Pension or ISA: which is better for long-term saving?

Both pensions and ISAs come with important – but different – tax benefits. But does it make a difference when saving for long-term goals such as retirement?

For many people in the UK, minimising the impact of tax on your investments means investing in an individual savings account (ISA) or a pension.

But which is better for long-term goals like retirement? While pensions are specifically designed to help fund retirement, there’s no reason why you can’t use your ISA savings for the same purpose.

In this article, we explore the key considerations and tax benefits of both options.

What are the tax benefits of pensions and ISAs?

ISAs

Annual contribution limit: You can invest up to £20,000 in ISAs each tax year.

Tax-free growth: Your ISA investments grow free of income tax, dividend tax and capital gains tax.

Tax-free withdrawals: When you withdraw money from your ISA, it is tax-free.

Pensions

Tax relief on contributions: When you pay into a pension, the government tops up your contributions by 20%, boosting an £80 contribution to £100. Higher-rate and additional-rate taxpayers can claim an additional 20% or 25%, respectively, by filing a self-assessment tax return.

Annual contribution limit: You can save up to £60,000 into pensions in the 2024-25 tax year1. You can get tax relief on contributions worth up to 100% of your annual earnings, capped at £60,000. Even if you have no earned income, you can still get tax relief on the first £2,880 you pay into a pension each tax year. Those with earned income may be able to ‘carry forward’ unused pension allowances from the previous three tax years. To benefit from tax relief, your earnings must be at least equal to the amount you wish to contribute. Carry forward is only available to those who were a member of a registered pension scheme during the relevant time period.

Withdrawals: When you take money out of a pension, up to 25% can be taken as tax-free cash (capped at £268,275) and the rest will be taxed as income. For example, a basic-rate taxpayer (someone who earns less than £50,271 but more than the tax-free personal allowance of £12,5702) could take £10,000 from their pension, with the first £2,500 tax-free and the remaining £7,500 taxed at 20%. That would equate to an effective tax rate of only 15%.

This shows the attraction of pension contributions. If you get 20% tax relief on the contribution but only pay an effective 15% tax when you withdraw, there’s a ‘tax uplift’ which helps to boost the after-tax value of the fund. Note that this tax uplift only occurs when you take tax-free cash as part of the pension withdrawal.

How ISAs and pensions compare

| ISA | Pension | |

| Tax relief on contributions | No | Yes |

| Access at any age | Yes | No – minimum age 55 (rising to 57 from April 2028) |

| Free of capital gains tax | Yes | Yes |

| Tax-free withdrawals | Yes | 25% can be taken as tax-free cash (capped at £268,275); the rest is taxed as income |

| Annual contribution limit | £20,000 | £60,000* |

| Subject to inheritance tax | Yes | Yes from 2027** |

Notes: Information correct as at 2024-25 tax year. *Depending on earnings. Higher earners may have a lower limit. **In the recent Autumn Budget, it was announced that unspent pensions will be subject to IHT from April 2027.

Source: Vanguard

How tax relief boosts long-term savings

If you’re a higher-rate taxpayer, this tax uplift is potentially even greater. Assuming you claim your extra tax relief and add it to your pension, you’ll get 40% tax relief on your pension contributions but could pay 20% income tax on withdrawals.

Let’s take an example:

