How currency movements can affect your investments

Learn how currency movements can impact your investment returns when you invest in global markets. Find out the pros and cons and how the process works at Vanguard.

Investing in global markets, rather than simply in the UK, gives you exposure to a much broader pool of shares and bonds1 across a variety of sectors and regions. This helps to diversify your portfolio, so you’re not relying on just one company, industry or economy to do well.

But investing overseas can sometimes cause confusion because investors based in the UK may get a different return than their foreign counterparts.

For example, you might notice that the S&P 500, which tracks the 500 largest US companies, rose by 10% one year but that the return on your own S&P 500 investment wasn’t quite the same.

A small part of the difference comes down to fees but there's another big reason for such discrepancies: currency fluctuations.

How foreign exchange rates impact your investments

Foreign exchange rates represent the value of one currency relative to another. They fluctuate daily based on factors like global demand, economic performance and market sentiment. This affects how much of one currency you receive when converting or making cross-border payments.

When you invest overseas, your investments are usually priced in the currency of the country you are investing in – be that US dollars, euros or Chinese yuan. That means the amount they return needs to be translated back into pounds. Sometimes this can work for you but it can also work against you.

For example, the table below shows how the returns from the S&P 500 can vary each year depending on whether they are calculated in US dollars or converted into pounds. In some years UK investors benefitted from foreign exchange rates, whereas in other years they did not.

Performance of the S&P 500 index in US dollars and British pounds

| Year | S&P 500 (US dollar) | S&P 500 (British pound) |

| 2016 | 12.0% | 33.6% |

| 2017 | 21.8% | 11.3% |

| 2018 | -4.4% | 1.6% |

| 2019 | 31.5% | 26.4% |

| 2020 | 18.4% | 14.7% |

| 2021 | 28.7% | 29.9% |

| 2022 | -18.1% | -7.8% |

| 2023 | 26.3% | 19.2% |

| 2024 | 25.0% | 27.3% |

| H1 2025 | 6.2% | -2.9% |

Past performance is not a reliable indicator of future results.

Source: Vanguard calculations, using data from Factset, as at 4 November 2025. Note: returns are calculated on a total return basis with dividends reinvested.

Currency movements

Exchange rates are constantly fluctuating in response to global economic and market conditions. This means the value of £100 in other currencies can vary significantly over time.

While you’re invested in an S&P 500 index fund your money is in US dollars. So, during this time, the value of those dollars relative to sterling is constantly fluctuating, regardless of how well the fund performs.

As shown in the table above, this creates an additional source of potential return – both positive and negative.

