Three common investment mistakes and how to avoid them

Whether you’ve been investing for years or just starting out, it can be easy to fall into these three investing traps. Here’s how to avoid them.

Investing can be a great way to grow your wealth and plan for long-term goals, such as your children’s education or your retirement.

But our research1 found that there are some common mistakes that even the most experienced investors can make; mistakes that could seriously impact your returns and hinder your ability to reach your financial goals. Below are three of the most common mistakes and the steps you can consider to avoid them.

1. Not having the right mix of investments for you

Picking the right investments can confuse even the most seasoned investor. If you don't do it correctly, you can undermine your ability to achieve your financial goals or expose yourself to too much investment risk.

The right investments for you are those which align with your goals and attitude to risk. For example, someone with a long-term goal and who is willing and able to accept the risk that comes with investing might allocate more of their portfolio to shares than bonds2. This is because shares have historically offered higher returns than bonds over the long term, albeit with greater volatility (or swings in prices) along the way. Bonds have historically offered lower but more stable potential returns than shares.

An investor’s mix of shares and bonds – known as their ‘asset allocation’ – is a key driver of long-term investment success3. However, our research found that 80% of investors who switched to our managed service – where we choose and manage funds for you – were not invested in a mix of assets that matched their attitude to risk when they were choosing and managing their own funds4.

Of those, 40% of investors were holding fewer shares than their attitude to risk would suggest, meaning they were investing too cautiously. When they joined our managed service, their average allocation to shares increased by 17 percentage points. On the other hand, 60% of investors were holding more shares than their attitude to risk would suggest, meaning they were investing too adventurously. When they joined our managed service, their average allocation to shares decreased by 21 percentage points.

Regularly reviewing and rebalancing5 your portfolio is key to keeping it aligned with your attitude to risk and financial goals should they change over time. With our managed ISA, we monitor your investments for you and offer an annual check-in to make sure your money is still invested at the right level of risk for you.

You can learn more about your attitude to risk and use our risk assessment tools when opening an account. When signing up to our managed ISA service, for example, we ask you a simple set of questions which will determine your risk tolerance for you and create a mix of investments that aligns with this.

2. Holding too much cash

Our research also found that many investors were holding large amounts of cash in their ISAs before moving to our managed service. Around a quarter held more than 5% of their ISA in cash and, of those, a third held at least 50% in cash6.

Of course, it is important to hold some cash in deposit accounts. For one-off expenses, one rule of thumb is to keep the greater of £2,000 or half a month’s expenses in a bank account. When it comes to an income shock caused by illness or unemployment, for example, we suggest keeping 3-6 months’ worth of expenses in an accessible savings account.

Cash is also useful for goals that are less than five years away because there's no risk of a stock market decline depleting your wealth just before you need to access it. However, for longer-term goals your savings can lose value due to the impact of rising prices, otherwise known as inflation. Holding too much cash might mean you don’t reach your goals as quickly as you hoped.