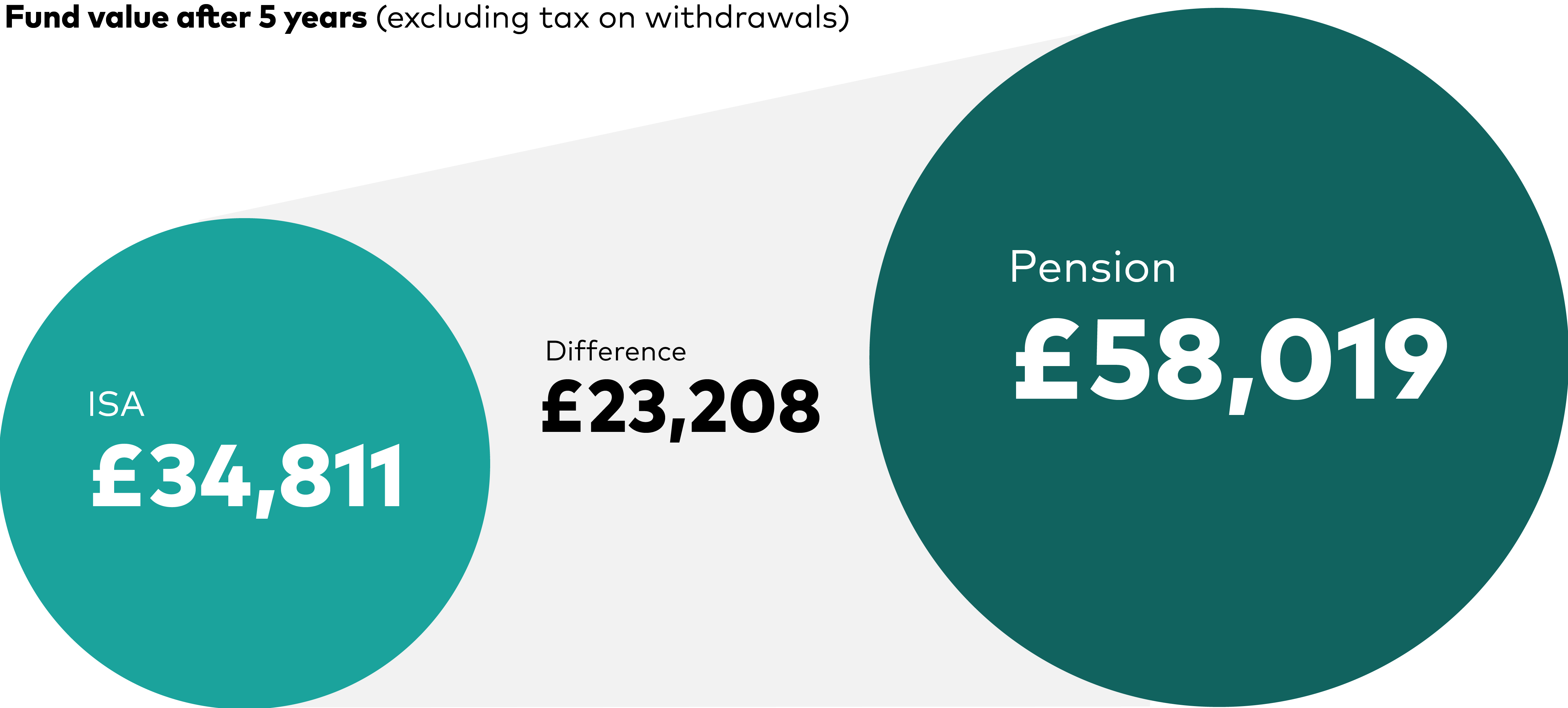

- Claire is 55, earns £80,000 and wants to save £6,000 a year until she retires at age 60.

- As a higher-rate taxpayer, Claire can claim 40% tax relief on her pension contributions. You can see the difference this tax relief makes in the table below. It shows what Claire would have in an ISA or pension after five years, assuming an annual return of 5% before fees.

Source: Vanguard calculations assuming an annual return of 5% before fees.

