The power of long-term investing: how much could you make?

We compare the potential returns from investing £10,000 over 50 years with holding it in cash, and explain what these results mean for you.

When it comes to building wealth over the long term, the choice between holding cash and investing in the markets can make a significant difference.

We compared the potential earnings from investing £10,000 over the next 50 years with the amount that could be earned from keeping the same amount in cash savings. The result? Investing is expected to outperform cash by a substantial margin across all the portfolios analysed.

Our forecasts are projections and not guarantees, but the data underscores the benefits of long-term investing.

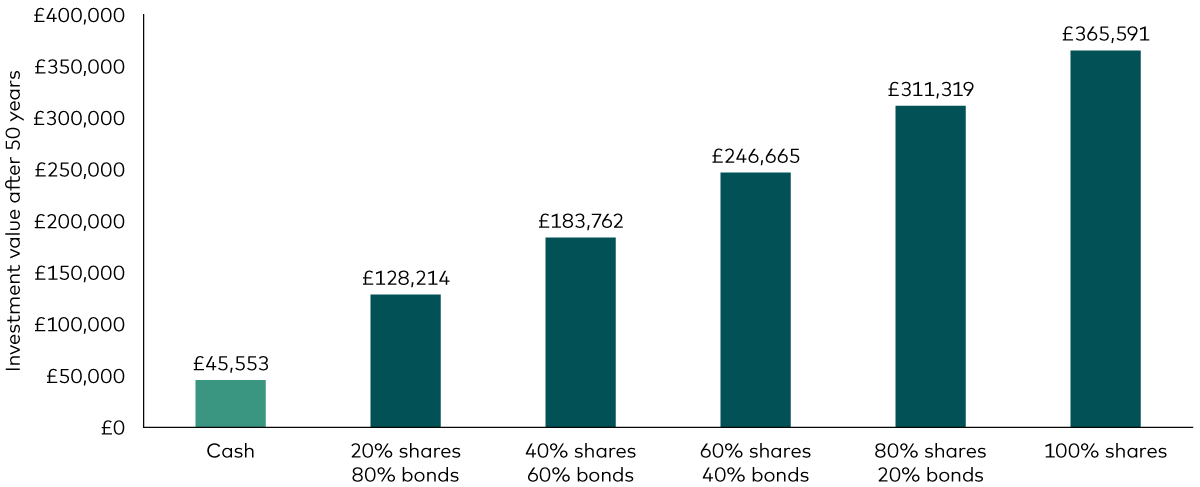

Cash versus investing: the results

We first looked at how much someone could earn if they held £10,000 in cash savings over the next 50 years. Based on our economists’ expectations that cash will deliver an average annualised1 return of 3.1%, their money could potentially grow to £45,553. While this might sound impressive, the potential returns from investing are even more striking.

By investing the same £10,000, their money could grow to between £128,214 and £365,592 before fees, depending on the proportion of shares and bonds2 in their portfolio. In other words, they could be between three and eight times better off by investing rather than holding cash.

It’s important to note that these numbers are based on average annualised returns, ranging from 5.2% for a portfolio containing 20% shares and 80% bonds to 7.5% for a portfolio containing 100% shares. The actual returns from year to year could be much lower or higher than the average and the portfolios with a higher proportion of shares are likely experience more pronounced fluctuations. When you’re deciding where to invest, it’s important to consider the level of risk you’re comfortable with as well as the expected returns (more on this below).

Potential returns from saving and investing £10,000 over 50 years

Notes: The chart illustrates the potential returns from holding £10,000 in cash savings over the next 50 years and compares this with the returns from investing in a range of portfolios with varying proportions of shares and bonds. The returns shown do not include the impact of fees.

Source: Vanguard calculations using the Vanguard Capital Markets Model (VCMM), which forecasts average annualised returns of 3.1% for cash, 5.2% for a portfolio containing 20% shares and 80% bonds, 6.0% for 40% shares/60% bonds, 6.6% for 60% shares/40% bonds, 7.1% for 80% shares/20% bonds and 7.5% for 100% shares. Forecasts as at 20 April 2025.

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model (VCMM) regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modeled asset class. Results from the model may vary with each use and over time.

