How to plan for retirement when the future is uncertain

In the second instalment in our retirement report series, we explore how to plan for the retirement you want, even when the future looks uncertain.

Planning for retirement is one of the most important things you can do to ensure you have the lifestyle you want in the future.

And the sooner you start, the better.

Our recent report into the nation’s level of preparedness for retirement found that those who planned ahead felt more in control, confident about the future and better able to adapt to life’s unexpected events.

Read on to learn about our research and how to plan for retirement step by step.

Start planning as early as you can

The earlier you start planning, the better your chances are of enjoying the retirement you want. Investing relatively small amounts of money on a regular basis can grow into a sizeable sum over time. But if you wait until you’re older, you’ll have to invest much bigger amounts of money to achieve the same result.

We calculated how much someone would need to save if they wanted £500,000 of pension savings by age 66. In addition to their workplace pension1, a 25-year-old earning £30,000 a year would need to invest £90 a month into a low-cost self-invested personal pension (SIPP) to achieve a pot of this size, assuming an annual return of 5%2. But for a 50-year-old earning £60,000 a year, they’d need to invest a huge £434 a month into their SIPP, even if they already had £100,000 of retirement savings. Starting early really does make a huge difference.

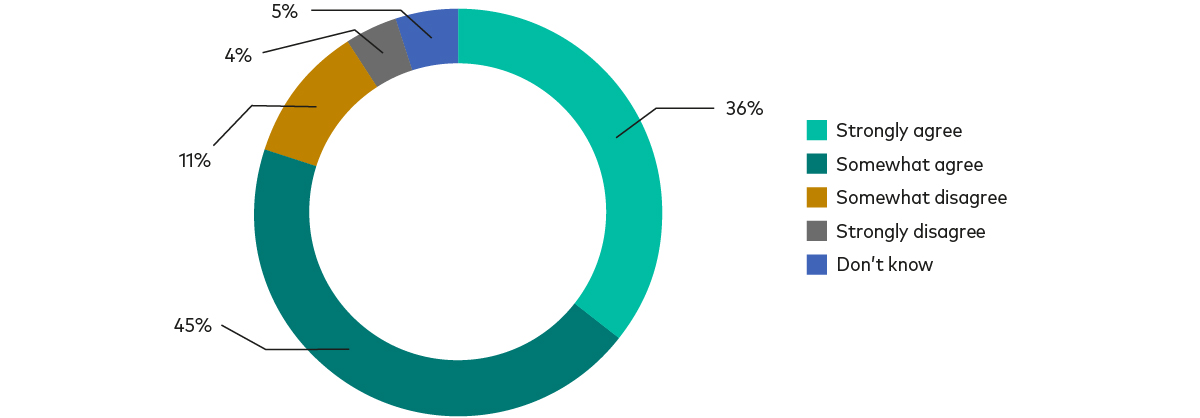

Planning early can also give you peace of mind that you’ve taken proactive steps to secure your financial future. However, our survey3 of 1,500 people aged 50 to 70 found that only 36% strongly agreed with the statement, ‘I have a retirement plan and I’m confident of how I will fund my retirement.’

'I have a retirement plan and I'm confident of how I will fund my retirement' - level of agreement

On average, the survey respondents started researching and calculating how much they’ll need for retirement just three to five years before their planned retirement date. We think the planning process should start a lot earlier. The sooner you start, the better the outcome is likely to be.

Accept that your plans might change – but you can still prepare

One challenge with planning for retirement is that there are a lot of unknowns and life is unpredictable. There are some things that are outside our control, such as illness, redundancy, death or a decline in the stock market, which results in your pension’s investments performing worse than expected. In our survey, 29% of respondents said they had experienced significant events that caused their plans to change.

Our research also found that the prospect of significant events occurring heightened people’s reluctance to plan for retirement. However, failing to plan could mean those events have a more severe impact on your retirement prospects than if you accept your plans might change and prepare your ‘plan B’. Your plan B might involve retiring a bit later, retiring gradually or reducing your living expenses. By thinking about your plan B in advance, it’ll lower the chances of making a decision in haste that ultimately proves costly.

Take simple steps to feel in control

Retirement planning might seem complicated, but there are some simple steps you can take to feel in control.

The timeline below shows some of the steps you might want to consider at each stage of your retirement planning journey. The steps won’t be suitable for everyone – we’d suggest speaking to a financial adviser if you’re unsure – but they’re useful pointers to start off with.

Retirement planning timeline – steps to consider

10+ years before retirement

- Open a pension if you don’t already have one.

- Work out how big your pot needs to be.

- Save as much as you can.

- Maximise employer pension contributions – some employers will pay in more if you increase your contributions too.

- Keep your costs low.

6-10 years before retirement

- Check whether you’re on track to meet your savings goal.

- Increase pension contributions if you can.

- Learn about your retirement income options.

- Start thinking about how you’ll take an income from your pensions.

- Track down lost pensions.

In the 5 years before retirement

- Make sure your investments still suit your attitude to risk.

- Work out your likely income and expenses in retirement.

- Address any shortfalls by saving more or retiring later.

- Decide how you’ll take an income from your pensions.

Once retired

- Create a budget and stick to it.

- Review your pensions each year.

- Don’t draw more income than you need.

- Use other savings pots to generate tax-efficient retirement income.

Source: Vanguard.

In the third and final instalment in our series, we’ll discuss the main ways to take money from your pension pots when you retire.

In the meantime, find out how much you might need to save for retirement in this earlier article and use our pension calculator to see if you’re on track for the retirement you want. You can also read some tips on how to draw tax-efficient retirement income.

1 We assumed minimum auto-enrolment of 8% of salary between £6,420 and £50,270. We also assumed their salary increased by 3% a year.

2 Returns do not take into account inflation, which reduces your money’s spending power over time. In other words, £500,000 in 40 years time will buy you less than it would today.

3 Vanguard commissioned Boring Money to survey 1,500 savers and investors aged 50 to 70 in January 2024. Survey participants had at least £75,000 in workplace or private pensions, or if they couldn’t provide a pension value, a minimum income of £30,000 (retired) or £40,000 (non-retired).

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Eligibility to invest in a Vanguard Personal Pension depends on your individual circumstances. Please be aware that pension and tax rules may change in the future and the value of investments can go down as well as up, so you might get back less than you invested. You cannot usually access your pension savings or make any withdrawals until the age of 55.

Any tax reliefs referred to are those available under current legislation, which may change, and their availability and value will depend on your individual circumstances. If you have questions relating to your specific tax situation, please contact your tax adviser.

Important information

Vanguard Asset Management Limited only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This article is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Asset Management Limited. All rights reserved.