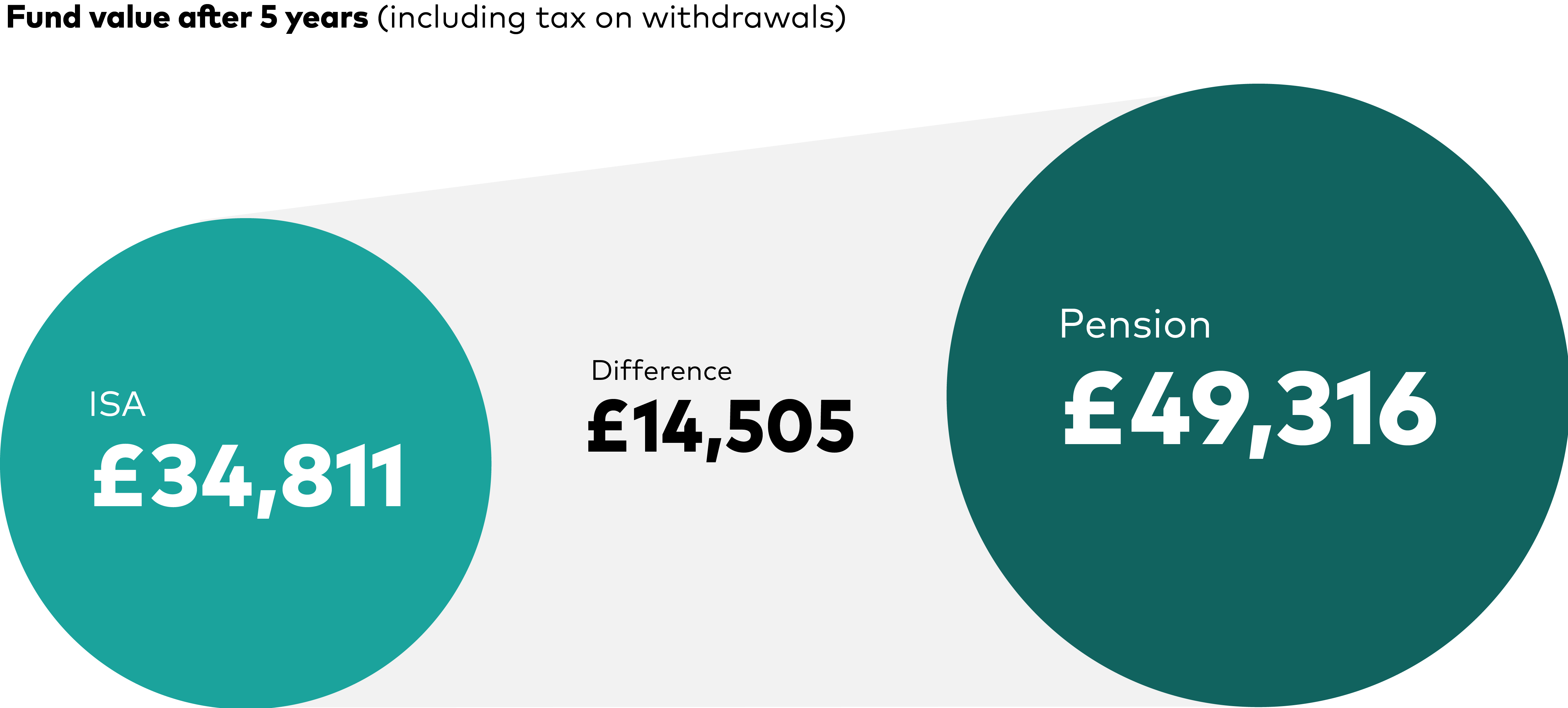

However, this is only part of the story. We also need to consider the impact of tax when Claire withdraws the money:

- Claire was a higher-rate taxpayer when she was saving into her pension but is a basic-rate taxpayer when she retires, as she’s earning below £50,271 but more than the tax-free personal allowance of £12,570.

- Provided Claire stays below the higher-rate tax threshold, she’ll only pay 20% income tax on her pension withdrawals, of which 25% will be tax free.

Once you take tax on withdrawals into account, the calculations look more like this:

Source: Vanguard calculations assuming an annual return of 5% before fees.

Even after accounting for tax on withdrawals, Claire is still almost £15,000 better off by investing in a pension rather than an ISA. That could make a significant difference to her spending power in retirement.

What’s right for you?

Tax isn’t the only factor to consider when deciding whether to save into an ISA or pension.

You can access ISA funds at any time, whereas you can’t access pension money until at least age 55 (rising to age 57 from April 2028). If you need access to your money before this age, a pension may not be the best choice.

Ultimately, what’s right for you will depend on your individual circumstances, including your current and future tax position, your financial goals and when you plan to retire.

1 Your pension annual allowance might be lower than £60,000 if you have a high income or you’ve already flexibly accessed your pension pot. To work out if you have a reduced (tapered) annual allowance, see HMRC’s website.

2 2024-25 tax year.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

The eligibility to invest in either ISA or Junior ISA depends on individual circumstances and all tax rules may change in future.

Eligibility to invest in a Vanguard Personal Pension depends on your individual circumstances. Please be aware that pension and tax rules may change in the future and the value of investments can go down as well as up, so you might get back less than you invested. You cannot usually access your pension savings or make any withdrawals until the age of 55, rising to the age of 57 in 2028.

If you are not sure of the suitability or appropriateness of any investment, product or service you should consult an authorised financial adviser. Please note this may incur a charge.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Any tax reliefs referred to are those available under current legislation, which may change, and their availability and value will depend on your individual circumstances. If you have questions relating to your specific tax situation, please contact your tax adviser.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4272908