The Bank of England (BOE) is still expected to raise interest rates further despite a sharp fall in inflation in June1.

Headline UK inflation fell to 7.9% in the 12 months to June, down from 8.7% in May. Inflation shows the rate at which prices for goods and services are increasing.

However, so-called ‘core’ inflation dipped only slightly to 6.9% in the 12 months to June, down from 7.1% in May. Core inflation is used to measure the underlying rate of inflation. In the UK, it excludes energy, food, alcohol and tobacco, as these measures are seen as more volatile or are heavily taxed.

The Bank of England still has some work to do to bring inflation down towards its 2% inflation target, even if the latest news is encouraging.

Our economists think the base rate will probably peak at either 5.5% or 5.75%.

Why has inflation been stronger than expected?

Coming into 2022, we saw a surge in energy and food prices due to Russia’s invasion of Ukraine, which compounded the increased inflation we saw coming out of the Covid pandemic.

Surprisingly, the shock in energy prices has proven to be larger in the UK than in the eurozone. European governments capped prices sooner than the UK, and our prices have been slower to fall back, due to technical reasons around how the price cap was implemented.

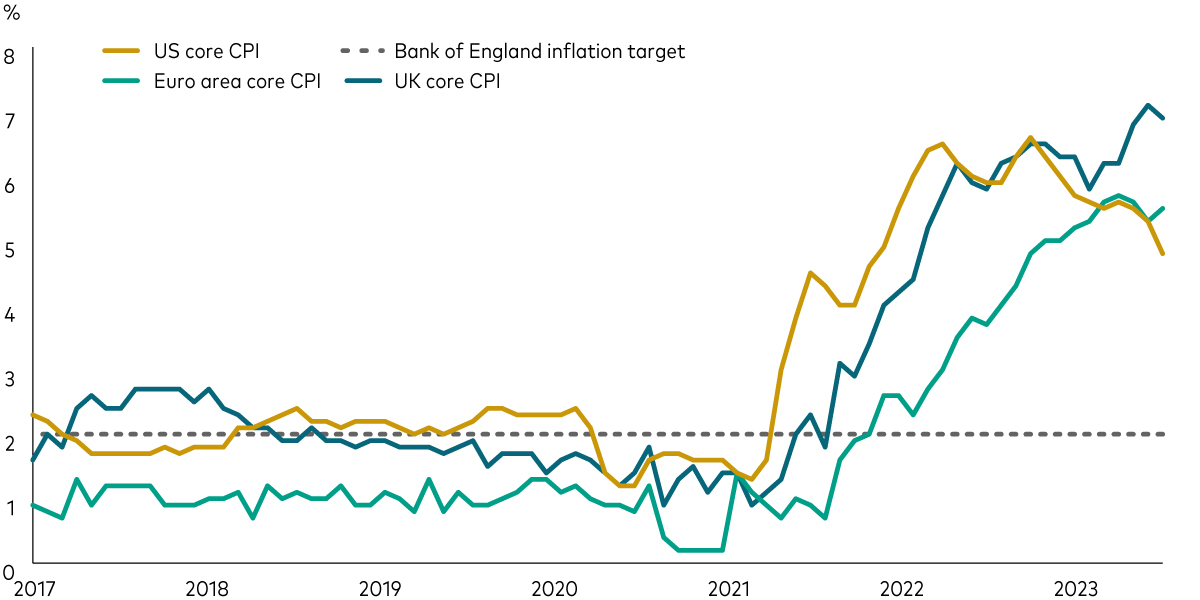

But it is core inflation, which strips out the energy effect, that is the bigger concern as it is closely tracked by the Bank of England when setting interest rates. And as you can see from the chart below, UK core inflation is higher than in the US and euro area.

Chart 1: UK core inflation is now higher than in the US and euro zone

Source: ONS, Eurostat, BLS, Bloomberg, as at 22 June 2023.

Among the reasons for this is the fact that labour shortages remain a problem for the UK, with the inactivity rate, the proportion of working-age people not in the workforce, some 1.5 percentage points higher in July 2022 than in February 2020.

A tight labour market with shortages of workers puts employees in a stronger position when negotiating for wage rises to cope with higher prices. This can further fuel inflation as companies pass on higher wages through higher prices, driving an inflationary spiral.

It is not clear that there is this ‘wage-price’ spiral in the UK yet, though services inflation, i.e., the price of something like a haircut, rather than a physical object, has picked up. Services inflation tends to be the most persistent, which is why many commentators are calling inflation ‘sticky’. Fundamentally, the Bank of England wants to see weakness in the UK labour market such as through a decline in job vacancies.

How have markets reacted?

Financial markets have responded by anticipating higher interest rates from the Bank of England, although expectations fell back slightly following June’s inflation data.

Rate expectations feed into the mortgage rate that banks can offer, which is why those rates had been rising sharply.

Higher interest rates are the textbook way of dealing with inflation. By raising the cost of debt like mortgages, you suck demand out of the economy. As consumers cut back on their spending, companies realise that they cannot pass on an increase in prices, and inflation moderates.

The challenge is that this can take time. How long it takes for rate rises to affect the economy is difficult to say, but it may be around 12-18 months. In fact, according to the Bank of England, we are yet to see most of the impact from the increase in interest rates that started in December 2021.

The impact of higher rates is also unlikely to have as big an effect as in the past. More than half of homeowners own their property outright now2. Mortgage costs are just not a factor for them.

It all suggests that interest rates may have to stay higher for longer with the Bank of England unlikely to cut rates until mid-2024 at the earliest.

What does it mean for my investments?

When central banks are raising interest rates, it can mean there is less fuel for growth, which can weigh on shares. Markets may start to worry that central banks will raise interest rates too much and choke the economy rather than moderate it.

Longer term, however, if higher rates make economic growth more sustainable, it can be good news for shares.

And what about bond markets? (For an introduction on what bonds are, read this article). Higher interest rates often lead investors to demand a higher interest rate or yield on the bond. The only way for this to happen is for the price of the bond to fall. Bond pricing is affected by other factors too though.

But longer-term, bond investors should ultimately benefit from higher rates because your money will be reinvested in higher-paying bonds that can generate better total returns. We would expect the UK government bond market to stabilise as a result of the Bank of England’s actions to tackle inflation.

Ultimately, the current uncertainty over the UK inflation outlook provides a reminder of why it is so important to have a globally diversified portfolio across both shares and bonds. This means that any short-term volatility in UK shares and bonds may be offset by the performance of shares and bonds in other markets.

Markets may be more volatile in the short term, but our research shows that investors who ignore short-term market noise do better in the long run. It’s time in the market, not timing the market, that ultimately delivers investment success.

Higher interest rates are concerning. But they are ultimately a signal that the Bank of England remains committed to bring inflation under control, which should be a long-term positive for the economy.

1 The main interest rate set by the Bank of England is also called the base rate.

2 UK Housing Survey

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

This article is designed for use by, and is directed only at, persons resident in the UK.

The information contained in this article is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so.

The information in this article does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

If you have any questions related to your investment decision or the suitability or appropriateness for you of the product(s) described in this document, please contact your financial adviser.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2023 Vanguard Asset Management Limited. All rights reserved.