Should I overpay my mortgage or invest?

With interest rates expected to fall this year, we compare how much you could save by overpaying your mortgage with the amount you could earn from investing.

With interest rates expected to fall in 2025, you might be wondering how to make the most of any extra savings or cash left over in your bank account each month. One common question is whether to overpay your mortgage or invest the money.

Making mortgage overpayments can be a smart move. However, the anticipated drop in interest rates – which may result in more favourable mortgage rates – means that investing your extra cash might make your money work even harder over the long run.

In this article, we summarise the pros and cons of overpaying your mortgage. We also compare how much someone could potentially save on mortgage interest with the amount they could earn from investing.

Overpaying a mortgage – key considerations

Overpaying a mortgage reduces the amount of debt you owe, which can be appealing for several reasons:

- You could be mortgage-free sooner.

- You’ll pay less interest overall.

- You could get a lower mortgage rate when you remortgage.

- You’ll be less exposed if interest rates rise again.

However, there are some potential drawbacks to be aware of:

- Typically, there is a fee if overpayments are more than 10% of the remaining mortgage balance, although this will vary from lender to lender.

- Money put into a mortgage might not be as easily accessible as that in a savings account or investment portfolio.

- Depending on your mortgage rate, the amount you’d save on interest could be lower than the amount you could earn from investing.

The lower the mortgage rate, the stronger the case for investing

Whether or not you’ll be financially better off overpaying your mortgage or investing will partly depend on your mortgage rate. It will also depend on how well your investments perform (more on that below).

In general, the lower the mortgage rate, the stronger the case for investing. That’s because, over the long run, you could potentially earn more from investments than you could save in interest by overpaying your mortgage. Remember, though, that the value of investments can fall as well as rise and you may get back less than you invested.

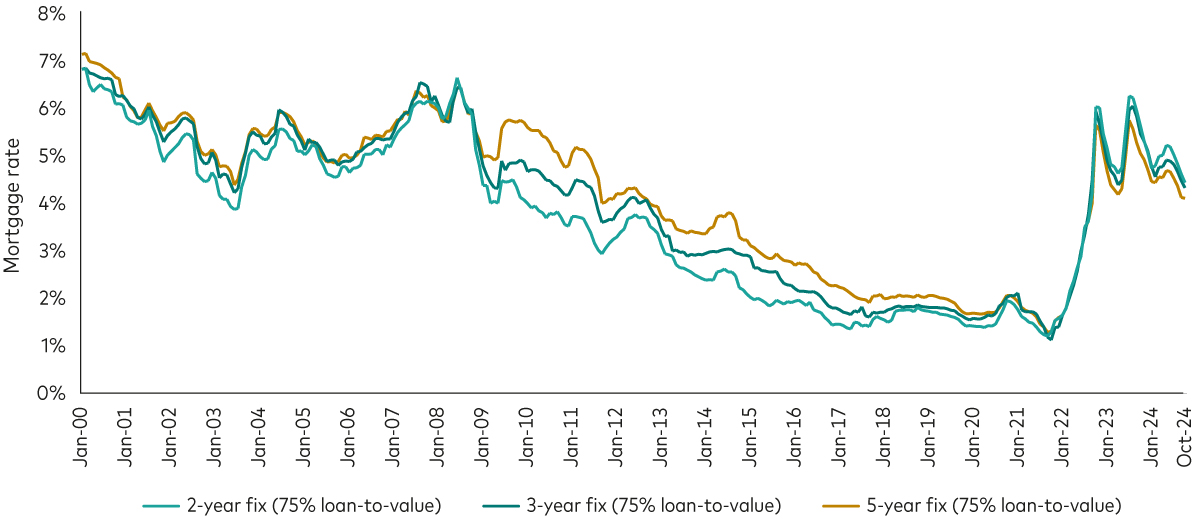

In August, the Bank of England cut interest rates for the first time in four years. This was followed by another cut in November and we’re likely to see further reductions in 2025. As the chart below shows, this resulted in mortgage rates coming down a bit after previously hitting their highest levels in over a decade.

Mortgage rates so far this century

Source: Bank of England data from 31 January 2000 to 31 October 2024.

Overpaying a mortgage versus investing: a comparison

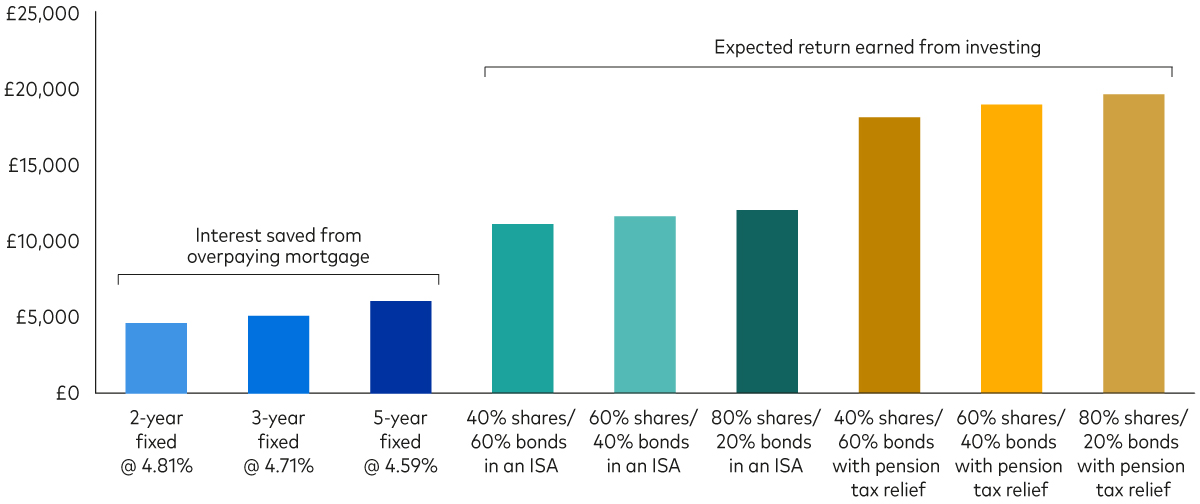

We compared the savings from overpaying a mortgage with the returns from investing over 10 years.

