Although investing can seem complex, success is largely within your control. Having an investment strategy that is tailored to your goals and attitude to risk can go a long way to reducing the stress and noise that is sometimes associated with investment decisions.

Here we explain Vanguard’s four investment principles, which are designed to help investors focus on what’s important to them and give them the best chance for investment success.

Create clear, appropriate investment goals

There is no one-size-fits-all plan for reaching financial objectives. Goals are unique to an investor’s situation, preferences and aspirations. Identifying and prioritising your financial intentions allows you to focus on what matters most, in an order that works for you. It also helps you to decide where you are prepared to make compromises.

Once investors have set and prioritised their goals, they can figure out how much—and for how long—they’ll need to save. The value any portfolio achieves over time is the sum of two elements: savings (the amount an investor puts into their portfolio) and investment returns.

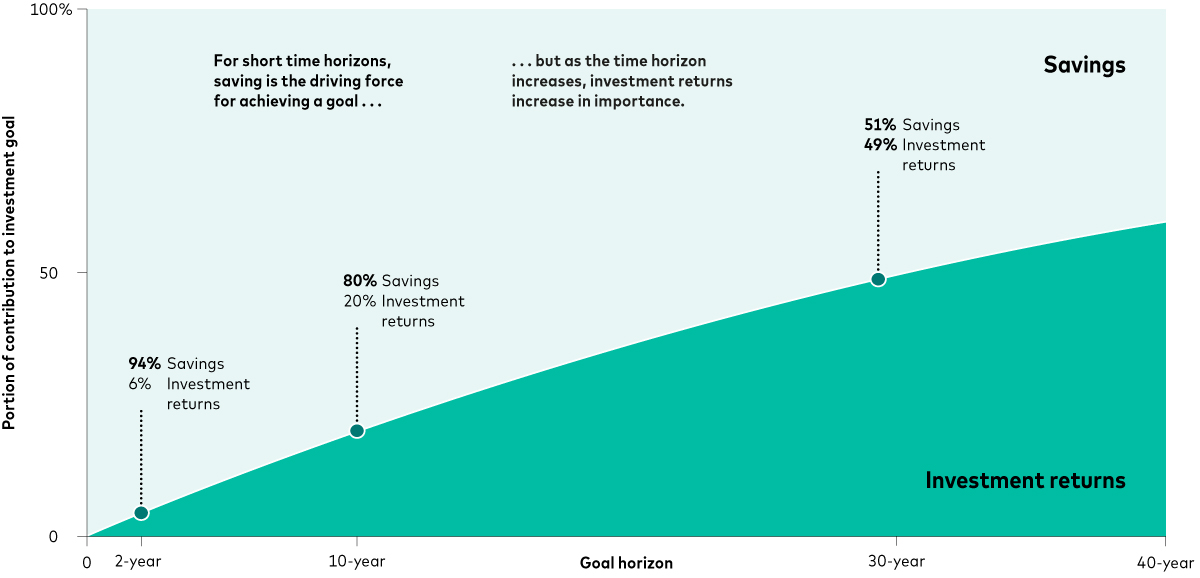

Much of the discussion about investment success tends to focus on investment returns, but both elements are crucial in reaching a goal. Time is a key factor here. The chart below shows how, for short time horizons, the amount of savings (the pale blue section) is the driving force in achieving an investment goal. As the time horizon increases, investment returns (the green section) increase in importance.

Savings and investment returns both contribute to the achievement of any investment goal

Over any given time horizon, an investment balance is the sum of savings (the amount an investor puts into the investment portfolio) plus the investment returns on the total amount invested.

These projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Notes: The calculation for the contribution of savings and investment returns is as follows: Assuming a 4% real return (after inflation and costs), we calculate how much an investor needs to invest annually to achieve a given investment goal for different time horizons, varying from 0 years (now) to 40 years. Savings represent the amount invested (the capital). Contributions are assumed to be the same every year relative to the year investing begins.

Source: Vanguard.

Keep a balanced and diversified mix of investments

Shares can be risky, but so is avoiding them. Shares have historically been more volatile in the short term (meaning they have fluctuated in price more sharply than other investments such as bonds or cash), but they’ve delivered higher inflation-adjusted returns over the long term1.

Spreading your investments across different assets (such as shares and bonds2) and also across different sectors and countries can help to reduce the overall volatility of a portfolio, while also cushioning against unnecessarily large losses from any one investment.

Remember, though, that past performance is no guarantee of future returns and there is a risk you may get back less than you invested.

An appropriate allocation to shares and bonds (known as asset allocation) takes into account an investor’s attitude to risk —how much volatility they can tolerate in their portfolio—and risk capacity—their ability to withstand a loss in their portfolio (a reflection of your time horizon and cash flow needs). Factoring in your time horizon and your tolerance for risk can lead to a tailored portfolio that’s suitable for your own personal circumstances.

Minimise costs

Market movements and financial returns are hard to predict, but costs are often controllable. The two broad types of cost that investors can face are (1) taxes and (2) investment costs, which include ongoing costs, transaction costs and one-off costs3.

Together, these costs cut into investment returns, sometimes significantly. To reduce this drag on returns, an investor can:

- Seek out lower-cost funds. The evidence is clear: Lower-cost funds have historically outperformed higher-cost funds after costs4.

- Consider tax-efficient accounts where appropriate. These could include individual savings accounts (ISAs) and personal pensions such as self-invested personal pensions (SIPPs).