What do the results mean for me?

While 50 years might seem a very long time to invest, it’s a realistic timeframe for many people, especially those who are young and saving for retirement or older individuals planning to leave a legacy for the next generation. Even if you’re investing for a shorter period, investing can be a powerful way of helping you achieve your goals.

While a savings account can be a good choice for goals that are less than five years away, for longer-term goals your savings can lose value because the cost of goods and services tends to rise over time (known as inflation). That means you might not reach your goals as quickly as you hoped. History shows that shares have typically delivered better returns than cash over long periods and have outpaced inflation by a larger margin.

Of course, investments can go down as well as up in value, and there’s a risk of losing some or all of your initial sum. However, you can reduce this risk by spreading your money across different types of investments, such as shares and bonds, as well as different industries and regions of the world.

Where should I invest?

The chart above shows that a portfolio containing 100% shares is forecast to deliver the highest returns over the next 50 years. However, it will also likely experience more pronounced ups and downs than the other portfolios. This is because shares can offer higher potential returns, but they also come with greater swings in prices. Bonds are typically more stable but offer lower potential returns.

Instead of focusing solely on the highest potential returns, it’s more important to consider what mix of shares and bonds is right for you. This will depend on how you feel about risk and your financial goals. Taking on too much risk can be stressful and may cause you to make impulsive decisions, such as selling investments at a loss when markets fall.

In general, someone who has a long-term goal and who is willing and able to accept the risk that comes with investing might allocate more of their portfolio to shares than bonds. In contrast, someone with a short to medium-term goal, or who is more cautious, might skew their portfolio towards bonds.

Investing with Vanguard

Knowing where to invest, whether it’s for 50 years or less, isn’t always easy. At Vanguard, we offer a range of funds and services to help you feel more comfortable and confident in your investment choices.

If you’re confident building and managing your portfolio yourself, you can choose from our wide range of low-cost individual funds. Or you can keep things simple by picking one of our LifeStrategy funds or Target Retirement funds, which combine different types of investments in one ready-made portfolio.

If you want more of a helping hand, our managed services will select and manage investments for you. We ask you a few simple questions to understand how you feel about risk and match you with one of five portfolios. We’ll manage your portfolio for you, making changes only when necessary to maintain the right level of risk.

1 Annualised returns show what an investor would earn over a period of time if the annual return was compounded (i.e. the investor earns a return on their return as well as the original capital).

2 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time. The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include US and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, US money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

The primary value of the VCMM is in its application to analysing potential client portfolios. VCMM asset-class forecasts—comprising distributions of expected returns, volatilities, and correlations—are key to the evaluation of potential downside risks, various risk–return trade-offs, and the diversification benefits of various asset classes. Although central tendencies are generated in any return distribution, Vanguard stresses that focusing on the full range of potential outcomes for the assets considered, such as the data presented in this paper, is the most effective way to use VCMM output.

The VCMM seeks to represent the uncertainty in the forecast by generating a wide range of potential outcomes. It is important to recognise that the VCMM does not impose “normality” on the return distributions, but rather is influenced by the so-called fat tails and skewness in the empirical distribution of modeled asset-class returns. Within the range of outcomes, individual experiences can be quite different, underscoring the varied nature of potential future paths. Indeed, this is a key reason why we approach asset-return outlooks in a distributional framework.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

The Vanguard LifeStrategy® Funds and Vanguard Target Retirement Funds may invest in Exchange Traded Fund (ETF) shares. ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

For further information on risks please see the “Risk Factors” section of the prospectus on our website.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product(s) described, please contact your financial adviser.

For further information on the fund's investment policies and risks, please refer to the prospectus of the UCITS and to the KIID before making any final investment decisions. The KIID for this fund is available, alongside the prospectus via Vanguard’s website.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information is general in nature and does not constitute legal, tax, or investment advice.

Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

The Authorised Corporate Director for Vanguard LifeStrategy Funds ICVC is Vanguard Investments UK, Limited. Vanguard Asset Management, Limited is a distributor of Vanguard LifeStrategy Funds ICVC.

For investors in UK domiciled funds, see our summary of investor rights and is available in English.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4484345