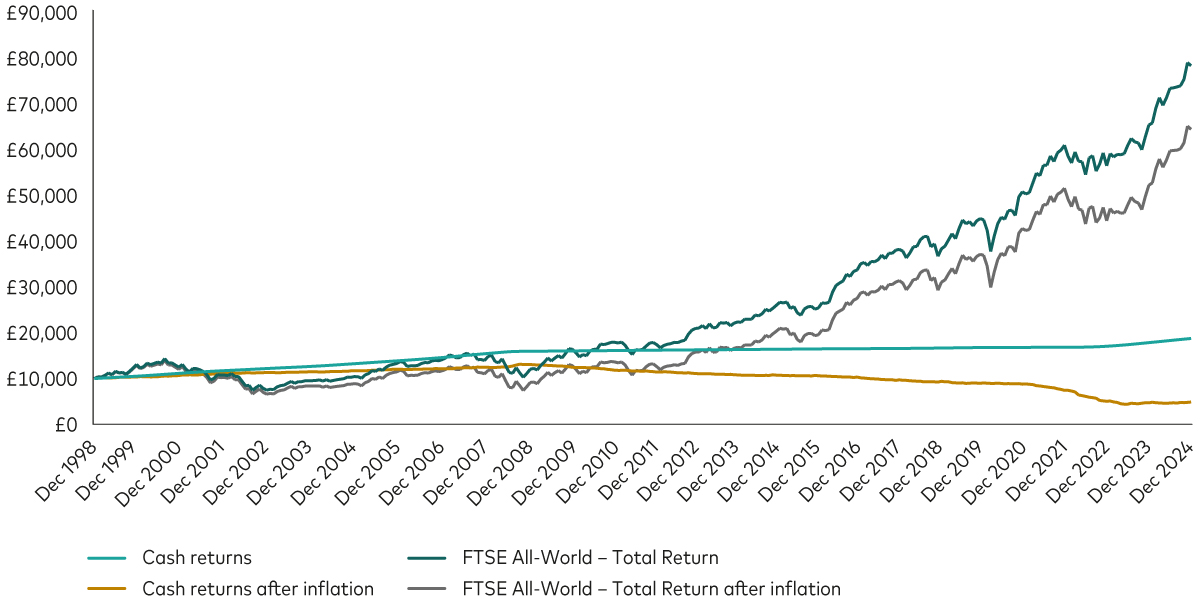

Shares have historically delivered a better return than cash over long periods and have outpaced inflation by a larger margin. For example, the chart below shows that a £10,000 investment in cash at the end of 1998 would have grown to £18,695 by the end of 2024. But after adjusting for inflation, its value would have more than halved to £4,918. In contrast, a £10,000 investment in shares would have grown to £77,826, or to £64,049 after adjusting for inflation.

Returns from £10,000 in cash and shares, before and after the effects of inflation

Past performance is not a reliable indicator of future results.

Notes: Cash returns represented by the UK Sterling Overnight Index Average benchmark (SONIA), global shares by the FTSE All-World Index with dividends reinvested; and inflation by the UK Retail Price Index. SONIA reflects the average rate of interest banks pay to borrow overnight. The value of investments may fall or rise and you may get back less than you invest.

Source: Factset, Vanguard calculations based on period 31 December 1998 to 31 December 2024.

We believe investors who are comfortable with taking some risk and can commit their money for at least five years are better off invested, even if markets disappoint in the short term.

3. Panicking in a market downturn

A common mistake made by investors at all levels of experience, and one that is often spurred on by emotion, is panicking during a market downturn.

It always helps to stay informed about market news but try not to let it dictate your decisions. Downturns – or threats of one – can be scary, but reacting emotionally can lead to poor decisions, such as selling your investments at a loss.

It’s important to stay focused on your long-term investment goals and avoid making impulsive decisions based on short-term market movements or noise.

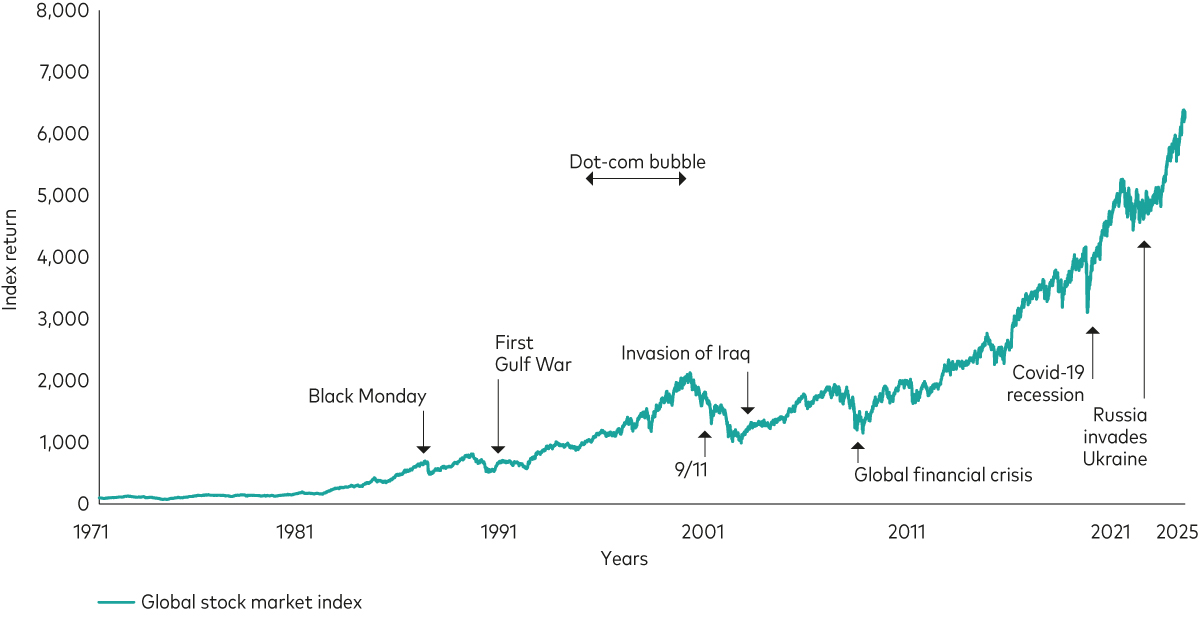

As the chart below shows, major global events over the years have impacted stock markets including the bursting of the dot-com bubble and the global financial crisis in 2007-09. However, stock markets eventually recovered from these events and went on to reach new highs.