Potential savings from overpaying a mortgage

We calculated how much interest someone could save by making a £15,000 mortgage overpayment at the start of a 10-year term and assuming an outstanding mortgage balance of £250,000.

Based on a five-year fixed-rate mortgage of 4.59%, we found that they could save £6,030 over 10 years.

The savings would be £5,070 for a 3-year fix of 4.71% or £4,600 for a 2-year fix of 4.81%.

Potential return from investing through an ISA

We also looked at the potential returns someone could earn from investing £15,000 over 10 years. We assumed they invest through an individual savings account (ISA), where you don’t pay tax on income or profits.

We found that the returns would range from £11,060 to £11,980, depending on the proportion of shares and bonds1 in the investor’s portfolio. In other words, they could be around £5,000 to £7,000 better off after 10 years by investing instead of overpaying their mortgage. However, note that these are projections and not guarantees.

Potential return from investing through a pension

If they invest through a pension instead of an ISA, the returns could be even greater because personal pension contributions benefit from tax relief. That means an £80 contribution is boosted to £100 if you’re a basic-rate taxpayer. Higher- and additional-rate taxpayers can claim an additional £20 and £25, respectively, through their self-assessment tax return.

A higher-rate taxpayer would see a £15,000 pension contribution boosted to £25,000 (assuming they claim their extra tax relief and add it to their pension). We found that the returns from investing this amount would range from £18,030 to £19,540 after 10 years, making them around £12,000 to £15,000 better off2 than if they’d made a mortgage overpayment.

Investment returns vs savings from overpaying a mortgage

Potential returns from investing £15,000 over 10 years versus interest saved by a £15,000 mortgage overpayment

Source: Vanguard calculations using the Vanguard Capital Markets Model (VCMM), which forecasts annualised3 returns of 5.7% for a portfolio containing 40% shares and 60% bonds; 5.9% for 60% shares and 40% bonds; and 6% for 80% shares and 20% bonds (as at 8 November 2024). Mortgage rates after the fixed-rate period are based on market interest-rate expectations as at 8 November 2024.

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model (VCMM) regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modeled asset class. Results from the model may vary with each use and over time.

What’s right for me?

If you can commit your money for at least five years and are comfortable with the risks of investing, it may be worth considering this option.

However, what’s right for you will depend on your individual circumstances, including:

- Attitude to risk: how much risk are you willing to take with your money and how much can you afford to lose ? Making mortgage overpayments is like getting a guaranteed return on your money, without any investment risk. Investing carries risk but has the potential for higher returns.

- Financial goals: what are your short, medium and long-term financial objectives?

- Potential cash needs: will you need easy access to your money?

- Mortgage details: what is your outstanding mortgage balance, credit score and current mortgage rate?

If you’re unsure, we’d strongly suggest speaking to a financial adviser. They can help you evaluate your options and determine the best course of action.

1 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term.

2 This assumes 20% tax relief is invested at the beginning of the first year, compounding for a total of 10 years. The remaining tax relief (a further 20%) is claimed back through the investor’s annual tax return and is invested at the beginning of the second year, compounding for a total of nine years only.

3 Annualised returns show what an investor would earn over a period of time if the annual return was compounded (i.e. the investor earns a return on their return as well as the original capital).

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time. The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include US and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, US money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

The primary value of the VCMM is in its application to analysing potential client portfolios. VCMM asset-class forecasts—comprising distributions of expected returns, volatilities, and correlations—are key to the evaluation of potential downside risks, various risk–return trade-offs, and the diversification benefits of various asset classes. Although central tendencies are generated in any return distribution, Vanguard stresses that focusing on the full range of potential outcomes for the assets considered, such as the data presented in this paper, is the most effective way to use VCMM output.

The VCMM seeks to represent the uncertainty in the forecast by generating a wide range of potential outcomes. It is important to recognise that the VCMM does not impose “normality” on the return distributions, but rather is influenced by the so-called fat tails and skewness in the empirical distribution of modeled asset-class returns. Within the range of outcomes, individual experiences can be quite different, underscoring the varied nature of potential future paths. Indeed, this is a key reason why we approach asset-return outlooks in a distributional framework.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Eligibility to invest in a Vanguard Personal Pension depends on your individual circumstances. Please be aware that pension and tax rules may change in the future and the value of investments can go down as well as up, so you might get back less than you invested. You cannot usually access your pension savings or make any withdrawals until the age of 55, rising to the age of 57 in 2028.

If you are not sure of the suitability or appropriateness of any investment, product or service you should consult an authorised financial adviser. Please note this may incur a charge.

The eligibility to invest in either ISA depends on individual circumstances and all tax rules may change in future.

Any tax reliefs referred to are those available under current legislation, which may change, and their availability and value will depend on your individual circumstances. If you have questions relating to your specific tax situation, please contact your tax adviser.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Asset Management Limited. All rights reserved.

4132295