Endorsed by Which? and Boring Money for over 5 years

“It's a great way to save for my future. I just wish I’d invested earlier in my life!”

What is flexible income (drawdown)?

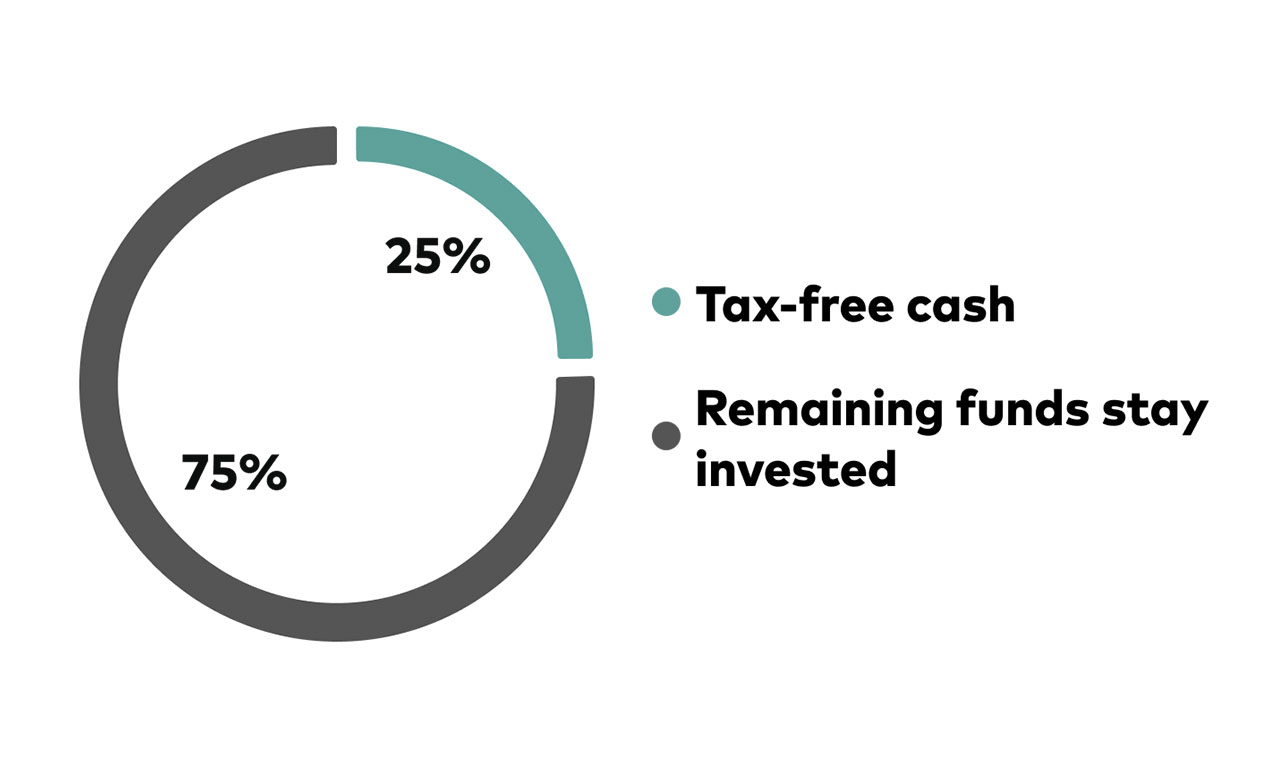

Flexible income (drawdown) allows to you keep your pension savings invested when you reach retirement and take money out of your pension pot. You can usually take up to 25% of your pension savings tax-free upfront. The taxable part of your pension is then moved into a drawdown account.

You can withdraw as much or as little you want from your remaining pension. However, you do not have to take all of your full tax-free cash entitlement in one go.

How flexible income (drawdown) works

Work out how much you need to live on

Your pension has to last a long time, so it's essential to consider your needs before you decide how to withdraw.

Withdrawing your money

You tell us how you want to withdraw your pension:

- tax-free lump sum – you can usually take up to 25% of your pension tax-free (up to a maximum of £268,275 across all your pensions)

- regular or one-off income payments

Choose your investments

When you take any tax-free money, we need to move money into your drawdown account. You'll need to decide how you want that money to be invested.

Your can choose from our full range of funds. Or, to make things easier, we've created 4 investment pathways you can choose from. Each investment pathway is based on your retirement goal.

Adapt when you need to

If your circumstances change, you can adjust your plan to your needs by speaking to us.

Our pension specialists are ready to discuss the process via pre-booked appointments if you are an existing client.

