In a previous article, we explored what it might take to become a pension millionaire. While a million pounds may be more than most people can hope to save in a lifetime, our previous article showed that it could be more attainable than you think.

But how much income could a £1 million pension actually provide and for how long? Below, we’ve crunched some numbers to help you consider your own circumstances and how much you might need.

How much do you need for a comfortable retirement?

According to the Pensions and Lifetime Savings Association (PLSA), a ‘comfortable’ retirement – one that allows for a couple of holidays each year and a bit of spontaneity – requires an annual disposable income of £43,900 for a single person or £60,600 for a couple1.

However, these figures are what you’d need after tax has been deducted. When you draw income from a pension, it’s taxed in the same way as income from employment. A single person would need to draw £52,214 a year before tax to fund a comfortable retirement, while a couple would need £80,048 (assuming they rely on just one individual’s pension and are therefore subject to a higher rate of tax2).

The PLSA figures also don’t account for the state pension, which most people will receive from their late 60s3. This can reduce the amount you need to draw from private pensions.

Hypothetical million-pound pension pot scenarios

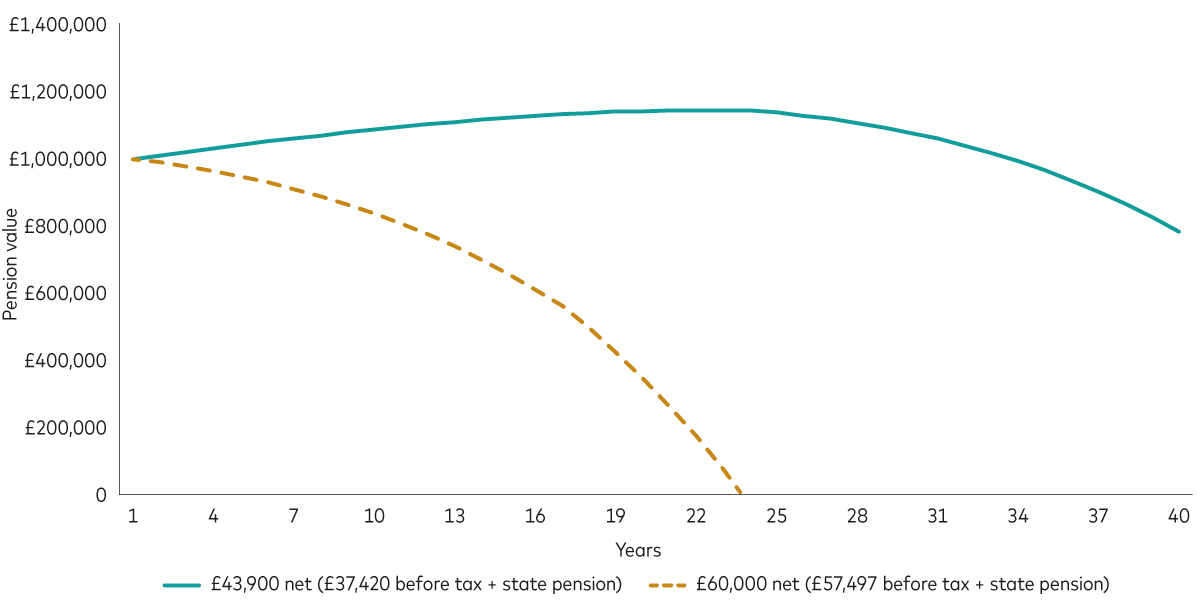

Based on the above, we’ve crunched some numbers to show how long a million-pound pension pot could last. We’ve considered both a comfortable retirement and a more extravagant lifestyle.

To keep things simple, our examples assume:

- The individual receives the full state pension, which rises by 2.5% each year.

- Their required spending rises by 2% a year to account for increases in the cost of goods and services.

- They draw tax-free cash from their private pension – under current rules, you can draw up to 25% of your pension as tax-free cash, up to a lifetime maximum of £268,275.

- The money left behind earns a 5% annual investment return after costs.

If someone started withdrawing £37,420 a year from their pension, they would achieve a total after-tax income (including the state pension) of £43,900, which is enough to fund a comfortable retirement as defined by the PLSA. As the chart below shows, a million-pound pension could theoretically support a comfortable retirement for as long as you need it and even allow you to leave a financial legacy for your loved ones.

However, if someone wanted a higher income of £60,000 a year after tax, a million-pound pension would last around 23 years, as the dotted line shows.

How long a £1 million pension might last based on initial pre-tax income

Notes: Spending amount rises by 2% per year; average annual investment growth is 5% after costs; the full state pension is the investor's only other source of taxable income. The investor withdraws their 25% tax-free cash (capped at £268,275) gradually over time rather than upfront.

Source: Vanguard calculations.

How much do you really need?

The PLSA estimates are a useful marker, but they won’t apply to everyone. Your retirement needs might differ based on your personal circumstances. You might find that you need less money due to lower expenses or occasional paid work. Conversely, you might desire a more luxurious lifestyle.

You could also find that your spending fluctuates. You might spend more in the early years of retirement, less as you age and then more again to cover care costs. Being aware of potential care costs in your later years is crucial when deciding how much to withdraw in the earlier years of retirement.

It’s also important to consider how long you might need to rely on your pension. If you underestimate your life expectancy, you might run out of money just when you most need it.

For example, a 50-year-old woman today has an average life expectancy of 87 years and a one-in-four chance of living to 95. Try the government’s life expectancy calculator to estimate how long your pension might need to last.

How to plug a gap in your savings

To get a better sense of what your retirement might look like, you can use our pension calculator. Think about the savings you’ve built up so far and whether you’re on track to retire when and how you want. If you’re falling short, consider what you can do to help plug the gap.

Could you increase your workplace pension contributions or make more use of employer matching4?

How about opening a self-invested personal pension (SIPP)? You could save into a SIPP alongside your workplace pension or use it to bring together all your other pensions, including those from previous jobs.

Combining your pensions can give you a clearer picture of your savings, so you can make more informed decisions around how much you need to save and when you can afford to retire.

1 Find out more about the PLSA’s retirement living standards.

2 Source: Vanguard calculations. If spread across two pension pots and subject only to basic-rate tax, the required gross total would be lower and closer to £69,500.

3 The state pension age will rise to 67 from 66 over 2026-2028. The full state pension is currently £11,973 a year. Check your own state pension forecast.

4 In addition to the statutory 3% of your pre-tax annual income between £6,240 and £50,270 that employers pay into your workplace pension, some will voluntarily pay more into your workplace pension if you agree to increase your contributions too. Check with your HR department.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Eligibility to invest in a Vanguard Personal Pension depends on your individual circumstances. Please be aware that pension and tax rules may change in the future and the value of investments can go down as well as up,

so you might get back less than you invested. You cannot usually access your pension savings or make any withdrawals until the age of 55, rising to the age of 57 in 2028.

If you are not sure of the suitability or appropriateness of any investment, product or service you should consult an authorised financial adviser. Please note this may incur a charge.

Your transfer will be sent to us as cash or shares (Vanguard funds only). During the transfer period any cash will not be invested so you could miss out on any increase in the value of your investments should the market rise.

Any tax reliefs referred to are those available under current legislation, which may change, and their availability and value will depend on your individual circumstances. If you have questions relating to your specific tax situation, please contact your tax adviser.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4694907