Autumn Budget 2025: What it means for you

A lower cash ISA limit, frozen income tax thresholds and changes to salary sacrifice were among the measures announced in the 2025 Budget. Our experts summarise the announcements and what they might mean for you.

Chancellor Rachel Reeves announced a fresh round of changes for savers and investors in her Budget on Wednesday, and while the headlines may not make for cheerful reading, there’s a silver lining for those who make the most of their tax wrappers.

The measures included a lower allowance for cash individual savings accounts (ISAs), an extended freeze on income tax thresholds, changes to salary sacrifice for pension contributions and higher rates of tax on dividends and savings income.

But here’s the good news: if you save regularly into your pension and ISA, you’re still in a strong position. Pensions and ISAs remain powerful tools for growing your wealth over the long term. By making the most of your allowances, you can benefit from tax-free growth and ensure your money is working as hard as possible – even in a tougher environment.

Below, we’ve summarised the key changes and what they might mean for you.

Has the ISA allowance changed?

The overall ISA allowance remains unchanged at £20,000. However, for those under age 65, the amount you can put into cash ISAs will be capped at £12,000 a year from 6 April 2027, with the rest of the allowance reserved for investments. People aged 65 and over will still be able to put up to £20,000 into cash ISAs.

This is a significant change for savers aged under 65, who can currently split the £20,000 allowance between the different types of ISAs (including cash ISAs and stocks and shares ISAs) as they see fit. The lower cash ISA allowance is part of the government’s ambition to encourage more people to invest.

What does the cash ISA allowance cut mean for savers and investors?

Importantly, the overall ISA allowance remains unchanged at £20,000, giving you plenty of scope to make the most of tax-free savings and investments. With the new limit on cash ISA contributions, this may be a good time to consider whether you really need to put money into a cash ISA each year. While everyone should keep some cash aside for emergencies, this change is designed to encourage more people to take advantage of the greater growth potential that investing can offer. By increasing how much you invest in a stocks and shares ISA, you could make your money work harder for you over the long term, all while benefiting from valuable tax-free growth and income.

One of the primary reasons to invest is to make your money work harder. History shows that while shares go down as well as up, they have delivered much better returns than cash over long periods. Cash, on the other hand, is more vulnerable to the effects of inflation1, which can erode its purchasing power. By investing, you give your money the chance to keep pace with inflation and grow in value over time.