Stock market performance from 1971 to 2024

Past performance is not a reliable indicator of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Notes: The chart shows the price of global shares (measured by the MSCI World Price Index until 31 December 1987 and the MSCI AC World Price Index thereafter) in GBP from 20 August 1971 to 31 December 2024. Returns do not include the impact of fees. The index was rebased so that 20 August 1971 equals 100.

Source: Vanguard calculations in GBP, based on data from Refinitiv, as at 3 January 2025.

Successful investors are those who manage to ride out the market falls, remain focused on their goal(s) and stay invested for when markets recover, as highlighted in our four simple principles for investing. Once you sell, it’s emotionally hard to start investing again.

More often than not, staying the course and sticking to your plan is the right thing to do.

1 Data collected from 455 Vanguard Managed ISA clients who transferred from our ‘do it yourself’ ISA since the launch of Managed ISA in December 2023 to October 2024.

2 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term.

3 Gary P. Brinson, L. Randolph Hood, and Gilbert L. Beebower, 1995. "Determinants of portfolio performance." Financial Analysts Journal 51(1):133–8. (Feature Articles, 1985–1994.)

4 Represents clients who saw an adjustment in their share allocation of 5 percentage points (either an increase or decrease) or more. Excludes clients who held more than 75% cash.

5 Rebalancing means changing the mix of investments in your portfolio if they move out of line with the target mix for your risk profile.

6 Excludes newly uninvested clients.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Some funds invest in emerging markets which can be more volatile than more established markets. As a result the value of your investment may rise or fall.

Investments in smaller companies may be more volatile than investments in well-established blue chip companies.

The Vanguard LifeStrategy® Funds may invest in Exchange Traded Fund (ETF) shares.

ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment.

The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

The Funds may use derivatives in order to reduce risk or cost and/or generate extra income or growth. The use of derivatives could increase or reduce exposure to underlying assets and result in greater fluctuations of the Fund's net asset value. A derivative is a financial contract whose value is based on the value of a financial asset (such as a share, bond, or currency) or a market index.

Some funds invest in securities which are denominated in different currencies. Movements in currency exchange rates can affect the return of investments.

The eligibility to invest in either ISA or Junior ISA depends on individual circumstances and all tax rules may change in future.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

For further information on the fund's investment policies and risks, please refer to the prospectus of the UCITS and to the KIID before making any final investment decisions. The KIID for this fund is available, alongside the prospectus via Vanguard’s website.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information is general in nature and does not constitute legal, tax, or investment advice. Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

Vanguard will manage your investments in the Managed ISA on your behalf. You will not be able to place trades on your own account.

The Authorised Corporate Director for Vanguard LifeStrategy Funds ICVC is Vanguard Investments UK, Limited. Vanguard Asset Management, Limited is a distributor of Vanguard LifeStrategy Funds ICVC.

The Manager of the Ireland domiciled funds may determine to terminate any arrangements made for marketing the shares in one or more jurisdictions in accordance with the UCITS Directive, as may be amended from time-to-time.

For investors in UK domiciled funds, a summary of investor rights can be obtained via https://www.vanguard.co.uk/content/dam/intl/europe/documents/en/Vanguard-InvestorsRightsSummaryUKFUNDSJan22.pdf and is available in English.

For investors in Ireland domiciled funds, a summary of investor rights can be obtained via https://www.ie.vanguard/content/dam/intl/europe/documents/en/vanguard-investors-rights-summary-irish-funds-jan22.pdf and is available in English, German, French, Spanish, Dutch and Italian.

London Stock Exchange Group companies include FTSE International Limited ("FTSE"), Frank Russell Company ("Russell"), MTS Next Limited ("MTS"), and FTSE TMX Global Debt Capital Markets Inc. ("FTSE TMX"). All rights reserved. "FTSE®", "Russell®", "MTS®", "FTSE TMX®" and "FTSE Russell" and other service marks and trademarks related to the FTSE or Russell indexes are trademarks of the London Stock Exchange Group companies and are used by FTSE, MTS, FTSE TMX and Russell under licence. All information is provided for information purposes only. No responsibility or liability can be accepted by the London Stock Exchange Group companies nor its licensors for any errors or for any loss from use of this publication. Neither the London Stock Exchange Group companies nor any of its licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the FTSE or Russell indexes or the fitness or suitability of the indexes for any particular purpose to which they might be put.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.