Bringing value to investors

Vanguard is a different kind of investment company. It was founded in the United States in 1975 on a simple but radical idea: that an investment company should manage its funds solely in the interests of its clients.

This philosophy has helped millions of people around the world achieve their goals with low-cost, uncomplicated investments.

It's what we stand for: value to investors.

Why Vanguard?

Over 50 years of experience

We’ve been taking a stand for investors for more than 50 years. Now over 50 million clients worldwide invest with us for their future.

Straightforward investing

We don’t think investing has to be complicated. Our four simple principles can improve your chances of investment success.

Vanguard value

Our funds provide you with low-cost investments, which means you get to keep more of your returns.

Taking a stand for investors, treating them fairly, and giving them the best chance for investment success.

Our investment principles

Goals

The investment process begins by setting measurable and attainable investment goals and developing a plan for reaching those goals.

Balance

A good investment plan starts with picking the right mix of investments. You can use different types of investments to reduce risk and help you meet your goals.

Cost

You can't control the markets, but you can control how much you pay to invest. Lower fund costs mean you keep more of your money.

Discipline

Investing evokes emotions that can disrupt the plans of even the most sophisticated investors. You can counter emotions with discipline and a long-term perspective.

“I love the range of funds Vanguard offers as well as the seamlessness of investing. I have everything set up how I want it and I barely think about the process anymore.”

Vanguard client

A little more about us globally

Valley Forge, Pennsylvania, USA

Salim Ramji

Client owned**

$10.4 trillion***

A timeline of our story

1975: Where it all began

The Vanguard Group begins operations on 1 May 1975. When Jack Bogle founded Vanguard, he made a revolutionary decision. He structured Vanguard in the US to be owned by its own funds – which means it’s owned by its investors. This ownership structure in the US is what sets Vanguard apart and lets us put investors first worldwide1.

1970s - 80s: Democratising investing

Vanguard launches the first index fund available to individual investors on 31 August 1976. Index funds track the performance of an entire market and offer a way for investors to get broad diversification at low cost. Since then, indexing has become mainstream and widely accepted as a key investing strategy.

1990s: Embracing the internet and taking our mission global

In January 1995, Vanguard launches a website on America Online, which is followed by Vanguard.com, debuting in December 1995.

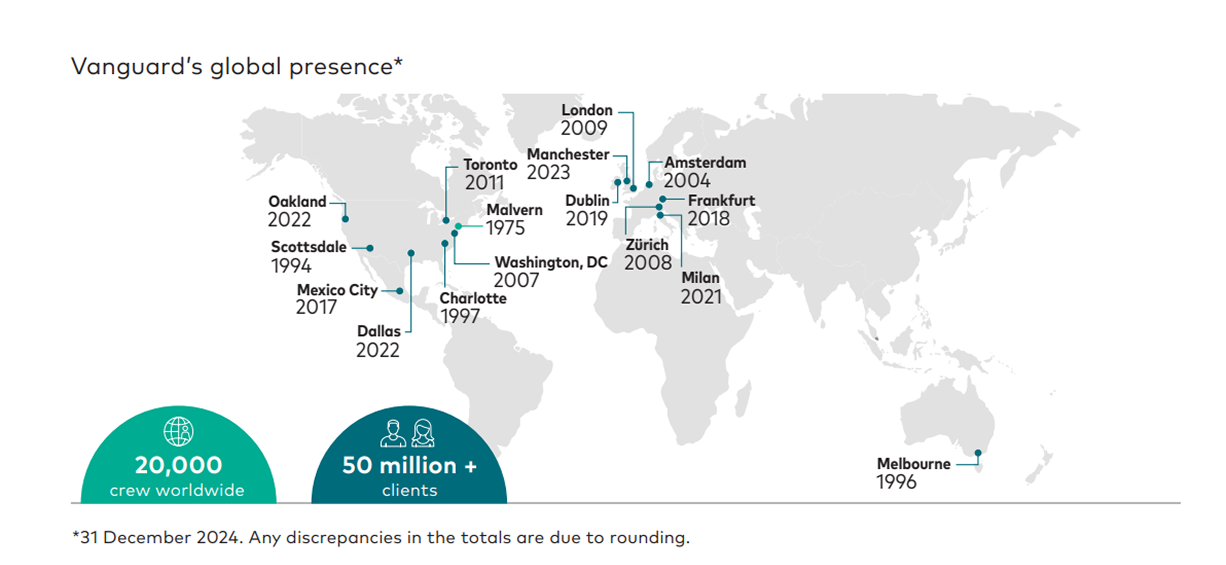

Vanguard establishes its first international operation with an office in Australia in 1996.

2000s: Expanding our presence in Europe

Vanguard expands its presence in Europe by opening offices in Amsterdam in 2004, Paris in 2005 and its European headquarters in London in 2009.

2010s: Bringing value direct to UK investors

Vanguard launches its consumer platform, UK Personal Investor, in May 2017 – an online service for UK investors designed to help simplify and lower the cost of investing.

Vanguard’s funds are available via an Individual Savings Account (ISA), Junior ISA or a general account.

2020s: Expanding our offer & partnering with clients

In February 2020, the Vanguard Personal Pension, a Self-Invested Personal Pension (SIPP) designed to make saving for retirement simpler and less expensive, is unveiled.

A few years later, in December 2022, Vanguard launches its Managed ISA, a low cost offer, where our experts choose and manage clients' investments so they don't have to.

In September 2024, Vanguard UK Personal Investor launches its new mobile app, created in collaboration with more than 7,000 clients.

**Our unique mutual ownership structure in the US, where we are owned by our clients, means our interests are aligned with those of our investors globally. It is this structure that underpins our core purpose, which is to take a stand for all investors, treat them fairly and give them the best chance for investment success.

***Data as of 31 January 2025. Monetary figures are in US dollars.

1 The Vanguard Group Inc. (VGI) is owned by Vanguard’s US-domiciled mutual funds and exchange-traded funds (ETFs). While VGI’s ownership structure can’t be replicated outside of the US (due to regulatory restrictions), this structure aligns Vanguard’s interests with those of our investors globally.