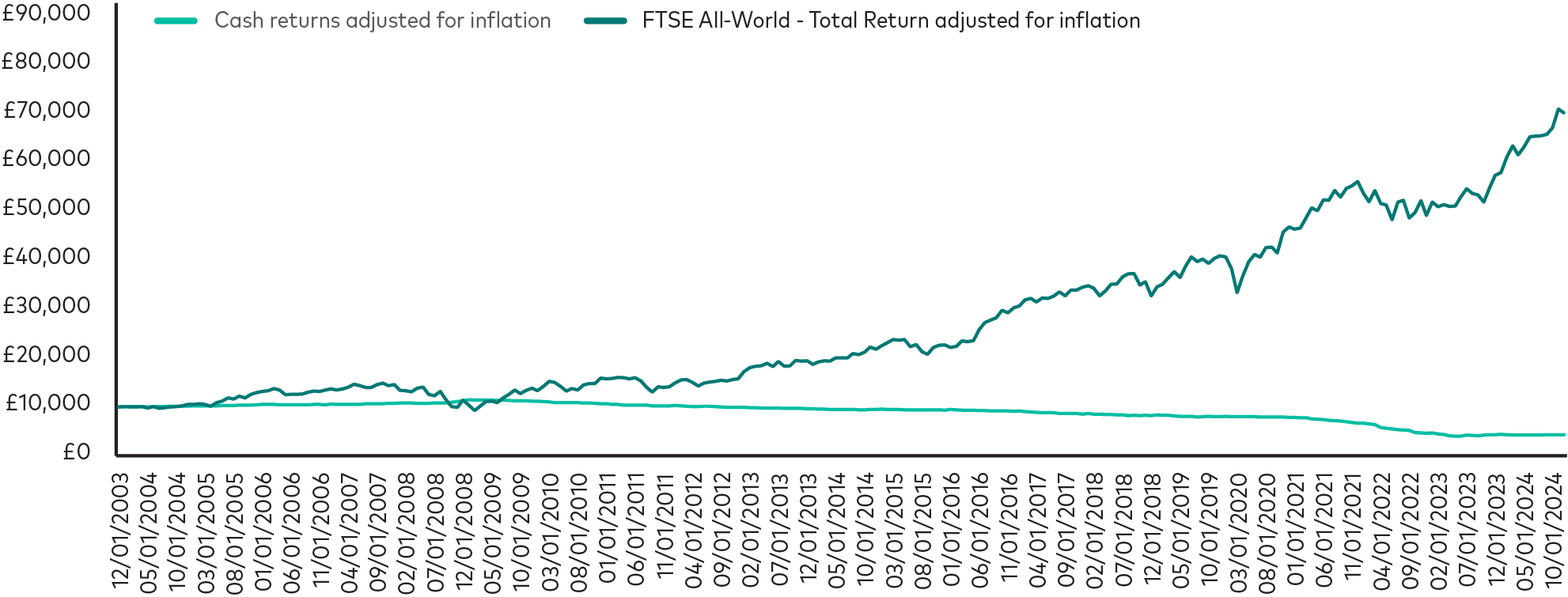

The chart below shows that £10,000 saved in cash in 2004 would be worth only £4,314 in ‘real’ terms today – that’s 57% less. The same amount invested in the global stock market would be worth £70,253 in today’s money – a 600% increase. Past performance isn’t a guarantee of future results, but it’s a compelling example of the power of investing.

Shares can deliver significantly higher returns than cash over time

Past performance is not a reliable indicator of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Notes: Cash returns represented by the UK Sterling Overnight Index Average benchmark (SONIA) and global shares by the FTSE All-World Index with dividends reinvested; and inflation by the UK Retail Price Index (RPI). SONIA reflects the average rate of interest banks pay to borrow overnight.

Source: Factset, Vanguard calculations based on period 31 December 2003 to 31 December 2024.

The chancellor also introduced measures to help investors identify UK-focused portfolios as well as funds dedicated to the UK. The measures include a pledge by investment platforms, including Vanguard, to highlight such funds on their websites. This will come into effect during 2026.

How is income tax changing?

There was some speculation that the chancellor would increase income tax rates, but this did not happen. The basic, higher and additional rates of tax on income from employment will remain at 20%, 40% and 45%, respectively2.

However, income tax thresholds have been frozen for another three years until the end of the 2030-31 tax year. This is a significant change from last year’s Budget, when the chancellor said the thresholds would start rising again from 2028 in line with inflation. The thresholds were frozen at their current levels by the previous Conservative government in 2022.

The announcement means that the personal allowance (the amount of tax-free income you can earn each year) will remain at £12,570 until April 2031. The higher-rate tax threshold will stay at £50,270 and the additional-rate threshold will remain at £125,140.

What does the freeze to income tax thresholds mean for investors and retirees?

When income tax thresholds are frozen, the amount of income you can earn before you start paying tax at higher rates does not increase, even as salaries or the cost of living go up. So, as people's incomes rise – whether through pay increases for workers or higher pension payments for retirees – they may cross into higher tax brackets and end up paying more income tax.

There are several ways you can reduce the impact of frozen income tax thresholds:

- Make the most of ISAs: income from investments in an ISA is completely tax free, which means it won’t push you into a higher tax bracket or result in a bigger income tax bill. You also don’t have to pay capital gains tax (CGT) on profits earned within an ISA, so all investment growth is sheltered from tax.

- Save more in pensions: paying into a pension reduces your taxable income. For example, if your income is £60,270, you’d usually pay 40% tax on the £10,000 above the higher-rate threshold. But if you contribute £10,000 (£8,000 plus £2,000 tax relief) to a self-invested personal pension (SIPP), your ‘adjusted net income’3 drops to £50,270, which is in the basic-rate band. You can claim this tax relief by filling in a tax return.

- Only withdraw what you need in retirement: it’s important to check you’re only drawing the income you truly need from your pension. Taking too much can mean an unnecessarily large tax bill and may deplete your pension pot too quickly. While your money remains inside your pension, it benefits from tax-free growth, which can help your savings last longer and potentially increase in value over time.

- Consider other sources of retirement income: income in retirement doesn’t have to come solely from pensions. For example, you can withdraw as much as you like from ISAs without paying tax. If you have a general account, you can earn up to £3,000 in tax-free capital gains and up to £500 in tax-free dividends in the 2025-26 and 2026-27 tax years.

Were there any changes to pensions in the Budget?

The chancellor introduced a £2,000 cap on the amount of salary that can be sacrificed into pensions before National Insurance applies. This cap will come into effect from April 2029.

Meanwhile, the full state pension will rise to £241.30 a week in the 2026-27 tax year.

Despite some speculation, the Budget contained no changes to pension tax relief or the amount of pension tax-free cash you can take in retirement.

What do the changes to salary sacrifice mean for workers?

Salary sacrifice enables employees to exchange part of their salary for employer pension contributions, allowing them to save on income tax and National Insurance while also saving for retirement. The new cap means that from 6 April 2029, if an employee sacrifices more than £2,000 of their salary for pension contributions, they’ll pay National Insurance on the portion above £2,000 (the National Insurance rate is 8% on earnings below the higher-rate tax threshold of £50,270 and 2% on earnings above this).

