Four reasons to top up your ISA by 5 April

With only two months to go until the end of the tax year, discover why topping up your ISA by 5 April could help to supercharge your long-term returns.

The recent increase in capital gains tax (CGT) means it’s crucial to think about making full use of your individual savings account (ISA) allowance before it resets at the end of the tax year.

Chancellor Rachel Reeves announced the increase in her Autumn Budget in October. With these higher rates, careful planning is essential to avoid paying more tax on your investments than necessary.

It’s one of the many reasons to consider sheltering your investments from tax through an ISA.

Below, we explore four reasons to maximise your £20,000 ISA allowance by the end of the tax year on 5 April.

1. Avoid higher tax bills

When you invest through an ISA your money grows tax-free. That means you won’t pay income tax on the dividends1 or interest you receive, and you won’t pay CGT on any profits you make when selling investments.

If you invest via a general account there is no such protection, so you could face a tax bill on dividends, interest and profits.

This year, that tax bill could be higher because CGT rates have risen. The lower rate is now 18% (up from 10% previously) and the higher rate is 24% (up from 20% previously)2.

Tax-free allowances have also fallen in recent years. The CGT allowance – which is the amount of profits you can make before CGT becomes due – is just £3,000 for the 2024-25 tax year, down from £12,300 a couple of years ago. The amount of tax-free dividends you can earn has also dropped to £500 from £2,000.

By investing through an ISA, you can avoid all these tax increases and keep more of your money.

2. Use it or lose it

A key reason to top up your ISA now rather than later is that the ISA allowance is a ‘use it or lose it’ allowance. In other words, you can’t carry forward any unused portion to the next tax year.

Now that CGT rates are higher, it could make even more sense to maximise your ISA allowance each tax year. Delaying could mean more tax to pay in the future.

3. Boost your returns

Investing in a stocks and shares ISA instead of a general account could make a big difference to your overall returns. We looked at how much a higher-rate taxpayer could earn by investing £20,000 every year for 10 years, assuming a 5% annual return after fees.

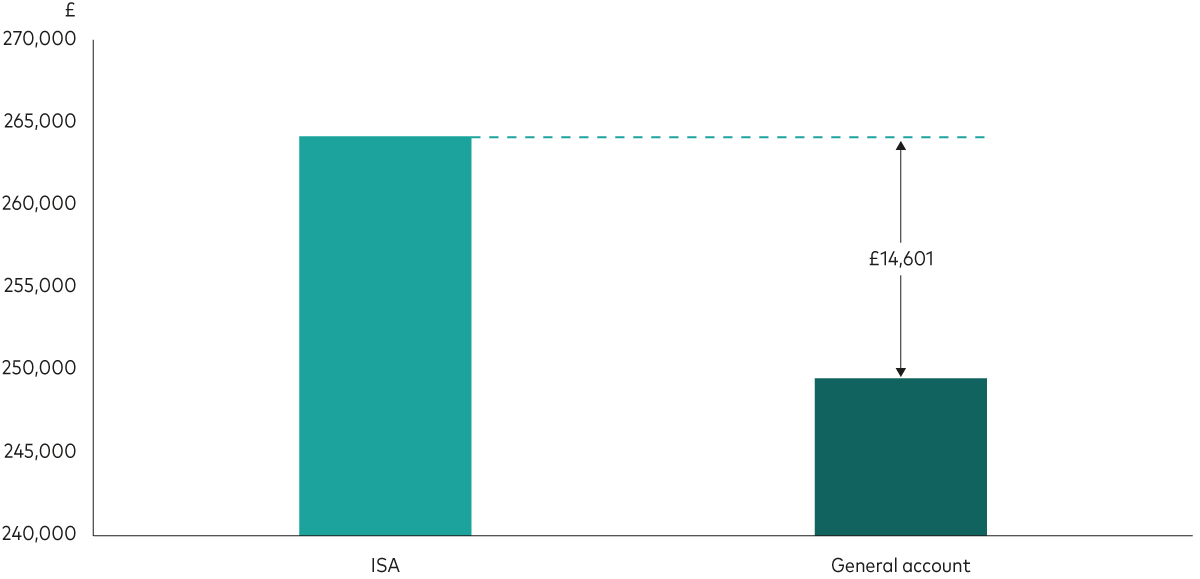

The chart below shows the difference it would make if they invested in an ISA versus a general account and then sold their investments at the end of the 10-year period.

By investing through an ISA, the individual earns £14,600 more, simply by choosing a more tax-efficient account. However, remember that these returns are not guaranteed. Investments go up and down in value and you could get back less than you invest.

How investing tax-efficiently can boost returns

Returns from investing £20,000 a year in an ISA vs a general account over 10 years

Notes: Based on a £20,000 annual investment. The 5% return used in the example is hypothetical and is not guaranteed. Assumes a higher-rate taxpayer with a personal savings allowance of £500, a dividend allowance of £500 and a CGT allowance of £3,000. Dividends after tax are assumed to be reinvested and the investments are sold at the end of the final year.

Source: Vanguard calculations.

4. Less admin and account flexibility

ISAs are not only tax-efficient but also more convenient. Unlike a general account, you don’t have to disclose your ISA holdings on your tax return, which means less admin and hassle.

If you have more than £20,000 to invest in a given tax year, you won’t be able to put it all in an ISA at once. Instead, you could consider putting the excess in a general account to begin with and then move it into an ISA in future tax years. This process is called ‘bed and ISA’ and it can be a useful way of managing tax liabilities.

Remember, the £20,000 ISA allowance applies across all your ISAs – including stocks and shares ISAs and cash ISAs – so make sure you don’t exceed the limit, especially if you have ISAs with different providers.

Unsure where to invest your ISA this year? Our earlier article explores some of the options to consider, whether you’re a beginner or experienced investor.

1 Dividends are the payments some companies make to their shareholders out of their profits.

2 For more information on CGT rates see HMRC’s website.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

The eligibility to invest in either ISA or Junior ISA depends on individual circumstances and all tax rules may change in future.

Any tax reliefs referred to are those available under current legislation, which may change, and their availability and value will depend on your individual circumstances. If you have questions relating to your specific tax situation, please contact your tax adviser.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4172217