to retire and we do the rest.

How do Target Retirement funds work?

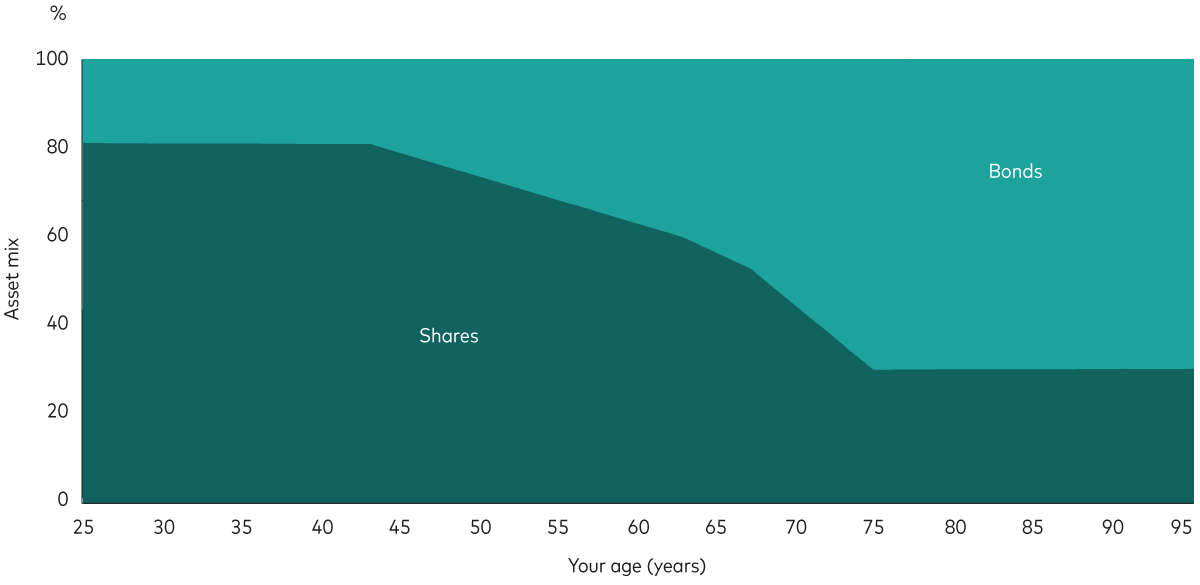

Target Retirement funds use a technique known as ‘lifestyling’, which gradually shifts you into less risky investments (bonds) as you get closer to retirement. This helps to reduce risk when you have less time to recover from market downturns.

For example, the Target Retirement Fund 2065 is designed for individuals who expect to retire in, or within five years of, 2065. Currently, it has a relatively high level of risk, with 80% invested in shares and lower-risk bonds making up 20% of the fund. As you get closer to 2065, the fund will become more conservative, increasing the bond allocation and decreasing the share allocation. By the time you are seven years into retirement, the fund is expected to have around 70% in bonds and 30% in shares, maintaining this ratio thereafter.

The idea is that by taking a lower-risk approach as you get closer to your retirement goal, you have more chance of preserving your wealth by reducing exposure to more volatile assets like shares and focusing on the stability provided by bonds.

Notes: This chart is illustrative and does not represent any particular Target Retirement fund.

Investing at Vanguard

Our multi-asset funds make it easy to achieve low-cost diversification while investing in line with your risk appetite and goals.

In addition to these funds, we also offer other investment options to suit different needs and preferences. For example, if you prefer to build your own portfolio, you can choose from our wide range of low-cost individual funds.

Alternatively, if you want more of a helping hand, we also offer a managed service where we select funds for you based on how you feel about risk and then manage your portfolio going forwards.

1 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term.

2 We’re reducing the LifeStrategy funds’ UK exposure to further help each fund meet its objectives. The proportion of UK shares and the proportion of UK bonds will fall from around 25% and 35%, respectively, to around 20%. This reduction will start on 27 March and is due to complete by the end of June.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Vanguard Target Retirement Funds and Vanguard LifeStrategy® Funds may invest in Exchange Traded Fund (ETF) shares. ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

For further information on risks please see the “Risk Factors” section of the prospectus on our website.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

For further information on the fund's investment policies and risks, please refer to the prospectus of the NURS and to the KII before making any final investment decisions. The KII for this fund is available, alongside the prospectus via Vanguard’s website. This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions. Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and/or units of, and the receipt of distribution from any investment.

Vanguard will manage your investments in the Managed ISA and Managed SIPP on your behalf. You will not be able to place trades on your own account.

The Authorised Corporate Director for Vanguard LifeStrategy Funds ICVC is Vanguard Investments UK, Limited. Vanguard Asset Management, Limited is a distributor of Vanguard LifeStrategy Funds ICVC.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2026 Vanguard Asset Management Limited. All rights reserved.

5114957