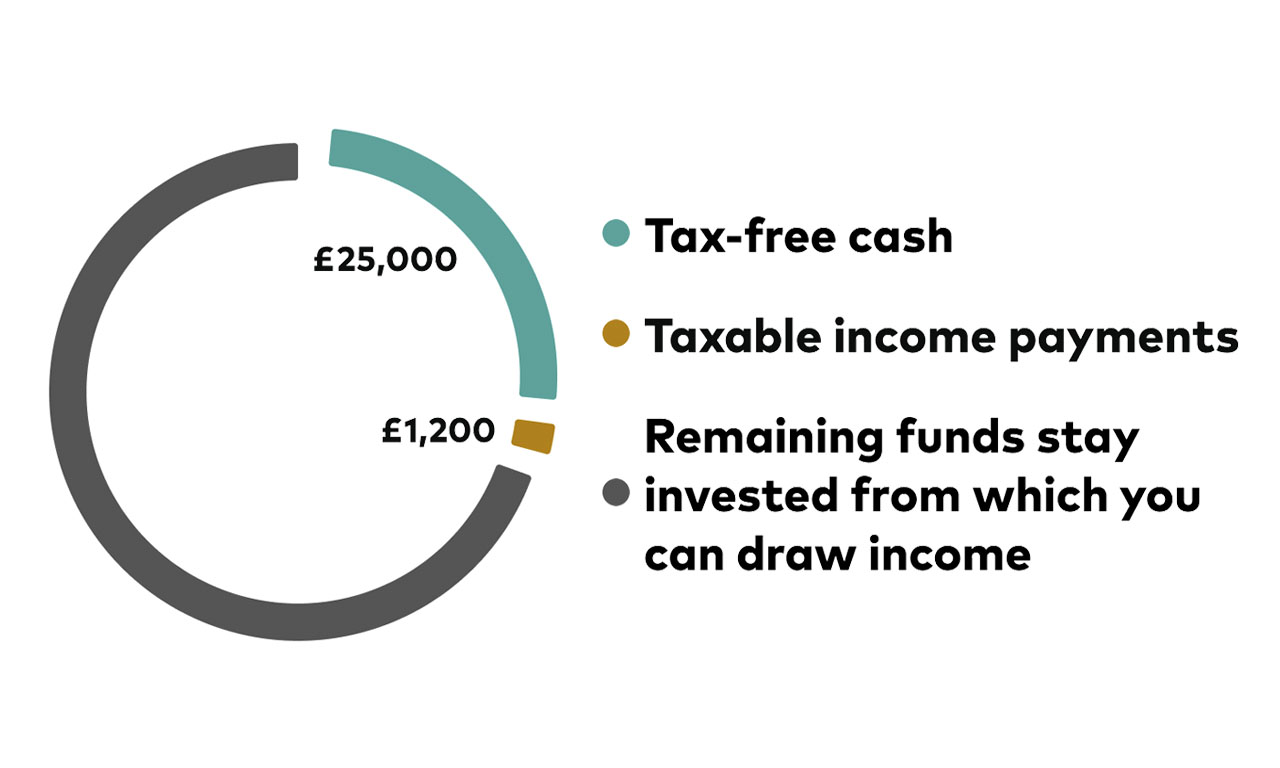

A simple example

- If you have a pension of £100,000

- You decide to take the first 25% as tax-free cash which is £25,000

- The remaining £75,000 stays invested.

- For example, you could use this to take a regular income of £1,200 – which will be taxed as an income.

You can withdraw as much or as little you want from your remaining pension.

Our investment pathways

When you move money into drawdown, you can choose the option that best fits your plans.

What do you plan to do with the money in your drawdown account within the next 5 years?

I have no plans to touch my money in the next 5 years

Your drawdown account will be invested in one of our Target Retirement funds. These aim to continue growing your savings while gradually reducing risk as time goes on.

I plan to use my money to set up a guaranteed income (annuity) within the next 5 years

Your drawdown account will be invested in the U.K. Short-Term Investment Grade Bond Index Fund. This low-risk fund aims to preserve your retirement savings while giving you a small short-term return. We do not offer annuities but will transfer you to a new provider if you want one.

I plan to start taking my money as a long-term income within the next 5 years

Your drawdown account will be invested in one of our Target Retirement funds. These aim to continue to grow your savings while gradually reducing risk as time goes on.

I plan to take out all my money within the next 5 years

Your drawdown account will be invested in our Money Market fund. This low-risk fund aims to protect your retirement savings.

