New to our Managed Personal Pension or just want to know more about how it all works? We answer your frequently asked questions on how we manage your portfolio.

Whether you're just starting out or already invested, you might lack the time or confidence to choose and manage your investments. That's why Vanguard launched the Managed Personal Pension in December 2023.

As part of this service, we take care of your investments for you, so you can focus on doing what you love.

But how exactly do we do that? Below, we answer our clients’ frequently asked questions on how we manage your portfolio, from changing your risk profile to navigating choppy markets.

What is Vanguard’s Managed Personal Pension?

The Vanguard Managed Personal Pension manages the investments in your Vanguard Personal Pension, which is a UK-registered pension scheme (recognised as a self-invested personal pension, or SIPP). It is a long-term, tax-efficient savings product designed to help you invest for your retirement.

Unlike our self-managed pension, where you choose funds yourself, or our Target Retirement Fund range, where you invest in a pre-built selection of funds, our managed personal pension service selects funds that align with your risk profile and retirement date and manages your portfolio for you.

Who is it for?

The Vanguard Managed Personal Pension is designed for investors who are willing to take on investment risk but don’t have the time, expertise or inclination to manage their own investments. The goal is to grow the value of your investments over the long term.

How does it work?

The Vanguard Managed Personal Pension offers five portfolios, each tailored to a specific risk profile: very cautious, cautious, moderate, adventurous and very adventurous. Your risk profile is determined based on the answers you give about your feelings towards risk when you sign up to the service.

The main difference between the portfolios is their percentage split between share and bond1 funds (see ‘What is my portfolio invested in?’). Shares generally offer higher potential returns but come with greater swings in prices. Bonds, on the other hand, are typically more stable but offer lower potential returns.

Each portfolio contains up to 13 low-cost index funds2 which invest in shares and bonds across the globe. By investing in funds that spread your money across different regions and industries, you’re not overly exposed to downturns in specific parts of the market.

The weighting towards each fund is designed to create a globally diversified portfolio that reflects the current make up of global markets. For example, you might notice that the largest geographical allocation in your portfolio is the US. This is because the US represents a significant part of the world’s companies.

The index funds within these portfolios aim to mirror the performance of a particular index. For example, the Vanguard US Equity Index fund aims to track the performance of the S&P Total Market index.

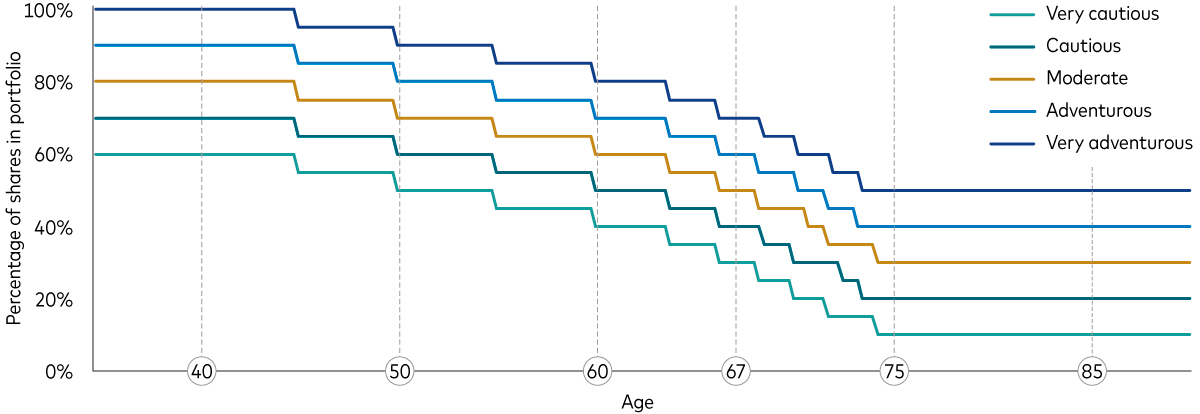

Your portfolio follows a ‘glidepath’ strategy. This means it has a target date (the date of your retirement) and the mix of shares and bonds is changed at specific points in time depending on the distance from this target date.

The chart below (which, in this example, assumes a retirement age of 67) shows that as you get closer to retirement, your exposure to risk is reduced. Since shares are considered riskier than bonds, your allocation to funds invested in shares decreases and your allocation to bond funds increases as you age. For example, a client with a moderate risk profile, planning to retire at 67, will have a portfolio fund split of 80% shares and 20% bonds at aged 40. However, when they are 75, this fund split will change to 30% shares and 70% bonds.

Vanguard Managed Personal Pension Glidepath

Source: Vanguard

When and why might you adjust the geographical exposure of my portfolio?

We review the geographical split of the managed portfolios every year to ensure they remain as closely aligned to global markets as possible.

What is my portfolio invested in?

Currently, the very cautious, cautious, moderate, adventurous and very adventurous portfolios each invest in six Vanguard funds focused on shares and six Vanguard funds focused on bonds. An inflation-linked bond3 fund is introduced to the portfolio at three-and-a-half years before retirement for the very cautious portfolio and one year before retirement for the very adventurous portfolio. This brings the total number of funds to 13. The proportion of shares and bonds varies according to the risk profile and how far you are from retirement, which you can see in the chart above.