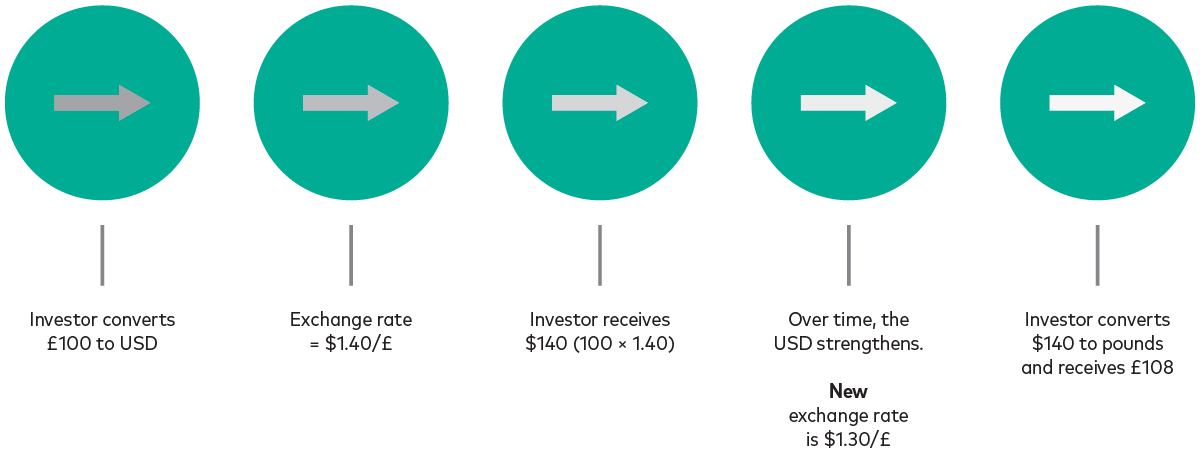

If the value of the dollar increases relative to the pound, as it did in 2016 in the wake of the Brexit referendum, you’ll make more money because you’ll get more pounds per dollar when it’s time to sell. Similarly, you’ll make less of a loss during a bad year, as was the case in 2022, when the pound and global stock markets were weak at the same time.

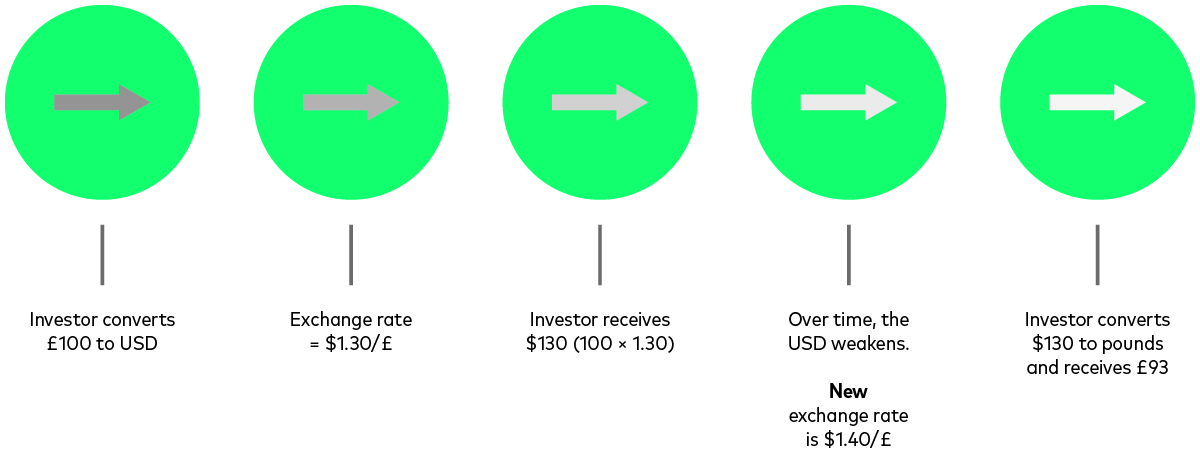

But if the dollar weakens against the pound, as it did in 2017 and in the first half of 2025, you could get fewer pounds back. The same principle holds for all overseas investments denominated in currencies other than sterling.

If the overseas currency strengthens, your return increases

For illustrative purposes only.

Source: Vanguard, using hypothetical exchange rates. Conversion rounded to the nearest pound

If the overseas currency weakens, your return decreases

For illustrative purposes only.

Source: Vanguard, using hypothetical exchange rates. Conversion rounded to the nearest pound

Can currency fluctuations be minimised?

Currency fluctuations can be significant in the short term, but they tend to even themselves out in the long run.

Their impact can be minimised through a process known as ‘currency hedging’, which involves using financial contracts to lock in a pre-determined exchange rate. It’s especially important in the case of bond investments, which are often used to provide stability and balance to an investment portfolio. Bonds have historically provided more stable (though often lower) returns than shares over the long term.

We offer hedged share classes for most of our bond funds and bond exchange-traded funds (ETFs)2 because we believe this type of investment benefits the most from currency hedging.

Shares, by contrast, are inherently more volatile than bonds. Shares are there to drive your investment returns, so being invested in them means being comfortable with a higher level of risk, which is why it’s more normal for share investments to be left unhedged.

1 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term.

2 An ETF invests in hundreds, sometimes thousands, of individual investments, such as shares or bonds. It trades on an exchange throughout the day like a stock and will typically track a specific market, like the FTSE 100.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Some funds invest in securities which are denominated in different currencies. Movements in currency exchange rates can affect the return of investments.

ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4970715