Maintain perspective and long-term discipline

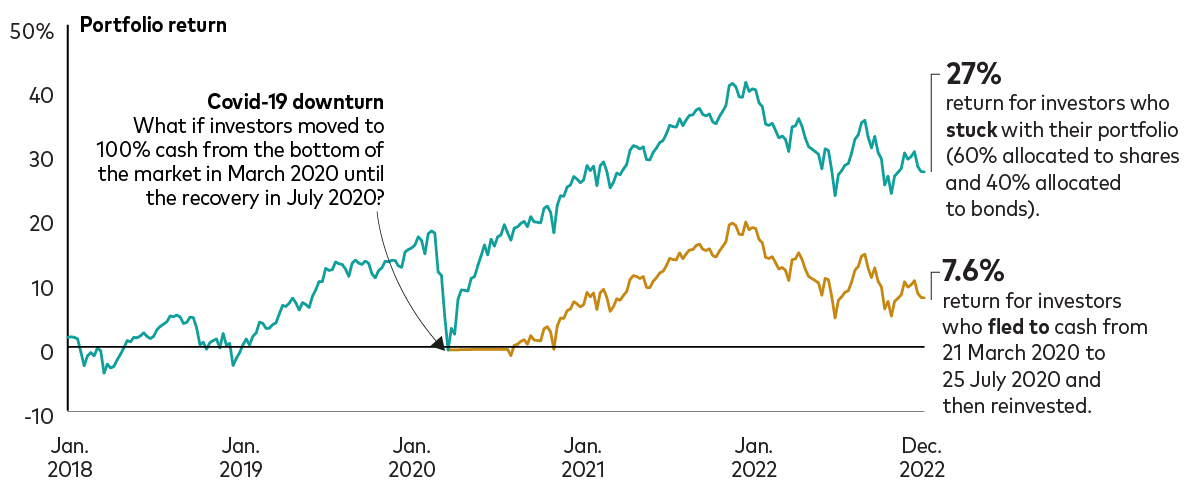

Discipline in investing is the ability to stick, over time, to an investment plan. It’s natural to want to react to market volatility, but acting on that emotion can lead to an impulsive decision, like panic selling during an unstable market. Taking a long-term perspective can help an investor maintain discipline and avoid a potentially harmful emotional move.

The importance of maintaining discipline: Reacting to market volatility can jeopardise returns

What if investors shifted to cash at the bottom of the Covid-19 downturn and stayed there until the market recovered?

Past performance is not a reliable indicator of future results.

Notes: Stocks are represented by the MSCI All Country World Index; bonds are represented by the Bloomberg Global Aggregate Bond Index (GBP Hedged). Hedged means investments are hedged back to the local currency to manage uncertainty around currency fluctuations. Cash is represented by the Intercontinental Exchange (ICE) 3-month Libor. This is a rate at which banks lend to each other in wholesale markets. All returns are in sterling and in nominal terms, with income reinvested.

Sources: Vanguard calculations, using data from Morningstar, Inc.

Staying the course can help increase your chance of investment success, but so can other actions, like making regular contributions to a portfolio, increasing them over time and having a plan to rebalance your portfolio (if the balance of shares and bonds moves away from your original target or allocation). That’s why our Managed ISA and our all-in-one funds, such as our LifeStrategy and Target Retirement funds, do the rebalancing for you.

Our four principles can help investors focus on the aspects within their control, so they can build tailored plans to help them achieve investing success.

1 Source: Vanguard research using Dimson-Marsh-Staunton global returns data from Morningstar. Data covers the period from 31 December 1900 – 31 December 2022. Returns are in local currency. Past performance is not a reliable indicator of future results.

2 Bonds are a type of loan issued by government or companies, which pay a fixed rate of annual interest and return the original sum borrowed at the end of the term.

3 Ongoing costs include the ongoing charges figure (OCF) which is paid to Vanguard for managing the fund and associated costs. Transaction costs are the charges incurred within the fund for buying and selling the underlying investments, including dealing costs and taxes. Vanguard’s exchange-traded funds (ETFs) incur one-off costs in the form of a bid-offer spread on any trades made. For more information, see our costs and charges information.

4 Lawrence, Stephen, and Jan-Carl Plagge, 2023. The Case for Low-Cost Index-Fund Investing. Vanguard research.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

If you are not sure of the suitability or appropriateness of any investment, product or service you should consult an authorised financial adviser. Please note this may incur a charge.

Past performance is not a reliable indicator of future results.

Performance may be calculated in a currency that differs from the base currency of the fund. As a result, returns may decrease or increase due to currency fluctuations.

The eligibility to invest in either ISA or Junior ISA depends on individual circumstances and all tax rules may change in future.

Some funds invest in emerging markets which can be more volatile than more established markets. As a result the value of your investment may rise or fall.

Investments in smaller companies may be more volatile than investments in well-established blue chip companies.

The Vanguard Target Retirement Funds and Vanguard LifeStrategy® Funds may invest in Exchange Traded Fund (ETF) shares. ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment. The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

The Funds may use derivatives in order to reduce risk or cost and/or generate extra income or growth. The use of derivatives could increase or reduce exposure to underlying assets and result in greater fluctuations of the Fund's net asset value. A derivative is a financial contract whose value is based on the value of a financial asset (such as a share, bond, or currency) or a market index.

For further information on risks please see the “Risk Factors” section of the prospectus.

Important information

Vanguard Asset Management Limited only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described in this document, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information is general in nature and does not constitute legal, tax, or investment advice. Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

The Authorised Corporate Director for Vanguard LifeStrategy Funds ICVC is Vanguard Investments UK, Limited. Vanguard Asset Management, Limited is a distributor of Vanguard LifeStrategy Funds ICVC.

For investors in UK domiciled funds, a summary of investor rights can be obtained via and is available in English.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2023 Vanguard Asset Management Limited. All rights reserved.