When and why might you buy and sell funds in my portfolio?

Our primary goal is to make sure your portfolio is always appropriately aligned with your level of risk and how far you are from retirement. We review portfolios daily to determine whether we need to buy or sell funds. This will typically be driven by market moves which may see the proportion of shares and bonds in your portfolio change. If it moves by 5 percentage points or more we will rebalance the portfolio.

For instance, imagine that after a strong year in the stock market, the value of shares has risen whereas the value of bonds has remained stable. This would mean your portfolio is more heavily weighted towards shares which, as mentioned above, are generally riskier than bonds.

It’s also important to maintain the mix of investments that’s right for where you are along the glidepath. For example, the closer you are to retirement, the less risk you will want to take regardless of your risk profile, so the more investments in bond funds you are likely to hold (see the chart above). To align with both your risk profile and how far you are from retirement, you would need to sell some shares and buy some bonds – this is called ‘rebalancing’ your portfolio. We do this for you.

How do I see which funds you’ve bought or sold?

You can view your account to see if we have bought or sold any funds. To do this, select ‘Transactions’, and then ‘Orders’ in your Managed Personal Pension account dashboard. Please note that with our managed service, you will not be able to buy or sell funds yourself.

Can I change my risk profile?

While you can change your risk profile at any time, this is typically done in response to a change in your circumstances, such as a shift in your financial goals. You can check what risk profile you are aligned to in your account dashboard and we also remind you in your annual check-in and quarterly updates. You should consider your options carefully before changing your risk profile solely based on market conditions. We do not recommend reacting to market events.

Why does the value of my portfolio change?

Financial markets will inevitably experience ups and downs, which means that the value of your investments can also fluctuate. As with any type of investing, including our managed service, where we manage your investments for you, you could get back less than you invested.

There’s a term in investing called ‘risk premium’, which is the additional return that investors get for taking on extra risk. When you invest, there’s a risk of losing some or all of your investment, but there is a premium to compensate for this. Put simply, higher returns for being invested is the reward for taking risk.

Should I do anything if and when markets fall?

The best thing to do when markets fall is to remain calm and think long term. Market fluctuations are a normal part of investing. While we can’t predict when these ups and downs will occur, we know they are inevitable. It’s important to consider staying invested during these periods because, over time, markets have historically delivered strong results.

What does Vanguard do if and when markets fall?

Our managed service does not make short-term decisions about where to invest based on market movements. Instead, we take what is know as a ‘strategic’ approach to the split of shares and bonds in your portfolio. This means we invest in a pre-set mix of shares and bonds depending on your attitude to risk.

We don’t change the mix of share and bond funds based on a short-term view of what will happen in markets. Markets can be unpredictable and difficult to forecast, so we do not make short-term changes to the portfolio on that basis (unless the portfolio moves out of line with your level of risk).

What will happen to my portfolio when markets are turbulent?

We invest your portfolio in a mix of share and bond funds that aligns with your attitude to risk to help smooth out the ups and downs of investing. By holding a globally diversified portfolio of investments in different regions and industries, you can benefit from growth opportunities in some parts of the market, while reducing the impact of downturns in others. This helps to avoid unnecessarily large losses and provide more stable returns over time.

It’s important to remember that while shares can experience greater price fluctuations than bonds, they usually deliver better returns over the long term. Bonds are typically less risky, so having some exposure to bonds can help to smooth out overall returns.

Apart from our highest-risk portfolio (very adventurous) which may hold funds invested solely in shares at an earlier stage in your glidepath, all our managed risk profiles include a mix of share and bond funds. An inflation-linked bond fund is introduced to the portfolio at three-and-a-half years before retirement for the very cautious portfolio and one year before retirement for the very adventurous portfolio.

1 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term.

2 An investment fund that aims to closely match the returns of a specified market index. The fund may hold all of the constituents of the particular index or buy a sample of those constituents so that its performance is as close as possible to the index.

3 An inflation-linked bond is a type of investment that adjusts its value based on inflation, helping to protect your money from losing purchasing power. The principal amount you invest grows with the rate of inflation, and the interest you earn is calculated on this adjusted principal. When the bond matures, you receive the inflation-adjusted principal, ensuring that your investment keeps pace with rising prices.

Last updated: 17 April 2025

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Eligibility to invest in a Vanguard Personal Pension depends on your individual circumstances. Please be aware that pension and tax rules may change in the future and the value of investments can go down as well as up, so you might get back less than you invested. You cannot usually access your pension savings or make any withdrawals until the age of 55, rising to the age of 57 in 2028.

If you are not sure of the suitability or appropriateness of any investment, product or service you should consult an authorised financial adviser. Please note this may incur a charge.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Vanguard will manage your investments in the Managed SIPP on your behalf. You will not be able to place trades on your own account.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

RedOak: 4397781