What the interest rate outlook means for investors

Find out how falling interest rates in 2025 could impact cash savings, shares and bonds and what this means for your long-term investment plans.

With the Bank of England (BoE) expected to continue to cut interest rates in 2025, it’s a good time to consider how to make your money work harder.

The BoE cut rates on 1 August 2024 for the first time in four years. This was followed by another cut in November, leaving rates at 4.75% at the end of 2024. Our economists think further interest rate reductions are on the cards, with rates expected to end 2025 at 3.75%.

Why does this matter for you? Interest-rate cuts typically result in lower returns on cash savings, which could hinder your ability to achieve your long-term financial goals.

Thinking about where to put your money is especially important right now because the end of the tax year is just around the corner. You only have a few months left to make the most of your 2024-25 individual savings account (ISA) allowance.

Here, we explore what to consider when deciding where to invest this year.

Rates on cash savings are likely to fall

It’s always important to have sufficient cash savings to cover emergencies, such as unexpected bills or a period of unemployment. One rule of thumb is to keep three to six months’ worth of outgoings in a bank account. Beyond this, holding too much cash could mean missing out on achieving your financial goals, especially as the rates on cash savings are likely to fall further this year.

Some savings accounts currently offer rates that are higher than inflation (the rate at which prices for goods and services rise over time). However, it’s important to consider the longer-term picture. Shares have historically delivered better returns than cash over long periods and have outpaced inflation by a larger margin.

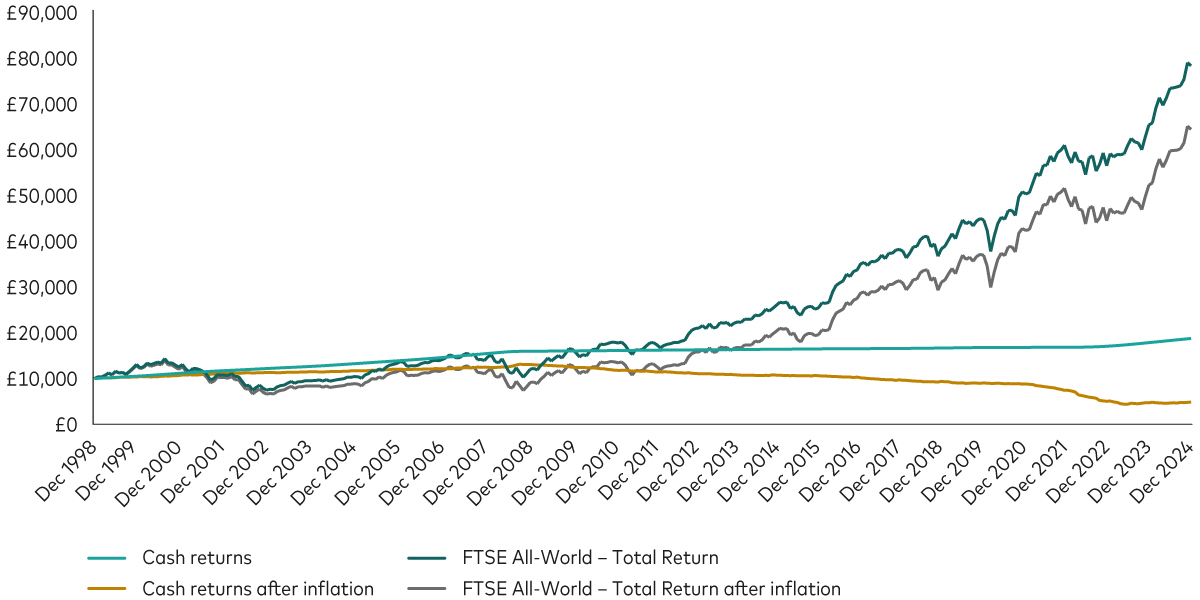

For example, the chart below shows that a £10,000 investment in cash at the end of 1998 would have grown to £18,695 by the end of 2024. But after adjusting for inflation, its value would have more than halved to £4,918. In contrast, a £10,000 investment in shares would have grown to £77,826, or to £64,049 after adjusting for inflation.

Returns from £10,000 in cash and shares, before and after the effects of inflation

Past performance is not a reliable indicator of future results.

Notes: Cash returns represented by the UK Sterling Overnight Index Average benchmark (SONIA), global shares by the FTSE All-World Index with dividends reinvested; and inflation by the UK Retail Price Index. SONIA reflects the average rate of interest banks pay to borrow overnight.

Source: Factset, Vanguard calculations based on period 31 December 1998 to 31 December 2024.

The outlook for shares is mixed

Falling interest rates can be good news for shares. Lower interest rates make it cheaper for companies to borrow money. This can help them grow and, in turn, boost their earnings. If mortgage rates decline, consumers may spend more, which also benefits the companies they buy goods and services from. Find out more about how interest rates affect shares.

In reality, interest-rate cuts are often expected well in advance and are already factored into investment prices. Interest rates are just one of many factors influencing investment performance. Other factors include inflation expectations, economic growth projections and geopolitical events.