Our calculations show that for a basic-rate taxpayer who sacrifices £5,000 a year into a pension, their take-home pay will reduce by £20 a month once the changes come into effect. A higher-rate taxpayer who sacrifices £5,000 a year will see their take-home pay fall by £5 a month.

It's important not to respond to this change by lowering your contributions if you can afford to maintain them. Pensions continue to be one of the best ways to save for retirement, offering valuable benefits like employer contributions, tax relief on personal contributions and tax-free growth on your savings. If continuing with your workplace scheme isn’t financially feasible, alternatives such as SIPPs are available. These also offer tax relief and tax-free growth, though you would miss out on valuable employer contributions.

What does the rise in the state pension mean for retirees?

The rise in the state pension works out at about £12,548 for the 2026-27 tax year, up from £11,970 currently. While the increase is welcome, it also means that the state pension will take up an even greater proportion of the tax-free personal allowance, which has been frozen at £12,570 until 2031. This means it’s even more important to ensure your retirement is as tax efficient as it can be.

The way you draw income from your investment and savings pots could make a big difference to your overall tax bill in retirement. It’s usually wise to take income and capital from general accounts before ISAs and pensions, so that you preserve the tax wrapper benefits for as long as possible. However, what’s right for you will depend on your individual circumstances, so we’d suggest speaking to a financial adviser first.

How has dividend tax changed?

Dividend tax changes also formed part of the Budget, with the chancellor announcing an increase in the rates of tax some investors pay on dividends they earn from shares (or from funds investing in shares). Currently, basic-rate taxpayers pay 8.75%, higher-rate taxpayers 33.75% and additional-rate taxpayers 39.35% on dividends that exceed the annual tax-free allowance of £500. From 6 April 2026, these rates will rise to 10.75% for basic-rate taxpayers and 35.75% for higher-rate taxpayers. The rate for additional-rate taxpayers will stay at 39.35%.

What does the dividend tax rise mean for investors?

If you earn dividends from investments inside a general account, you may find yourself paying higher taxes once the changes come into effect. For example, if you’re a higher-rate taxpayer and earn £2,000 of dividends, you’ll pay £536 in dividend tax next year versus £506 currently.

A simple way to reduce the impact of the dividend tax increase is to move more of your investments into an ISA. The process for doing this is called ‘bed and ISA’. When you initially sell holdings in your general account, you’ll be liable to capital gains tax (CGT) on profits that exceed your CGT allowance (which is currently £3,000). However, once your investments are inside the ISA wrapper, you won’t have to pay tax on any future profits, interest or dividends. Bear in mind that bed and ISA transactions will count towards your £20,000 ISA allowance.

How has tax on savings interest changed?

The chancellor announced higher rates of tax on savings interest that exceeds the personal savings allowance (which is £1,000 for basic-rate taxpayers, £500 for higher-rate taxpayers and £0 for additional-rate taxpayers). Currently, you pay tax at your usual income tax rate, but from 6 April 2027 the rates will rise to 22% for basic-rate taxpayers, 42% for higher-rate taxpayers and 47% for additional-rate taxpayers.

You don’t pay tax on savings in an ISA, but as mentioned above, this could be a good time to check how much you’re holding in cash versus investments. For savings over and above your emergency fund, a stocks and shares ISA can give your money more opportunity to grow over the long term.

Irrespective of the changes announced today, we believe that investors remain well-served by Vanguard’s four principles for investing success: have clear investment goals; invest in a balanced portfolio of shares and bonds4; keep costs low; and maintain perspective and long-term discipline.

Notes: All data in this article are sourced from Budget 2025, HM Treasury, November 2025 and reflect information available at the time of publication.

1 Inflation is the rate of increase in prices for goods and services.

2 These rates apply to taxpayers in England, Wales and Northern Ireland. For Scottish tax bands and rates see HMRC’s ‘Income Tax in Scotland’.

3 Adjusted net income is total taxable income before any personal allowances and after certain tax reliefs. To work out your adjusted net income, see HMRC’s website.

4 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Eligibility to invest in a Vanguard Personal Pension depends on your individual circumstances. Please be aware that pension and tax rules may change in the future and the value of investments can go down as well as up, so you might get back less than you invested. You cannot usually access your pension savings or make any withdrawals until the age of 55, rising to the age of 57 in 2028.

If you are not sure of the suitability or appropriateness of any investment, product or service you should consult an authorised financial adviser. Please note this may incur a charge.

The eligibility to invest in either ISA or Junior ISA depends on individual circumstances and all tax rules may change in future.

Any tax reliefs referred to are those available under current legislation, which may change, and their availability and value will depend on your individual circumstances. If you have questions relating to your specific tax situation, please contact your tax adviser.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4997351