The end of stagnation for the UK and Europe

As we enter the second half of 2024, Jumana Saleheen, our chief economist in Europe, discusses the economic outlook for the UK and euro area.

After months of little to no economic growth – otherwise known as ‘stagnation’ – the UK and the euro area have finally started to grow again.

Meanwhile, the European Central Bank (ECB) has already cut interest rates and there are signs that the Bank of England may not be far behind. But future rate cuts will depend on continued progress in the fight against inflation.

UK and Europe break trend of little to no growth

The euro area economy grew by 0.3% in the first quarter of this year compared with the fourth quarter of 2023, and the UK grew by 0.6%, breaking the recent trend of very slow or negative growth. This uptick was driven by recovering ‘real’ household incomes (that is, adjusted for inflation) and an improved outlook for the global economy, which helped to boost exports and reignited business confidence.

We expect economic growth to continue for the rest of the year, although we expect economic activity to be restricted by manufacturing that remains weak.

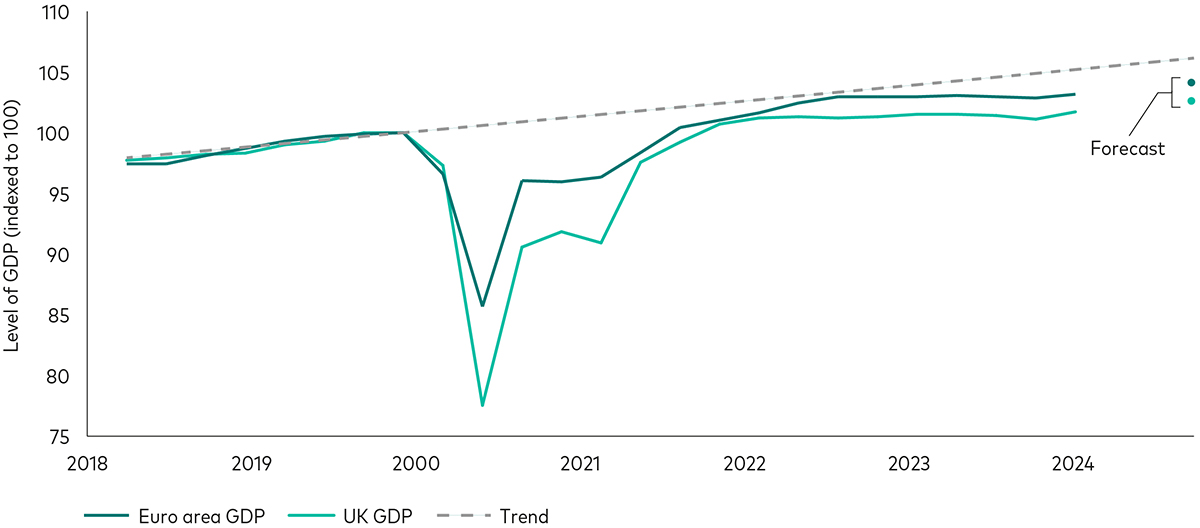

The chart below shows how the UK (light green line) and the euro area (dark green line) economies have grown since March 2018. The dotted line shows the pre-Covid trend for both economies and the larger green dots are Vanguard’s forecasts for the end of 2024.

UK and euro area have recovered but likely to remain below pre-Covid trend

Notes: The solid lines show real (after inflation) gross domestic product (GDP) for the euro area and the UK since 31 March 2018. GDP is a measure of the size and health of a country’s economy over a period of time. In the chart, GDP has been indexed to 100 as of the fourth quarter of 2019. The dotted lines show the pre-Covid trend for both economies. The green dots are Vanguard forecasts for the end of 2024.

Sources: Vanguard calculations based on data as of 10 June 2024, from Eurostat and the Office for National Statistics. Vanguard forecasts thereafter.

Fight against inflation continues

The last mile of the fight against inflation is proving challenging. Inflation in energy, food and core goods is now closer to the long-term trend, but prices for services have yet to normalise. The stronger outlook for economic growth has contributed to services prices rising again over the last three months. This means there is a risk that inflation might stay higher for longer than expected.

Although wage growth remains strong, we expect it will moderate based on a softening of the labour market.

We expect headline inflation to return to the 2% target by the end of the year in the euro area. UK headline inflation hit 2% in May, but it isn’t expected to settle at that level until the first quarter of 2025. Core inflation, which excludes volatile items such as food, energy, alcohol and tobacco, likely won’t return to target until the first quarter of 2025 in the euro area and the second quarter of 2025 in the UK.

Interest rate cuts begin

The ECB moved first in starting to cut interest rates, with a 0.25 percentage point cut earlier in June. We expect two more cuts by the end of this year and four cuts next year. This would leave interest rates at 2.25% at the end of 2025.

The Bank of England’s first rate cut will likely come in August. Thereafter, we expect the Bank Rate to be cut by an additional 0.25 percentage points before the end of this year and further cuts next year totalling one percentage point. This would take the rate to 3.75% by the end of 2025.

However, there is a risk that both the Bank of England and the ECB will cut rates by less than this, as the re-acceleration in services prices may push policymakers to take a more cautious approach.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Important information

Vanguard Asset Management Limited only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This article is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Asset Management Limited. All rights reserved.