When it comes to successful investing, it’s important to build the right portfolio. But it’s not just about what we invest in. How we behave also has a significant impact.

In this series of five articles, we will look at investor behaviour. Behavioural biases are ingrained in all of us. Their origins go back to pre-historic times, so they can be difficult to shake.

Still, if you can understand your own patterns of behaviour, you will be better able to control them and make smarter decisions about your finances.

The need to act when danger looms

Early humans’ very survival was grounded in the acute instincts of fight and flight. When attacked, fear set in and led people to either run or mobilise their best defences. Standing by when danger loomed was rarely an option.

To this day, if there’s a crisis, or if something goes wrong, we take action. If our car breaks down, we take it to the garage. However, while we are programmed to fix, mend, improve and meddle, investing is different. This is because when people around you are panicking, the best course of action may well be to sit on your hands and do nothing.

Human nature is such that we tend to feel better when we do something. Although it sounds easy, even lazy or, as some financial professionals would have you believe, negligent, doing nothing is often the right thing to do.

Imagine stock markets falling all around you (as they did when the pandemic hit) and everyone is selling. It’s natural to want to follow the crowd and join in. Prices may have fallen by double-digit percentages and, naturally, you want to protect what you have left. Your friends have smugly told you that they sold a few days ago for a big loss, but the situation is even worse now. But one certainty for long-term investors is that markets don’t go in a straight line. There are bumps, sometimes big ones, along the way.

Under such circumstances, it takes real courage to do nothing.

But fast forward a couple of months (as was the case after the Covid sell-off) or years. You’ve benefitted from the discipline of sticking with the plan. Stock markets have recovered and you’re making money again. In contrast, your friends took their losses and have nursed their wounds.

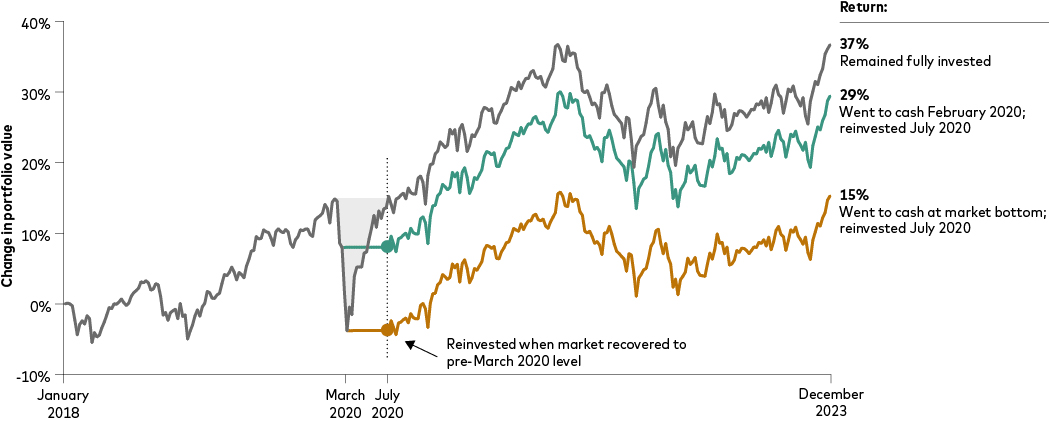

The chart below illustrates how staying the course can increase your chances of investment success. It shows three examples of investor behaviour during the Covid-19 market downturn: staying invested throughout (grey line); going fully to cash in the week of 18 February 2020 and reinvesting in the week of 7 July 2020 (green line); and going fully to cash in the week of 20 March 2020 (market bottom) and reinvesting in the week of 7 July 2020 (orange line). The investors who fled the market locked in losses and ended up with much lower returns than the investor who remained invested throughout.

The importance of maintaining discipline: Reacting to market volatility can jeopardise returns

Going to cash for just a few months can lead to underperformance

Past performance is not a reliable indicator of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Notes: The investment is in a portfolio made up of 60% shares and 40% bonds. Shares are represented by the FTSE Global All Cap Index. Bonds are represented by the Bloomberg Global Aggregate Bond Index (GBP Hedged). Currency hedging reduces the increase or decrease in the value of an investment due to changes in the exchange rate. It usually involves a separate transaction that is undertaken in the foreign exchange market before being converted into the investor's local currency. Cash is represented by the Sterling Overnight Index Average (SONIA) rate. Returns do not take into account inflation.

Sources: Vanguard calculations, using data from Morningstar, Inc. 1 January 2018 to 25 December 2023.

Strategies to overcome the fight or flight instinct

When fear invades markets and you’re itching to act, remind yourself of a few timeless pieces of investment wisdom.

- Remember that staying the course is hard and that you’re making a conscious decision to do so.

- Remind yourself of your financial goals and the strategy you have set in place to reach them. A good strategy will have factored in the typical ups and downs of markets.

- Have a process to remove the emotion from investing. Decide how often you are going to review your portfolio. Monthly, or even annually, will do for most investors.

- If your asset allocation – the relative weighting of shares and bonds1 within your portfolio – has drifted away from its target, rebalance your investments. This will ensure your portfolio continues to offer the risk and reward profile you chose. Many multi-asset funds like our LifeStrategy range, or our managed pension and individual savings account (ISA), will do the work of rebalancing for you. It also means that when markets do start to recover, your weighting in shares will help your portfolio recover faster.

In the following articles, we will look at more situations where we, as human beings, fall victim to distortions in our thinking. And although we are unlikely to be able to ever fix these biases because they are hard-wired into us, simply understanding that they are there will help you to manage them better. In each article, we will also outline a number of actions you can take to give yourself a greater chance of investment success.

1 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Eligibility to invest in a Vanguard Personal Pension depends on your individual circumstances. Please be aware that pension and tax rules may change in the future and the value of investments can go down as well as up, so you might get back less than you invested. You cannot usually access your pension savings or make any withdrawals until the age of 55.

Past performance is not a reliable indicator of future results.

The eligibility to invest in either ISA or Junior ISA depends on individual circumstances and all tax rules may change in future.

For further information on risks please see the “Risk Factors” section of the prospectus on our website.

Important information

Vanguard Asset Management Limited only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

For further information on the fund's investment policies and risks, please refer to the prospectus of the UCITS and to the KIID before making any final investment decisions. The KIID for this fund is available, alongside the prospectus via Vanguard’s website.

This article is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information is general in nature and does not constitute legal, tax, or investment advice. Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

The Authorised Corporate Director for Vanguard LifeStrategy Funds ICVC is Vanguard Investments UK, Limited. Vanguard Asset Management, Limited is a distributor of Vanguard LifeStrategy Funds ICVC.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Asset Management Limited. All rights reserved.