How small regular pension contributions add up over time

Learn how small regular pension contributions can grow into a substantial nest egg over time, helping you achieve the retirement you want.

Building a substantial pension pot that supports you throughout your retirement can feel daunting, but it may be easier than you think. What people often don’t realise is that small consistent pension contributions can make saving for retirement much more manageable.

In this article, we explore how saving regularly can help you grow a pension fund that gives you peace of mind and the ability to live the retirement you want.

The power of compounding

One of the best things about saving regularly is that you can harness the power of compounding – when you earn returns on the money you invest as well as on the returns themselves. This means that even a relatively modest monthly contribution can turn into a substantial sum by the time you retire.

Imagine your pension contributions as a snowball gathering momentum as it rolls downhill. Each month, you add a little more snow (your contributions), and as the snowball continues its journey (time passes), it picks up more and more snow (investment growth). By the time you reach the bottom of the hill (retirement), your snowball has become impressively large, just as your pension savings can grow into a substantial sum.

The earlier you start, the better – but it’s never too late

The sooner you start saving, the easier it is to build up your pension pot. For example, if someone earning £35,000 a year begins contributing to an auto-enrolment workplace pension at age 221, they could accumulate just under £600,000 in pension savings by age 67. This assumes their pension grows by 5% a year after fees and their salary and the auto-enrolment earnings thresholds rise by 3% a year.

However, for an investor in their 40s, with a couple of decades until retirement, it’s not too late to give your pension savings a boost. Auto-enrolment alone might not be enough, but making small, regular payments into a self-invested personal pension (SIPP) can help bridge the gap.

Small steps, big wins – how much could you gain?

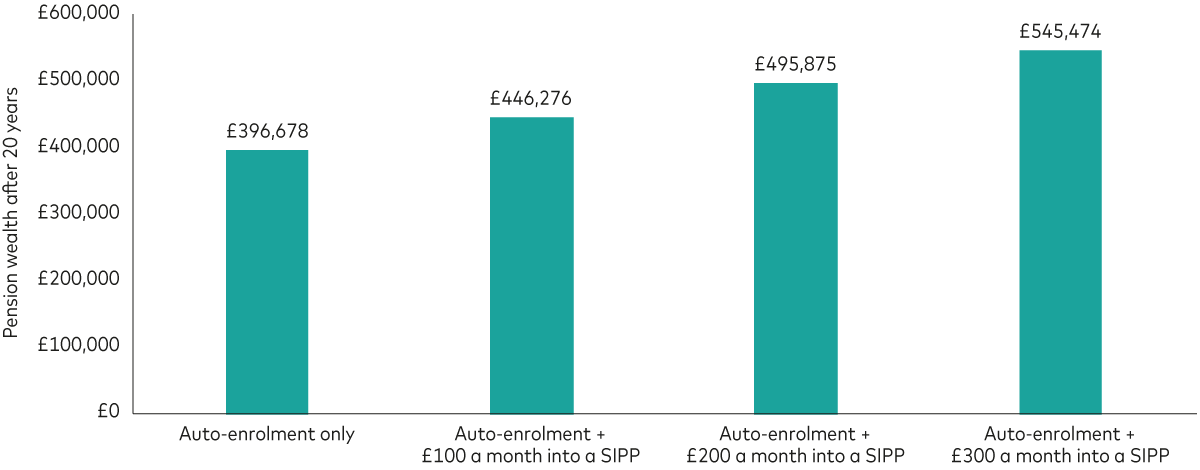

The chart below shows the difference it would make if someone saved £100, £200 or £300 a month into a SIPP for 20 years. We assume they already have £100,000 of pension wealth (the average for a woman in her 40s2) and earn £45,000 a year.

If they relied on auto-enrolment alone, their pot would be worth just under £400,000 after 20 years, based on the same assumptions as before. But if they also saved into a SIPP, their pot would be worth between £445,000 and £545,000. That’s an extra £45,000 to £145,000 to spend on holidays, spoil your grandchildren or pursue hobbies you’ve always wanted to try.

Small increases can make a significant difference

Pension wealth after 20 years, assuming a starting value of £100,000

Notes: This hypothetical scenario is for illustrative purposes only and doesn’t represent a particular investment or its expected returns. It assumes annual returns of 5% after fees and a 3% annual increase in salary and auto-enrolment thresholds. The monthly contribution of £100 into a SIPP is boosted to £125 by basic-rate tax relief, the £200 contribution is boosted to £250 and the £300 monthly contribution is boosted to £375.

Source: Vanguard calculations.

Tips for consistent saving

As we’ve shown, consistent contributions can add up to a substantial sum over time. Here are some tips to help you save regularly and stay disciplined:

Automate your contributions

Set up a direct debit to fund your pension. This ensures that you save consistently without having to think about it each month. You might not even notice the money leaving your account, but it’ll be working hard for your future.

Review and adjust regularly

Periodically review your contributions and consider adjusting them as your income changes. Even small increases can have a big impact over time. Think of it as a long-term investment in your happiness and security.

Take advantage of employer matching

If your employer offers a matching contribution, take full advantage of it. This is essentially free money that can boost your savings.

There are lots of other ways to boost your pension and increase your chances of having the retirement you want. Read our previous article to find out how to make your pension fit enough to last.

1 The auto-enrolment minimum contribution for the tax year 2025-26 is 8% of your salary between £6,420 and £50,270. The 8% comprises 5% from you (including tax relief) and 3% from your employer.

2 Vanguard analysis of the Office for National Statistics’ Wealth and Assets Survey, 2018 to 2020.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Eligibility to invest in a Vanguard Personal Pension depends on your individual circumstances. Please be aware that pension and tax rules may change in the future and the value of investments can go down as well as up, so you might get back less than you invested. You cannot usually access your pension savings or make any withdrawals until the age of 55, rising to the age of 57 in 2028.

If you are not sure of the suitability or appropriateness of any investment, product or service you should consult an authorised financial adviser. Please note this may incur a charge.

Any tax reliefs referred to are those available under current legislation, which may change, and their availability and value will depend on your individual circumstances. If you have questions relating to your specific tax situation, please contact your tax adviser.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4730796