Our pathways and value for money

Read these independent reports on our pathways and value for money.

How much tax you might pay

You can usually take up to 25% of your pension tax-free. The maximum tax-free cash you can take from all your pensions is £268,275.

Any money you withdraw from the remaining 75%, in your drawdown account, will be added to any other income you have for that tax year.

You will pay tax on your drawdown income if you draw more than your personal allowance. How much depends on your total income for that tax year. HMRC has guidance on the tax you might pay.

Your first payment will likely put you on an emergency tax code. HMRC needs to provide us with your tax code before we can tax you correctly. You do not need to contact HMRC to change the tax code, but you can claim a refund on the tax you overpaid.

/UKPI_SIPP_How_much_tax_mightp_pay.jpg)

Advantages and disadvantages of flexible income (drawdown)

You decide how much money to take and when to take it. You can set up an income that you can stop, start or change at any time.

Any money that you do not take now, you can leave invested so it has the potential to grow in a tax efficient way.

You can decide how you want your money invested.

We'll pay any money in your pension to your beneficiaries when you die. How much tax they'll pay on that money will depend on how old you are when you die and what your beneficiary’s tax situation is.

Stay in control of how much tax you'll pay by managing how much you take out of your pension.

If you do not trigger the Money Purchase Annual Allowance (MPAA), you might be able to carry forward unused allowances from previous years.

Compare your retirement options

Flexible income (drawdown) | Individual lump sums (UFPLS) | Annuity | |

|---|---|---|---|

Can I only take tax-free cash? | |||

Will it trigger the Money Purchase Annual Allowance? | Only if you take income | ||

Can I pass on this pension to a beneficiary if I die? | |||

If my circumstances change could the pension adapt? | |||

Which option can I carry on contributing to? | |||

Do my investments remain invested? |

How to apply for flexible income (drawdown)

1. Book a call

Log in to your account and book a call with our pension specialists to discuss your options. Submit a request for the withdrawal you want via your account.

2. Get an illustration

We'll create an illustration to show you how your withdrawal could impact your savings.

3. Review and agree

Review your illustration and book another call with our pension specialists to complete the final steps.

4. Receive payment

Once you've told us you are happy to proceed, we'll process your pension withdrawal to your bank account. You'll receive your pension withdrawal within 10 working days.

Already in drawdown with another provider?

It’s not too late - you can still transfer to us.

Why choose us?

No minimum withdrawal amounts

Unlike some providers we do not have a minimum withdrawal amount, so you can take your tax - free cash in lots of smaller chunks if you want to.

Value

Our funds are good value, which means you can keep more of your returns.

UK-based support

Our pension specialists are on hand to help, no matter what the question.

Things to consider

If you take money from a defined contribution pension, the amount you can put in while still getting tax relief could reduce. For most people, the total amount you can contribute is £60,000 each tax year. if you trigger the MPAA, this reduces to £10,000 a year.

MPAA can be triggered if:

- you take your entire pension pot as a lump sum or start to take lump sums from your pension pot

- you move your pension pot money into drawdown and begin to take an income

- if you have a pre-April 2015 capped drawdown plan and start taking payments that exceed the cap

When you first receive a taxable payment from us it’s likely that you’ll pay an emergency tax rate. This is because HMRC will need to provide us with your tax code before we can tax you correctly. This means you may pay too much tax at first – but you’ll be able to claim a refund from HMRC.

You can carry on saving into your pension, even after you've started taking money from it. However, the amount you're allowed to save into your pension will be reduced once you start taking a taxable income from your pension.

- taking your 25% tax-free cash – you can carry on saving up to £60,000 per year into pensions. This is the standard annual allowance, and the same as if you'd not taken any money from your pension

- start taking a taxable income – this will trigger the Money Purchase Annual Allowance and reduce how much you can save into pensions from £60,000 to £10,000 per year

We'll pay any money in your pension to your beneficiaries. How much tax they'll pay on that money will depend on how old you are when you die.

- if you die before you're 75, your beneficiaries will usually receive any money remaining in your pension tax-free

- if you die when you’re 75 or older, your beneficiaries will usually have to pay income tax on any money remaining in your pension when they withdraw money from it

If you take money out of your pension and leave it to your beneficiaries, they may have to pay inheritance tax on it.

Need help?

Guidance from Pension Wise

Get free and impartial guidance from the government’s Pension Wise service.

Regulated

We are authorised and regulated by the Financial Conduct Authority.

Secure

We keep your personal information and investments safe at all times.

Covered

We are covered by the Financial Services Compensation Scheme.