US shares performed well in 2024. While they may continue to perform well over the short term, our economists are a bit more cautious about their longer-term outlook. We expect annualised1 returns of 2.9%-4.9% for US shares2 over the next decade, compared with 5.7%-7.7% for UK shares, 7.4%-9.4% for developed markets excluding the US and 5.3%-7.3% for emerging market shares3. This highlights the importance of spreading your investments across different regions of the world. You can reap the benefits of having exposure to regions that may perform well to offset those that perform less well.

While cash may seem attractive now, investing in shares means benefiting from something known as the ‘equity-risk premium’. This is the idea that, because share prices move up and down more frequently than other investments, investors are rewarded for taking on this additional risk.

One way to help manage this risk is to invest through funds, which can spread your investments across thousands of different shares and/or bonds4.

Falling interest rates support bond prices

Bonds generally perform well when interest rates are falling. When rates fall, the income from existing bonds looks more attractive compared to new bonds that pay a lower income. This can make the price of existing bonds go up, leading to capital gains for investors.

Bond yields (which show income from bonds as a proportion of the current price) have risen in recent years as central banks increased interest rates and the price of bonds fell. This should support future returns because even if interest rates were to unexpectedly rise, resulting in yields increasing and bond prices falling, those higher yields should be sufficiently large to keep total returns positive.

We expect annualised returns of 4.3%-5.3% for UK bonds and 4.5%-5.5% for global ex-UK bonds over the next decade5.

Holding the right mix of investments for you is key

Regardless of whether interest rates are rising or falling, it’s important to keep perspective, focus on your long-term goals and ensure your portfolio is right for you. Research shows that investing in the right mix of shares and bonds could have a bigger impact on your returns than anything else you do6. It’s also important to spread your investments across different industries and regions of the world.

Building and maintaining a portfolio that suits your needs isn’t always easy to do on your own. If you want a helping hand, we offer a managed service for those investing via our ISA or personal pension. We’ll select a balanced portfolio of investments for you, based on your attitude to risk.

If you prefer to build your portfolio yourself, you can choose from our range of over 85 low-cost individual funds. We also offer all-in-one multi-asset funds, such as our LifeStrategy funds, which are already diversified across global shares and bonds.

Remember, the current tax year ends on 5 April

A quick reminder that £20,000 is the most you can invest in your ISA this tax year, which ends on 5 April.

This allowance covers all your ISAs, so if you invest £10,000 in a cash ISA, you can only invest a maximum of £10,000 in your stocks & shares ISA in the same tax year.

You can’t carry over any unused allowance to the following tax year, so make sure you use it to avoid losing out.

1 Annualised returns show what an investor would earn over a period of time if the annual return was compounded (i.e. the investor earns a return on their return as well as the original capital).

2 US shares are represented by the MSCI USA Total Return Index Sterling.

3 UK shares are represented by the MSCI UK Total Return Index, developed market ex-US shares are represented by the MSCI World ex USA Total Return Index Sterling and emerging market shares are represented by the MSCI Emerging Markets Total Return Index Sterling.

4 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term. Once issued, bonds are traded, like shares, and their prices can fluctuate.

5 UK bonds are represented by the Bloomberg Sterling Aggregate Bond Index and global ex-UK bonds (hedged) are represented by the Bloomberg Global Aggregate ex Sterling Bond Index Sterling Hedged. With hedging, managers typically use derivatives (a type of financial contract) to offset exchange rate movements. The contracts typically lock in a pre-determined exchange rate at which the manager can buy or sell the foreign currency at a future date.

6 Gary P. Brinson, L. Randolph Hood, and Gilbert L. Beebower, 1995. "Determinants of portfolio performance." Financial Analysts Journal 51(1):133–8. (Feature Articles, 1985–1994.)

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

The eligibility to invest in either ISA or Junior ISA depends on individual circumstances and all tax rules may change in future.

Eligibility to invest in a Vanguard Personal Pension depends on your individual circumstances. Please be aware that pension and tax rules may change in the future and the value of investments can go down as well as up, so you might get back less than you invested. You cannot usually access your pension savings or make any withdrawals until the age of 55, rising to the age of 57 in 2028.

If you are not sure of the suitability or appropriateness of any investment, product or service you should consult an authorised financial adviser. Please note this may incur a charge.

Past performance is not a reliable indicator of future results.

The Vanguard LifeStrategy® Funds and Vanguard Target Retirement Funds may invest in Exchange Traded Fund (ETF) shares. ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

For further information on risks please see the “Risk Factors” section of the prospectus on our website.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

For further information on the fund's investment policies and risks, please refer to the prospectus of the UCITS and to the KIID before making any final investment decisions. The KIID for this fund is available, alongside the prospectus via Vanguard’s website.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information is general in nature and does not constitute legal, tax, or investment advice.

Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

Vanguard will manage your investments in the Managed ISA and Managed SIPP on your behalf. You will not be able to place trades on your own account.

The Authorised Corporate Director for Vanguard LifeStrategy Funds ICVC is Vanguard Investments UK, Limited. Vanguard Asset Management, Limited is a distributor of Vanguard LifeStrategy Funds ICVC.

For investors in UK domiciled funds, see our summary of investor rights and is available in English.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4143526