What is a LifeStrategy® fund?

Building and managing your own portfolio is not for everyone. That’s why we created the LifeStrategy range.

Each LifeStrategy fund combines multiple individual index funds into one fund portfolio, giving you access to thousands of shares and bonds in a single investment. This helps reduce risk by spreading your investments.

Each fund has a different risk level, so you can choose one that suits you and your investment goal – whatever stage of life you're at.

How a LifeStrategy® fund works

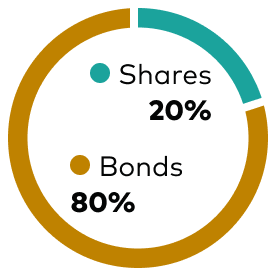

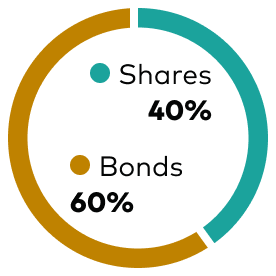

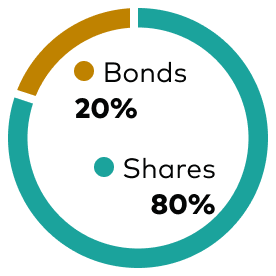

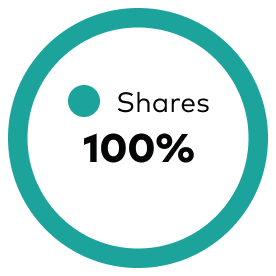

Each LifeStrategy fund has a different mix of shares and bonds. We manage each fund to keep the mix the same, which means the risk level stays the same.

Shares typically give you a higher return over the long run, but are riskier. Whereas bonds are more stable but offer lower returns. Having a mix of both helps balance risk and reward.

Why choose our LifeStrategy® funds

Stays on track

We monitor each LifeStrategy fund to make sure it sticks to the original balance of shares and bonds, so you don't have to.

Diversified

Each LifeStrategy fund holds 6,000 to 20,000 shares and bonds around the world – helping to reduce your risk.

Simple

Just pick the LifeStrategy fund that best fits your investment goal and attitude to risk. We’ll do the rest.

Choose where to invest

We have 2 LifeStrategy ranges, giving you more choice about where to invest. Both are low-cost, globally diversified, ready-made multi-asset portfolios.

LifeStrategy invests more in UK shares and bonds than LifeStrategy Global, which invests in line with global markets.

LifeStrategy | LifeStrategy Global | |

|---|---|---|

Invested in global markets | ||

Proportion of shares invested in UK | 25%* | About 3% |

Proportion of bonds invested in UK | 35%* | About 4% |

How to choose between LifeStrategy® and LifeStrategy® Global

Select the type that best suits you and your investment goals.

Why choose LifeStrategy®

May be suitable if you:

- are familiar with UK companies and markets

- want to be more exposed to sterling

- prefer to align investments with the local economy

- are comfortable investing slightly more in sectors such as finance and consumer staples

Why choose LifeStrategy® Global

May be suitable if you:

- prefer to invest in funds in line with their share of global markets

- do not want to be more exposed to sterling

- want to reduce the risk of being slightly more invested in the UK market

- are more comfortable investing in sectors such as technology and healthcare

View all our LifeStrategy® funds

Select each fund to find out its risk level. The higher the percentage of shares, the higher the risk and potential returns.

LifeStrategy® 20% equity fund

LifeStrategy® 40% equity fund

LifeStrategy® 60% equity fund

LifeStrategy® 80% equity fund

LifeStrategy® 100% equity fund

Which LifeStrategy® fund is right for you?

When it comes to choosing a LifeStrategy fund there are 3 things you need to think about.

What’s your attitude to risk

Shares offer higher potential returns than bonds – but are riskier. If you’re a more cautious investor you might want to choose a LifeStrategy fund with fewer shares and more bonds. An adventurous investor, on the other hand, might want to choose a LifeStrategy fund with more shares.

How long you plan to invest for

The longer you invest for, the more time you have to ride out any ups and downs in the stock market. So if you have time on your side, you could think about choosing a LifeStrategy fund with more invested in shares and less in bonds.

Where you prefer to invest

Both LifeStrategy and LifeStrategy Global are low-cost, globally diversified, ready-made multi-asset portfolios. LifeStrategy invests more in UK shares and bonds than LifeStrategy Global, which invests in line with global markets.

Important things you need to know before you invest

These funds invest in shares and bonds. Prices can rise and fall, so you might not get back what you invested.

The funds invest in emerging markets, which can involve higher risk of loss than investments in developed markets.

The funds invest in overseas markets so changes in exchange rates can affect the value of your investment.

The funds may invest in financial derivatives, which can cause greater fluctuations in value.

Please make sure you read the Key Investor Information Document before you invest. If you’re not sure about the suitability of any investment, you should speak to an authorised financial adviser.

Got a LifeStrategy® fund with another provider?

You could potentially save money by transferring to us. Our account fee is just 0.15% per year, capped at £375.

One low fund charge of 0.20%

Ongoing Charges Figure (OCF) across all our LifeStrategy and LifeStrategy Global funds.